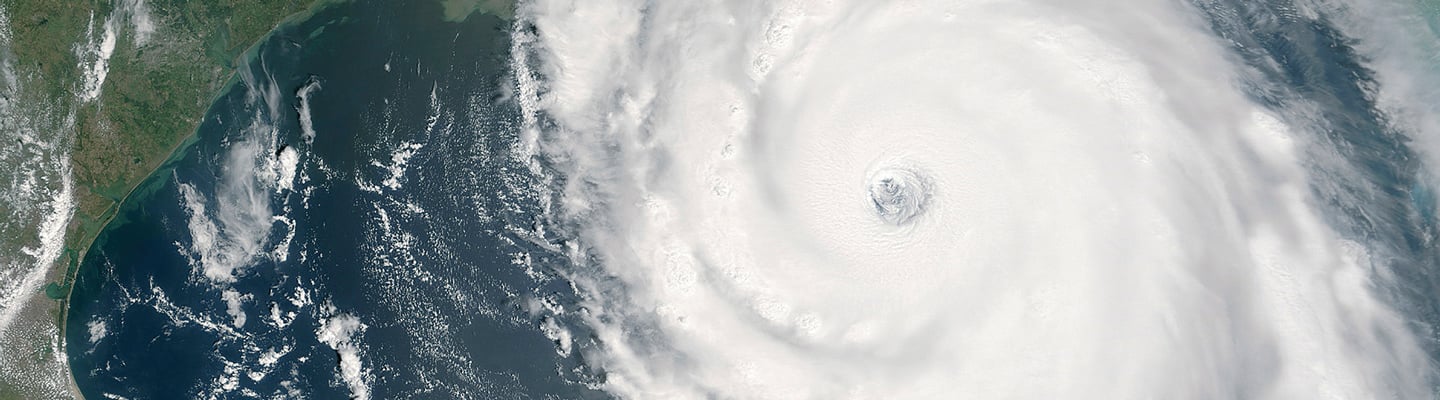

Three Ways Real Estate Owners Can Benefit from Parametric Insurance Coverage

These alternative policies can be used for specific risks such as hurricanes or other natural disasters.

Owning a business or property in 2021 is anything but easy. With the effects of the COVID-19 pandemic still dictating daily operations and the rising number of insurance claims causing carriers to limit policies and boost coverage costs, owners are looking for alternative ways to reduce their risk, minimize costs and plan for the unexpected.

One option available to real estate owners and operators is parametric insurance, an alternative coverage solution that is growing in popularity. According to a January 2020 Insurance Journal article, parametric policies first appeared in the 1990s and were launched by commodities traders and energy companies. Today, they are used to insure a wide range of industries in addition to commercial real estate, including agriculture and transportation.

Two key elements differentiate parametric coverage from traditional property insurance.

- A triggering event. Parametric policies are tailored for a specific peril that property owners might face. In the Midwest, this could be a tornado measuring EF3 or greater on the Enhanced Fujita scale, which estimates damage based on wind speed. In the Southeast, it could be a hurricane reaching Category 3 or higher or a certain wind-speed threshold. The occurrence of these perils within a defined geographic area triggers a policy payout, regardless of the effect the weather event has on the covered property. Parametric policies are available across North America, including Canada.

- A predetermined payout. A parametric policy pays out in full when the named peril reaches an agreed-upon threshold, based on third-party metrics, usually a National Weather Service unit. The payout does not require claim filings or an adjuster to review the site. There is no standard parametric policy. Instead, coverage is written unique to each property in which purchasers set the limit, and therefore, the payout. Any type of weather event, including a flood, can be chosen as the triggering event. Non-weather triggers can be considered as long as they are pre-determined and measurable.

These two elements combine to create three potential benefits for real estate owners and operators. Customization to each real estate portfolio’s specific risks. Parametric insurance can be customized to each real estate portfolio’s specific risks, allowing owners and operators to set the terms and conditions for payout.

A parametric program takes local, historical weather data from a third-party municipal source to determine the likelihood of a weather event, like a hurricane or earthquake that would damage or destroy the building. This weather data is based on the exact latitude and longitude of the hotel. From this data, a trigger threshold for coverage payout is determined and named in the policy.

For example, if a Miami hotel took out a $100,000 parametric policy to cover a category 4 or greater hurricane in its vicinity, the hotel would receive the full $100,000 if the catastrophic event occurs, regardless of the amount of damage to the hotel.

Real estate investors with several holdings can also customize their policies to cover multiple properties within a one- or two-mile radius. It is up to the business or property owner to set the optimal parameters for coverage.

Expedited payouts. The speed at which a claim payout is made can have an impact on policyholders, especially disaster victims. Many traditional insurance claims can take up to 30 days to be settled. Because there is no claims adjustment for a parametric policy, payout is expedited, allowing real estate owners and operators to meet the obligations of their loss immediately and continue operations or reopen quickly.

Added flexibility to cover business interruption costs. Since parametric payouts are based on predetermined triggers and thresholds, not claim assessments, real estate owners with parametric coverage could receive a payout even if their property is not directly damaged by the event. These payouts could then be used to supplement any lost revenue caused by the surrounding damage.

For example, a rental property is miraculously undamaged by a local hurricane; however, tourism in the area is affected as the community recovers and rebuilds. The rental property’s parametric payout would cover any forgone revenue as customers cancel reservations or business slows down.

Kimberly Gore is the chief marketing officer for Hub International’s Hospitality Specialty Practice.

|

Risks and Rewards According to a June 2020 article from the National Association of Insurance Commissioners (NAIC), basis risk is a potential downside of parametric policies. “The economic losses of the insured could differ by any margin from the amount of coverage, or the insured could have losses without the parameter being triggered,” according to the article. “Accurately structuring and pricing the product requires a firm understanding of the exact exposures of the policyholder and carefully selecting the most appropriate parameter to fit those exposures.” |