Forging the Future of North American Manufacturing

Report examines how reshoring and nearshoring are reshaping industrial real estate.

As demand for warehousing and distribution space slows from pandemic-era highs, manufacturing has given industrial real estate markets in North America a second wind. Manufacturing construction starts surpassed warehousing construction in dollar terms in the U.S. in 2022 and continued to outpace warehousing in 2023. Disruptions caused by the COVID-19 pandemic added to the perceived risk of globalized, just-in-time supply chains, which already faced stress from trade disputes between the U.S. and China.

U.S. government investments in infrastructure, green energy, electrification and strategically important technologies have further tilted the scales in favor of North American manufacturing in several industries. Manufacturers have responded by announcing plans for new facilities across the U.S., and many are nearshoring supply chains by investing in plants in Mexico and Canada.

The NAIOP Research Foundation’s February 2024 report, “Forging the Future: Manufacturing Growth and Its Effects on North American Industrial Markets,” examines the trends behind reshoring and nearshoring and the industries behind new manufacturing construction. The report’s authors, Lisa DeNight and Elizabeth Berthelette at Newmark, analyzed manufacturing plant announcements and interviewed developers, investors and other commercial real estate practitioners to quantify recent and projected construction activity and evaluate how the expansion of manufacturing will affect demand for commercial real estate.

Visit naiop.org/research-and-publications to read “Forging the Future: Manufacturing Growth and Its Effects on North American Industrial Markets."

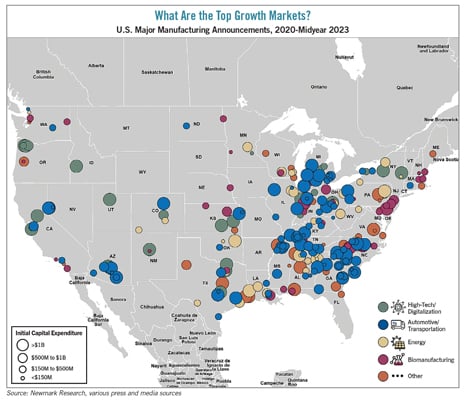

Newmark Research identified more than 300 large U.S. manufacturing facility announcements since 2020 that collectively represent $400 billion in pledged investment and 250 million square feet of new construction. The new facilities are expected to create 210,000 jobs. Most large plant announcements have been concentrated in industries that stand to benefit from new government incentive programs, such as the high-tech, automotive, energy and biomanufacturing sectors. Companies have announced plans to open new plants across the U.S. but are gravitating toward lower-cost locations that offer sufficient access to skilled workers and a reliable supply of affordable energy. Midwestern and Southeastern states have attracted more investment than other regions.

Most new manufacturing construction is owner-built or build-to-suit, but reshoring activity has also increased demand for speculative industrial buildings that can accommodate manufacturing uses and has contributed to demand for warehousing and logistics spaces that support manufacturing supply chains. The opening of new plants is also expected to spur local markets for retail and multifamily real estate, particularly in smaller communities where a new plant can have an outsize effect on the local economy.

The report observes that the United States-Mexico-Canada Agreement has encouraged greater integration of North American supply chains and more foreign direct investment in manufacturing in Canada and Mexico. In 2023, Mexico replaced China as the top advanced manufacturing exporter to the U.S. Nearshoring investments in Mexico are also spurring demand for logistics and complementary manufacturing facilities near key border crossings like Laredo, Texas.

New plant announcements and man-ufacturing construction starts have come at a rapid clip over the past two years as companies race to complete buildings in time to receive the full benefit of federal programs. As the window to receive government subsidies closes, this activity will likely slow, but the current expansion will reshape the landscape of North American manufacturing for decades to come.

Shawn Moura, Ph.D., is senior research director at NAIOP.

In Memoriam: Robert Cutlip Former NAIOP and Research Foundation Chair Robert Cutlip passed away unexpectedly on Feb. 13, 2024. Bob was a strong advocate for NAIOP, the National Forums and the Research Foundation. Bob joined NAIOP in 1993 and served as NAIOP Chair in 2006. His achievements during his term included launching the awards program for young professionals, forming a partnership with AMPIP (the Mexican Association of Industrial Parks), spearheading an international trade mission to China, and initiating NAIOP’s support of organizations dedicated to attracting minority groups into commercial real estate. After serving as chair, Bob continued his involvement in NAIOP as a member of the Industry Trends Task Force and the Industrial Development I National Forum, and as a governor and trustee with the NAIOP Research Foundation, where he served as chair in 2014. At the beginning of 2024, Bob was appointed Senior Visiting Fellow with the Research Foundation, a role he had looked forward to because it would keep him connected to the industry and NAIOP throughout his retirement. His contributions to NAIOP and CRE were numerous, and he will be missed greatly. He is survived by his wife, Jean, and their daughters, Lisa, Bonnie and Stacy. Please contact Bennett Gray at gray@naiop.org if you are interested in donating to the Research Foundation in remembrance of Bob. |

RELATED ARTICLES YOU MAY LIKE

Navigating the AI Revolution: A Blueprint for Real Estate Executives

While artificial intelligence reshapes industries globally, commercial real estate is at a crossroads of adapting swiftly or being left behind.

Read More

NAIOP Research Directors Discuss an Industry in Transition

At their annual meeting, research directors shared their outlooks for capital markets, office, retail and industrial real estate.

Read More

Demand Remains High for Construction Workers

Firms with openings for craft workers report challenges in filling those positions.

Read More