Demand Remains High for Construction Workers

Firms with openings for craft workers report challenges in filling those positions.

Developers aiming for a definite opening date for a new project or renovation must face the reality that the supply chain has not healed completely and that key construction workers may be unavailable. Both shortages can throw schedules off-track and off-budget.

Most materials can be procured without undue delay, unlike the situation during 2020-2022. However, unprecedented lead times still exist for electrical equipment such as transformers and switchgear. Electronic components for elevators, HVAC systems and door-security hardware may also be hard to obtain. Without these items, buildings aren’t ready for occupancy.

Tight labor supply is a more widespread problem than is a lack of materials. In a survey the Associated General Contractors of America (AGC) released in early September, 88% of respondents with openings for craft workers said the openings were hard to fill. For each of 21 separate crafts, at least 60% of the firms that had openings for that craft reported difficulty filling the positions.

Among the more than 1,400 respondents, similar levels of difficulty were reported by all sizes of firms, all project types and all regions. While open-shop contractors reported somewhat greater difficulty in filling positions than did unionized firms, even the latter had problems with labor supply.

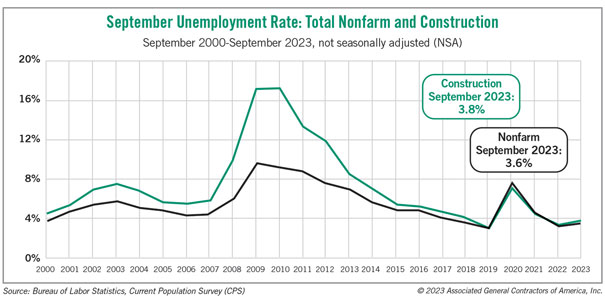

That’s not surprising, given the low number of experienced construction workers who are unemployed and looking for work. Until recently, the unemployment rate for construction was typically higher than the overall rate, because after finishing a project, some construction workers would have to wait months for a suitable new project to begin. But the Bureau of Labor Statistics (BLS) reported that the unemployment rate for workers with construction experience in September was only 3.8%, essentially matching the 3.6% total nonfarm unemployment rate. (Unemployment rates by industry are not seasonally adjusted; the seasonally adjusted or “headline” nonfarm rate was 3.8%.)

Two-thirds of respondents to the AGC survey reported that at least some job applicants were not qualified. These applicants may have lacked the required skills or work papers, or they may have had a blemish on their records that barred them from certain jobsites. In addition, one-third of respondents said some applicants couldn’t pass a drug test. One out of four respondents said a lack of transportation kept some job candidates from being hired.

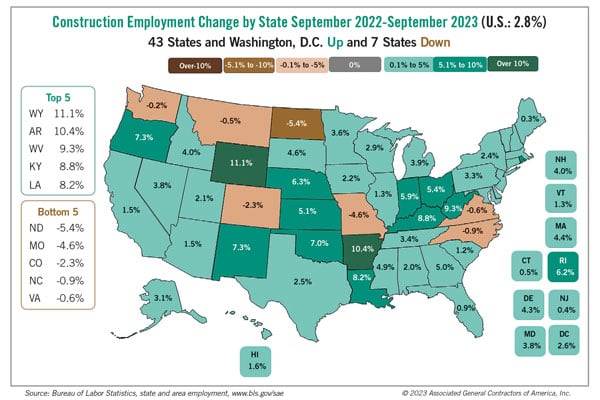

Contractors have had some success adding workers. Industry employment rose by 2.8% from September 2022 to September 2023, outpacing the 2.1% increase in overall nonfarm employment. The gains were widespread, occurring in 43 states and Washington, D.C.

However, the employment increases have come at the cost of elevated wages, relative to other sectors. BLS reports each month on average hourly earnings for production and nonsupervisory employees. Such workers in construction include most craft workers as well as office workers. Their earnings climbed 5.7% in the 12 months through September, compared with 4.5% for production and nonsupervisory workers in the overall private sector.

Contractors will probably continue having a hard time filling positions. Most likely, they will have to boost the “wage premium” they pay relative to other industries and pay more overtime to the employees they do have to make up for ones they weren’t able to hire.

As a result, developers and property owners should expect that contractors will be passing along higher labor costs when they can. In addition, many projects could experience delays due to a shortage of key workers.

Ken Simonson is the chief economist with the Associated General Contractors of America. He can be reached at ken.simonson@agc.org.

RELATED ARTICLES YOU MAY LIKE

Construction Cost Challenges Shift from Materials to Labor

A limited supply of experienced workers pushes wages higher.

Read More

The Logistics Building of the Future

A new prototype aims to solve the challenge of putting industrial facilities in dense urban areas where land supplies are constrained.

Read More

Costs Cool Down, but Not for All Construction Items

Products such as concrete and flat glass are seeing record-setting price increases.

Read More