Costs Cool Down, but Not for All Construction Items

Products such as concrete and flat glass are seeing record-setting price increases.

Headline figures for consumer and producer prices have been reassuring compared to the numbers from a year ago. However, the data provides cold comfort to developers still experiencing heated construction costs.

By March, the year-over-year change in the consumer price index (CPI) had chilled to 5.0% from a torrid 9.1% in June 2022, the Bureau of Labor Services (BLS) reported in April. BLS’s producer price index (PPI) for inputs to new nonresidential construction — a weighted average of the cost of all materials and selected services such as design and trucking services — moderated even more. That index fell 1.1% from March 2022, a huge turnaround from increases of 20% for 12 straight months in 2021 and the first half of 2022.

But averages and aggregates can mask a lot of variation. In this case, the recent decline has been driven by plunging prices compared to a year earlier for lumber, fuels and metals, while numerous other input prices continued to increase steeply.

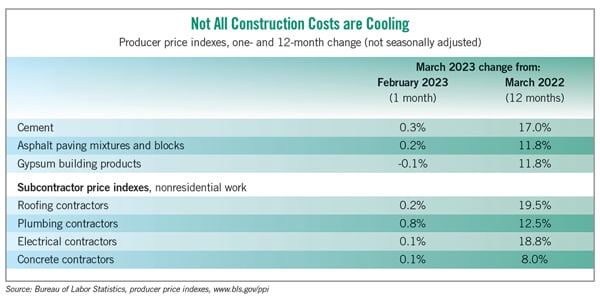

For instance, from March 2022 to March 2023, the PPI for cement jumped 17.0%, the largest increase since 1975. Cement price increases are typically passed along with a short lag by ready-mix concrete suppliers. That suggests that the PPI for ready-mix concrete, which climbed 13.2% over the same period, may soon post even larger increases.

Developers can’t expect to get any price relief on paving by switching from concrete to asphalt. The PPI for asphalt paving mixtures and blocks rose 14.1% for the year ending in March. The index for construction sand, gravel and crushed stone — which go into both ready-mix and asphalt — rose 11.3% over 12 months.

When it comes to the building itself, there have been price increases aplenty. The price index for flat glass recently posted its largest increase in 40 years and rose 10.6% from March 2022 to March 2023. The index for insulation materials climbed by a similar 10.5%. Gypsum building materials such as wallboard increased 11.8% in price during the same timeframe. And the index for architectural coatings such as paint jumped 14.5%.

Not surprisingly, subcontractors are raising their bid prices to reflect their higher materials, labor and financing costs. PPIs for new, repair and maintenance work by nonresidential subcontractors jumped 19.5% through March for roofing contractors, 18.8% for electrical contractors, 12.5% for plumbing contractors and 8.0% for concrete contractors.

Input costs overall have moderated because of a limited number of recent, sharp price declines. From March 2022 to March 2023, PPIs tumbled 38.5% for lumber and plywood, 19.4% for diesel fuel, 15.1% for steel mill products, and 13.0% for aluminum mill shapes.

Given the volatility of prices in the past three years, it is no wonder that contractors’ bid prices have remained high. BLS compiles a “net output index” for new nonresidential building construction by asking a fixed group of contractors what they would charge to put up a set of buildings. BLS combines this information with data from cost-estimating firms. The resulting index rose 16.5% from March 2022 to March 2023.

In short, developers should not assume that moderation in broad indexes, such as the CPI, or the cost of a few inputs, such as fuel or lumber, means that nonresidential construction costs will decline anytime soon. There are too many other moving parts — many of which are moving in different directions.

Ken Simonson is the chief economist with the Associated General Contractors of America. He can be reached at ken.simonson@agc.org.