Construction Cost Challenges Shift from Materials to Labor

A limited supply of experienced workers pushes wages higher.

Developers who have watched consumer-level inflation decline might assume the same holds for construction costs, especially given the steep retreat from record-high steel and lumber prices. But materials costs are only part of the pricing equation.

Direct labor costs and subcontractors’ prices are still rising at elevated rates. Moreover, those costs account for a higher percentage of total inputs for renovation and remodeling projects than for new construction.

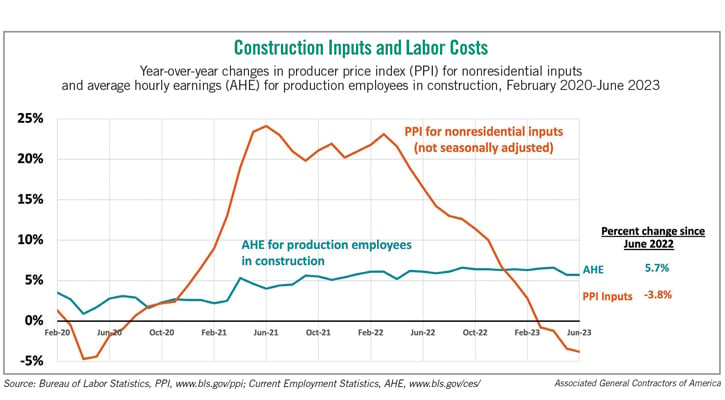

Overall materials costs have tumbled as rapidly — or more so — than they rose. The most comprehensive measure of these costs is the producer price index (PPI) for inputs to new nonresidential construction, which the Bureau of Labor Statistics (BLS) posts around the middle of each month. This index is a weighted average of the cost of all materials and selected services, such as trucking and design services, used in nonresidential construction.

Immediately following Russia’s invasion of Ukraine in late February 2022, prices shot up for petroleum products, steel and numerous other inputs. These increases came on top of pandemic-driven shortages and price hikes for many other commodities.

In March 2022, the construction-inputs PPI had its largest one-month jump ever, 3.9%, resulting in a near-record year-over-year increase of 23.1%. Yet, by June of 2023, the index was 3.8% lower than in June 2022.

Most subcontractors’ pricing has not followed the downward path of materials prices. BLS posts PPIs for four types of subcontractors. From June 2022 to June 2023, the PPI for roofing contractors soared 17.2%; for plumbing contractors, 9.5%; and for electrical contractors, 9.0%. Only concrete contractors posted mild year-over-year price increases: 2.8%.

While supply chains improved and demand slowed for many materials, the same was not true for construction labor. BLS reports each month on average hourly earnings for production and nonsupervisory employees. Such workers in construction include most craft workers as well as office workers.

For the overall private sector, the year-over-year change in average hourly earnings peaked at 7.0% in March 2022. By June of 2023, wage growth had cooled to 4.7%. But wage growth in construction slowed only fractionally, from 6.1% in March 2022 to 5.7% in June 2023.

Further acceleration of labor costs appears to lie ahead, especially for projects executed with union labor. The Construction Labor Research Council reported in July that local construction union settlements in the first half of 2023 included first-year increases for pay and benefits that averaged 4.4%, up from 3.9% in 2022 and 2.8% in 2020. The council expects the average to rise to 4.7% by 2025.

Although wage growth in the broader economy may be subsiding, this appears unlikely to occur anytime soon in construction, as the industry is still experiencing very tight labor supply. The 396,000 job openings in construction at the end of May was the second-highest May total in the 23-year history of the BLS Job Openings and Labor Turnover Survey.

Finding experienced workers to fill those positions will be difficult. BLS reported that the unemployment rate among jobseekers with construction experience in June was only 3.6%, the lowest June rate since that series began in 2000. With such a limited supply of experienced workers to fill a near-record number of openings, it is probable that construction firms will have to raise pay even more.

In short, developers and owners of commercial real estate, especially properties undergoing labor-intensive remodeling or repurposing, should not expect their costs to level off, even if other measures of inflation or wage growth do. For projects with union labor, new contracts will mean even higher labor costs than under contracts signed three or four years ago.

Ken Simonson is the chief economist with the Associated General Contractors of America. He can be reached at ken.simonson@agc.org.