Speculative Cold Building Development: Trends and Strategies

This sector of industrial was booming even before the pandemic, and future demand is expected to soar even higher.

In the age of one-hour package shipments, the infrastructure needed to serve a growing on-demand culture is scrambling to keep up. This has taken on even greater significance amid the COVID-19 pandemic, which forced millions to stay home for months.

According to Coresight Research’s U.S. Online Grocery Survey 2020, online grocery sales are expected to increase by about 40% this year due to the pandemic. That’s after a 22% increase in 2019.

The strong growth in e-commerce is a main reason that the industrial real estate sector is a bright spot in the U.S. economy, as developers and tenants continue to construct millions of square feet of warehouses and logistics centers.

Within the industrial sector is a unique class of buildings that maintain the continuity of the “cold chain,” which is crucial for the integrity of U.S. food and pharmaceutical logistics. While market factors are driving rising demand for cold buildings, there are also practical reasons behind the need for this asset class. The existing cold building stock in the U.S. is becoming antiquated, with an average age of 34 years, according to CBRE research.

In the past, cold storage buildings were built to suit, but due to the surge in demand and the need to upgrade these facilities, the era of the speculative cold building could be upon us.

Cold Demand

Recent research by CBRE estimates that demand for cold storage will increase by 100 million square feet in the next five years. However, there is less than 5 million square feet of cold storage currently being built across the U.S.

“In our view, there is the potential for an enormous amount of new climate-controlled space,” David Egan, former global head of industrial and logistics research at CBRE, told attendees at NAIOP’s CRE.Converge 2019 in Los Angeles.

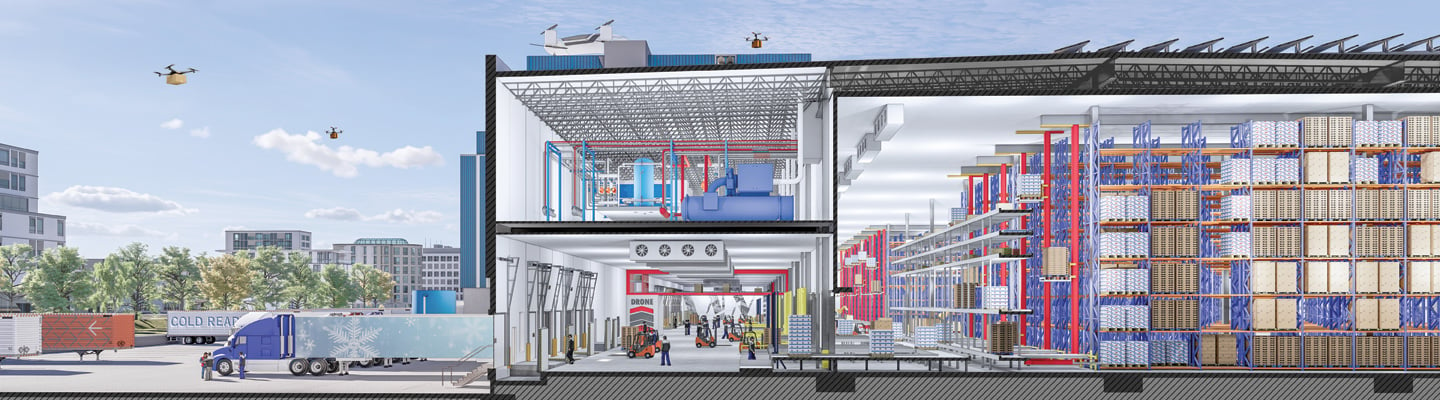

At refrigerated facilities, a significant amount of site area is required for refrigeration equipment and storage silos that supply the manufacturing process. Ware Malcomb

These cold buildings take various forms. Food processing facilities are located near farms and ports, which have specialized requirements to meet the needs of tenants and comply with food safety protocols. Processing facilities are supported by gateway cold storage buildings, which feed regional distribution facilities. Finally, there are the local last-mile facilities, which provide service to grocery stores, restaurants and, increasingly, directly to consumers.

Cold buildings have traditionally been purpose-built for a specific end user with a particular set of needs. These can range from high-bay, fully automated cooler and freezer buildings to lower-clear-height processing facilities. While unique to the end user’s needs, these buildings share many common design features: refrigerated space (often well below zero degrees Fahrenheit), enhanced thermal and vapor envelopes, areas of insulated freezer slabs, space on site and within the building for refrigeration equipment, and a number of other requirements.

Using these common building attributes, Ware Malcomb recently developed a “cold ready” speculative prototype building that can be adapted for a number of uses requiring refrigeration and freezer areas. Finding a solution for a cost-effective and highly flexible speculative cold building has long been an issue, and this new prototype could help accomplish that.

Cold-Ready Strategies

There are two primary strategies that can be implemented for the cold ready speculative building. The first uses insulated metal panels as the primary exterior building skin. This requires columns at the building perimeter and increased roof insulation as part of the thermal envelope. This building offers a stable thermal and vapor envelope. However, it can be more challenging to place internal walls between temperature zones because the insulated metal panel walls will not be able to penetrate the metal roof deck if not planned as part of the initial building construction.

An engine room with compressors lined up inside a cold storage facility. Ware Malcomb

The second option for the cold ready speculative building is commonly referred to as the “box in a box.” This building utilizes a precast or tilt-up concrete exterior wall panel, which can be load bearing and avoids the need for perimeter steel columns. The building’s thermal and vapor envelope uses insulated metal panels to line the exterior walls, as well as insulated metal panels suspended from the roof structure to create a ceiling. This design offers more flexibility to add future walls as the thermal and vapor envelope can be accomplished by the suspended insulated metal ceiling panels. The “box in a box” design also allows the majority of the cost for the building thermal and vapor envelope to be deferred to the tenant improvement and can help keep the first cost of the building lower.

Both options share many unique design traits that make them suitable for cold building users. More space on the site is dedicated for refrigeration equipment and generators that are required for cold buildings, as well as sufficient queuing area for trucks and ample parking for refrigerated trailers. Office pods are located adjacent to the building cold dock for better separation from primary freezer and cooler areas as well as easy access to the cold dock. The dock doors are spaced slightly wider than a typical dry warehouse building to allow for the increased dock equipment and enhanced dock seals. The dock doors themselves are insulated and are designed be at a 50-inch height above grade. This allows for better accommodation of refrigerated trailers that have a higher bed height.

The cold ready building offers flexibility to tenants by leaving out floor slabs and placing all building columns on base isolation blocks. This allows for insulated freezer slabs to be placed only where a tenant requires freezer areas.

Using either of the development strategies for the speculative cold-ready building allows developers to significantly reduce the initial capital expenditure investment, but still provides the building shell with the specialized features mentioned above that allow for quick tenant buildouts. The question is, does the market demand it?

The Broker Perspective

Development magazine has covered the explosion in demand for cold storage in recent issues (see “Cold Storage Can Be Complex and Costly” in Fall 2020 and “The Cold Storage Market is Heating Up” in Spring 2020). Despite the intense interest, some in the industry remain cautiously optimistic about future growth.

“Grocery delivery is here to stay, but the scale remains to be seen,” said David Sours, senior vice president with CBRE’s National Food Facilities Group. “Time will tell whether the industry is really growing or just evolving.”

Sours added that historically, developer and investor interest in cold storage has been cautionary. The sector was perceived as expensive with modest growth and discounted exit values. Built-to-suits were the norm, and speculative development was unheard of until recently. Over the years, some developers marketed speculative cold storage buildings but lacked the equity and/or debt to allow construction to commence unless it was preleased or presold.

A cold dock with palettes waiting to be loaded into refrigerated trucks. Ware Malcomb

Like other new concepts in real estate, the market will watch carefully as the first few speculative cold storage buildings are built and fully leased. So far, the results are reassuring. For example, Ware Malcomb recently worked with a developer in Texas to complete what is believed to be the first cold storage speculative development in the country. The building is 296,840 square feet at 45-foot clear height and was designed with an insulated metal panel skin. The Texas project has been fully leased, and the final phases of the tenant build-out are underway.

Sours points out that the learning curve is steep within the sector. There are several highly unique, expensive facility build-out subtypes, each with their own nuances. It is not one-size-fits-all for what the real estate industry broadly calls “cold storage” — that is, anything with refrigeration.

Many investors and developers do not realize there are several distinct food building subtypes. These can be broadly classified by the amount and configuration of each temperature zone: freezer (space that maintains temperatures at 0 degrees Fahrenheit or lower), cooler (space that maintains temperatures between 0 and 50 degrees Fahrenheit) and dry. These facilities have custom details throughout nearly all elements of the facility design. Understanding design differences is key to aiming for the right targets when it comes to speculative design.

Like all complex building types, diligent planning and proper design are paramount, as well as the optimal project location and cost structure. For example, JLL research from 2018 indicates that cold-storage facilities can cost from $250 to $350 per square foot to build. They can also take several months longer to construct than standard warehouses.

The Developer Perspective

As is the case in traditional speculative industrial building development, flexibility remains a priority. When conducting site selection and planning activities for cold buildings, Anthony Pricco, president of Bridge Development Partners, says these attributes are important to consider:

- Sites capable of supporting 200,000 to 300,000 square feet of building.

- 50-foot clear height buildings to accommodate tenant automation needs.

- Strongly consider accommodations for packaged rooftop refrigeration systems.

- Make provisions for equipment mezzanines.

- Urban infill locations are preferred due to limited supply in these areas.

Another important consideration is the current inventory of cold buildings throughout the country. According to Scott Pertel, the president and CEO of Cold Summit Development, and Alex Langerman, the company’s co-founder and COO, the existing inventory is largely old, inefficient and poorly located. Old buildings can cause significant issues for food processing and cold storage operations. Deteriorating insulation and vapor intrusion due to poor construction detailing or lack of required maintenance can cause ice buildup in freezers and coolers. These problems can also increase operating costs due to diminished envelope efficiencies. Food safety is a priority for companies in the food industry, and shutdowns for building maintenance are costly. Likewise, when it is time for expansion, companies cannot afford to wait years to construct new buildings for their exact needs.

When delivering cold buildings across the country, there are a few key factors to consider:

Efficiency. Build in efficiency in terms of cubic footage and racking as well as energy and operating expenses.

Location. Build facilities where they are needed — desirable logistics hubs, in and around major population centers, and adjacent to where food is grown.

Cost. Build facilities at a cost basis that keeps real estate costs low.

Pertel and Langerman also rate the complexity of cold buildings. On a scale of 1 to 10, with 1 being the least complex and 10 being the most, they rate traditional dry warehouses from 1 to 2. Refrigerated warehouses score from 7 to 8. Automated/high-bay freezer facilities rate from 8 to 9, and food-processing facilities score 9 to 10.

The Capital Markets Perspective

The capital markets have taken notice of the imbalance between supply and demand for cold buildings in the U.S. An October 2020 article from the Wall Street Journal noted that Lineage Logistics LLC, the world’s largest landlord of temperature-controlled warehouses, recently raised $1.6 billion in a fundraising round and may pursue a public offering of stock. Additionally, Americold Realty Trust, which is currently the only publicly traded cold-storage REIT, saw its net operating income jump 6% in the second quarter. According to the Wall Street Journal report, those two firms control 59% of the cold-storage market in the U.S.

Research from CBRE shows that the slim portion of capital focused on cold buildings is currently heavily weighted toward private investors. Private investors make up nearly 80% of the buyer pool, but with cap rate spreads shrinking, REITs and institutional capital may join in greater numbers.

Sours said the capital markets have never been more focused on cold storage, but investors are still primarily looking at buying buildings with credit tenants and long-term leases that are in core industrial markets. Only a small number of transactions check all the boxes each year. Nevertheless, yields for cold storage have narrowed tremendously in recent years while maintaining a healthy premium over dry industrial warehouses with similar term and tenant credit profiles.

Build-to-suit cold buildings often cost at least three times more than traditional speculative warehouse buildings, with many costing much more. Dry-to-cold conversions can have comparable costs to build-to-suit, but greater speed to market in many cases. This has been a barrier to investment in these buildings — greater cost equals greater risk.

The cold-ready concept can reduce the initial costs to as low as 20% over traditional speculative warehouses, deferring the rest of the building costs until a tenant is in place, likewise lowering risk. The cold-ready shell and tenant improvements together have comparable costs to build-to-suit, but with speed to market for the tenant comparable to dry-to-cold conversions.

The Design and Construction Perspective

Given the specialized nature of a cold building, a properly designed project is critical to success. There are more decisions to be made at the project start with speculative cold storage buildings than traditional dry spec buildings. How the refrigeration will be handled is one of the most important decisions.

Kate Lyle, studio manager for industrial cold and food with Ware Malcomb, notes that refrigeration systems must be customized to the end user’s temperature requirements. Unlike an HVAC system, where temperatures fall in a consistent range from user to user, refrigeration systems can range from 55-degree cold processing rooms down to negative 20-degree freezers (or even colder for blast freezers and pharmaceutical super-freezers).

Furthermore, users of refrigeration systems might have specific requirements regarding air flow, incoming product temperature, type of refrigerant and best placement of air coils for their room layouts. Deferring the installation of the refrigeration system until the end user is identified seems to be the best course of action, but it’s important to consider the needs of that future refrigeration system.

Types of refrigeration systems can include central ammonia plants, low-charge ammonia packaged rooftop units, packaged “freon” rooftop systems using approved refrigerants, pre-fabricated ammonia “rack systems” and CO2 cascade systems. The central ammonia system has traditionally been the favorite method of refrigeration for many large end users due to its reliability and efficiency at a variety of temperature ranges.

However, it comes with significant first costs, requires room within the building for the compressors, space on the site for condensing units, and a certified and competent on-site maintenance technician. As previously mentioned, some preference is given to packaged rooftop refrigeration systems with speculative cold buildings. This is due to the inherent flexibility of these systems, which allow for faster and more cost-effective installation.

The challenge with rooftop systems is their weight, which can be difficult to accommodate in speculative structural systems. Ware Malcomb’s cold-ready design allows plenty of site area for ground-mounted prefabricated ammonia “rack” systems, which are another viable solution. The overall goal of cold ready is to allow flexibility in the end user’s choice of systems.

The speculative cold building is designed for cold storage or food processing. Typical design attributes may include insulated metal panel building envelopes, increased insulation in roofs, increased roof load capacity for insulated ceilings, enhanced insulation in dock doors, preparation for the use of insulated floor slabs for freezer spaces, specialized freezer and cooler personnel doors, and heightened attention to construction details with vapor and moisture control in mind.

Another feature of the cold-ready building is the sprinkler system.

“It’s very important to many cold users to avoid in-rack sprinkler systems,” Lyle said. “The accidental impact of an in-rack sprinkler head can fill a dry sprinkler system with water that quickly freezes. It can be an enormous ordeal, both from a time and financial perspective.”

Lyle said cold users often also consider vertical storage to be very important, because the same refrigeration systems can cool more pallets and thus gain efficiency as height is added. To gain height while minimizing risk, build-to-suit cold building projects have been on the forefront of adopting new fire protection technologies, like Quell, and low-oxygen systems. However, these new technologies can be rejected by local fire jurisdictions, adding risk to speculative development.

“Unlike refrigeration, we likely cannot defer the fire sprinklers and still achieve a temporary certificate of occupancy at project completion,” Lyle said. “Recent innovations in early suppression, fast response (ESFR) sprinkler technology provides part of the answer, as the latest sprinkler heads can accommodate ceiling-only protection up to 50 feet top of product. ESFR can be designed as a fully dry system, or as a wet system with dry sprinkler heads. Most importantly, fire jurisdictions are familiar with ESFR because it’s clearly mentioned in fire codes, which reduces risk for the developer.”

The enhancements required for a speculative cold building drive the cost increases outlined above. This heightens the importance of having a qualified contractor on the team. There are many nuances when building a cold facility, such as sequencing of construction activities to ensure proper sealing of the building thermal envelope. A contractor with experience on cold facilities typically also has relationships with subcontractors who install critical building components such as insulated metal panel walls and floor slabs.

Cameron Trefry, RA, LEED AP, is a principal with Ware Malcomb.

Cold Chain and COVID-19 VaccinesIn November, Pfizer announced that it had developed a vaccine for COVID-19 that is 95% effective. A week later, Moderna announced that its COVID-19 vaccine showed similar effectiveness. However, both vaccines require cold storage, which could present logistical challenges in the months ahead as billions of doses are distributed across the country. According to a November report from the New York Times, Pfizer’s vaccine must be stored for extended periods at minus 94 degrees Fahrenheit, though it can be held in conventional freezers for five days. Moderna’s vaccine requires long-term storage temperatures of minus 4 degrees Fahrenheit, but it can be stored in standard refrigerators between 36 and 46 degrees Fahrenheit for up to 30 days. |