Commercial Real Estate Professionals Faced a Challenging Year

Compensation survey reveals that difficult decisions lie ahead for firms regarding pay, benefits and staffing levels.

2020 was the year that changed everything for the U.S. real estate industry. It is in a three-dimensional game of reactions, resetting and restructuring as a result of COVID-19 and the ensuing economic shock. Almost every aspect of running a business, including organizational architecture, staffing levels, remote work, adjusting to a new operational normal, revised budgets and year-end compensation unknowns, has been reconsidered.

Because total personnel costs can reflect 65% to 70% or more of a firm’s operating budget, real estate organizations across the country are re-examining their entire talent management platform. According to a July/August 2020 CEL & Associates, Inc. survey, more than 78% of real estate companies have adjusted, or are planning to review and potentially adjust, one or more elements of their compensation and benefits program in response to COVID-19. While actions have varied by type of company, position and location, it is clear that the pandemic will impact talent management and compensation in 2021 and for years to come.

Staffing, Reskilling and More

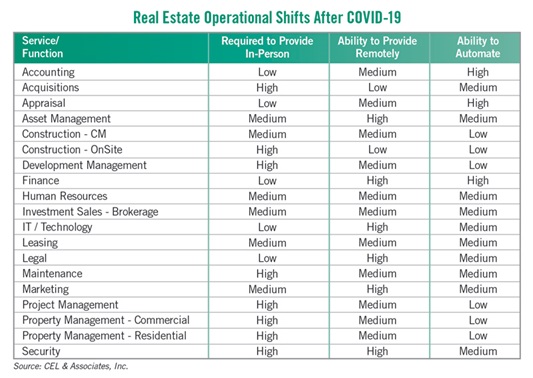

While nearly all real estate companies are eager to develop and implement future proofing and long-term strategic plans, they are also committed to eliminating daily surprises that may be limiting growth. Recent CEL & Associates, Inc. surveys, administered prior to the pandemic, show that 72% of real estate firms are likely to use more independent contractors, contingency workers and freelancers. Before the pandemic, staffing levels were being adjusted to reflect greater automation of routine functions (e.g. accounting and administration). ESG (environmental, social and corporate governance) and DEI (diversity, equity and inclusion) initiatives have also garnered greater attention this year, while the adoption of digitally based productivity technologies and the re-examination (“reskilling”) of various positions has been accelerating. Additionally, mandated remote work has put a spotlight on the challenges facing families. The table below highlights staffing considerations now underway.

Work Policies Change in the Aftermath of COVID-19

A universally agreed-upon fact during and after COVID-19 is that “talent matters.” Great talent is hard to find, so it is crucial to attend to next-generation leaders and high-potential employees (HIPOs) while creating a valued workplace culture.

Real estate talent leaders are crafting and adopting new work policies around work-life balance, restructured benefits programs, enhanced transparency, better internal communications, and stronger “culture” initiatives. Among the major recurring questions facing real estate organizations are “what do we do about compensation in 2020 (i.e. bonuses and raises), and what changes do we need to make as we prepare to enter 2021?”

The State of Compensation

Compensation in 2020 has been a rollercoaster. Going into 2021, over two-thirds of real estate firms say they are likely to freeze C-suite salaries (with the potential for adjustment in the first or second quarters of 2021). According to the CEL survey, employee merit increases are expected to range from 2.4% to 2.6%. This is the first year-over-year decline in annual pay increments in more than a decade. Bonus realizations will likely be down 20% to 30% or more.

More than 80% of real estate firms say they have not adjusted 2020 performance goals. However, there is a growing movement toward increasing the discretionary percentage when determining bonus awards. Some firms have suspended 401(k) contributions, and special bonuses are being considered for select front-line responders such as property managers and maintenance personnel. In a time of uncertainty, firms are also examining and restructuring benefits to navigate and highlight wellness at the right price for the entire workforce.

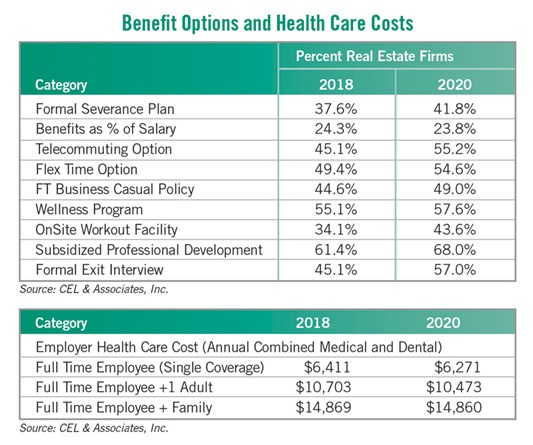

During the past 24 months, CEL has found a number of benefits options have shifted, including but not limited to those in the tables above.

While balancing business results with employee retention and satisfaction, real estate companies have looked into or embraced one or more of the following: cost containment, temporary salary reductions, furloughs, reductions in force, outsourcing and new-hire freezes. Some firms may adopt a quarterly or a mid-year review process in 2021 due to the uncertainty. “Getting through 2020” and “preparing for 2021’s uncertainties” will likely continue to be the focus of most CEOs and talent managers.

The Future of Telework

One issue that is a growing concern is a perceived decline in worker productivity, dedication, initiative, commitment and desire to excel as a result of working at home or remotely.

While working remotely went smoothly in the first 60 to 90 days of COVID, there is a perception that the past few months have been less productive and/or collaborative. Flexible work schedules and working remotely were clearly needed in March, April and May. However, many real estate companies have adopted, or may adopt, technologies that track productivity for remote employees. Decisions on who should or must return to the office are frequently negotiable. Some firms are exploring a multi-tiered bonus structure based on time spent in the office or onsite vs. time spent working from home.

Yes, 2020 was the year that changed everything. The challenge for all real estate firms is to focus on the new ways people will work, be compensated and evaluated.

Christopher Lee is president and CEO of CEL & Associates, Inc.

Available Now: 2020 Compensation ReportsIs your 2021 salary and bonus package competitive? Find out with the 2020 NAIOP/CEL Commercial Real Estate Compensation and Benefits Reports. These valuable reports enable commercial real estate businesses to stay current on salaries, bonuses and benefits for CRE professionals from executives to entry-level positions. The reports include:

Data is presented by:

For more information, visit www.naiop.org/compensation2020 |