Construction Costs Outlook

Steel yourself for higher materials costs.

THE OTHER SHOE has dropped: Contractors are beginning to pass along more of their costs to building owners. (See Construction Costs Outlook, Winter 2017/2018.)

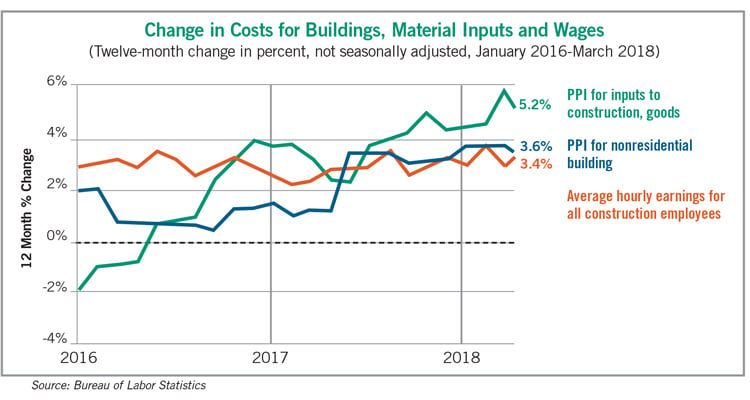

In 2017, construction labor costs increased at a 2.7 percent annual rate, not seasonally adjusted, as measured by the Bureau of Labor Statistics’ monthly series on average hourly earnings. By the first quarter of 2018, the rate had accelerated to 3.1 percent.

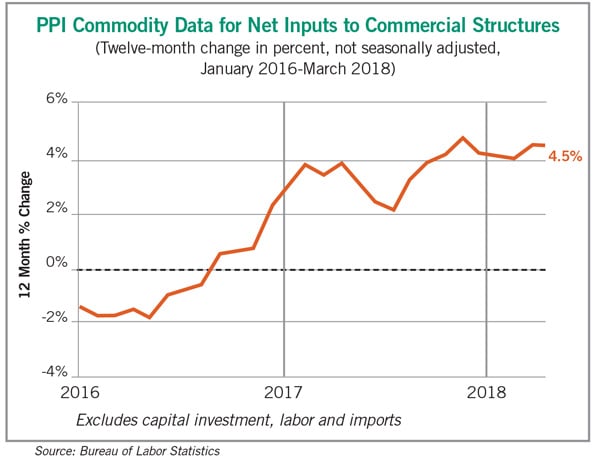

Meanwhile, the cost of materials and services purchased by contractors, which was decreasing at a rate of nearly 2 percent annually just two years ago, climbed 5.6 percent from March 2017 to March 2018, according to BLS’s producer price index (PPI) for inputs to nonresidential construction. That index measures the cost of a fixed “basket” of goods used for all types of nonresidential construction, including the cost of items consumed by contractors, such as diesel fuel, along with the cost of services used in construction, such as equipment leasing and trucking.

The goods portion of the index jumped by 5.8 percent in the 12 months ending in March 2018 – the largest rise since 2011 – while the services portion increased 5.3 percent. Both numbers were up sharply over the past two years.

How have contractors responded to these escalating prices? Probably the best indicator of contractors’ pricing is the PPI for new nonresidential building construction. BLS compiles this index by asking a fixed group of contractors how much they would charge to put up the same set of buildings month after month. The contractors do not have to estimate the cost of materials and services each time, only what they would add to those costs to cover their labor and markup.

During 2016 and the first half of 2017, this index generally increased at an annual rate of less than 1.5 percent. But in July 2017, contractors began pricing their (hypothetical) bids more than 3 percent higher than they had a year earlier. By March 2018, the annual rate of increase averaged 3.6 percent for five types of nonresidential buildings. Increases ranged from 3.2 percent for new office buildings to 4.3 percent for new industrial buildings. (BLS defines “industrial” projects as primarily manufacturing facilities.) School, warehouse and health care building construction pricing lay in between.

The Implications

In other words, contractors have raised their prices, but generally not enough to cover the pickup in the cost of materials. What are the implications for developers and other owners?

One possibility is that contractors can recoup the higher costs through productivity gains. A study by BLS economists published in early 2018 found that from 2007 through 2016, output per employee hour in industrial building construction increased at a robust 5.3 percent average annual rate. If replicated across all nonresidential building construction, that would imply that contractors can at least absorb higher direct labor costs, though not necessarily higher materials and subcontractor costs.

However, productivity gains are probably harder to achieve in other segments than in industrial building construction. Industrial projects tend to be larger and more capital intensive than, say, retail or office developments.

Without sufficient productivity gains, contractors face two choices: accept lower profit margins or pass along cost increases. The evidence on profit margins is skimpy, but it is widely believed they have remained much lower than they were before the long 2006-2011 slump in construction spending.

Further Increases?

What is the likelihood of further cost increases? Very high, based on notices contractors have received in recent months. Suppliers of rebar – the reinforcing steel bars used in concrete construction – have raised prices repeatedly since December, generally with no advance notice. By early April, these increases totaled as much as 20 percent, with many contractors anticipating more increases weekly. Other steel products, such as wire mesh, steel masonry accessories, and studs, also have posted double-digit price increases.

Ready-mix concrete suppliers announced they would increase prices by as much as 10 percent in April. Many other products have had price increases of 5 percent or more. And the retail price of diesel fuel, which contractors use to power off-road equipment, dump trucks and concrete mixers, climbed nearly 20 percent from March 2017 to March 2018.

Additional increases are almost certain if the Trump administration follows through on tariffs it has threatened to impose on imported steel (at a rate of 25 percent), aluminum (10 percent) and a long list of products from China (various rates). While it is too early to say how much these proposed tariffs will ultimately push up prices, contractors are likely to put an allowance for these costs in their bids, or ask developers to cover possible increases.

A further – and perhaps larger – worry for owners is delivery times. The frequent, sudden price shocks that have already occurred, along with the expectation of large additional increases, have led contractors and steel service centers to flood mills with orders. In addition, widespread shortages of truck drivers have injected uncertainty into delivery dates from fabricators and service centers to construction sites.

Worker shortages are not limited to truck drivers. Contractors have reported widespread difficulty finding qualified workers for a variety of hourly and salaried positions. BLS reported that there were 196,000 job openings in construction at the end of February 2018, the highest February total since 2007. Meanwhile, the number of unemployed job seekers with recent construction experience fell to the lowest February total in the 19-year history of that data series. The implication is that the hunt for qualified workers will get harder and labor costs will continue to accelerate, whether in the form of higher straight pay, overtime, benefits, or recruiting and training expenses.

In short, owners and developers should expect no letup in contractors’ bid prices through summer and early fall 2018. They may also face shortages of certain materials that will create either project delays or the need to redesign or “value engineer” projects.

Ken Simonson (simonsonk@agc.org) is chief economist at Associated General Contractors of America.