Multifamily Offers Stability in the Face of Uncertainty

The sector has always performed well during recessionary periods.

Multifamily real estate is poised to continue to be a bright spot in 2023 despite current economic uncertainty, with the potential for distinct pockets of opportunity for those looking in the right places — and even more so for those with the expertise to build.

Where Do Things Stand Today?

While the real estate market has been significantly affected by recent macroeconomic uncertainty and rising interest rates, rental rates over the past three years have seen historic growth among a stable tenant base. This created a dichotomy between macro conditions and on-the-ground operations. According to research from Real Estate Investment Services and Federal Reserve Economic Data, apartment rents have increased by 21% since 2020, while inflation has risen by 15.5% in the same period.

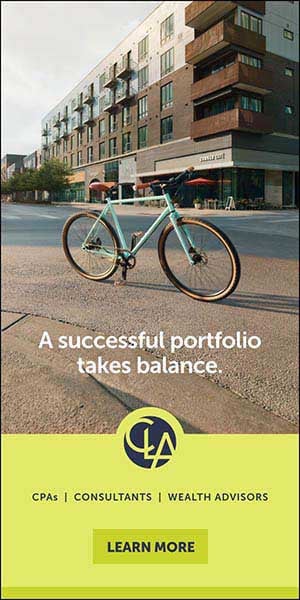

Although there have been historic transaction volumes in the past few years (See Figure 1), much of that centered on existing product rather than new development, which has done little to help the persistent shortage of housing that plagues many markets in the U.S. The fundamental need for housing and a lack of sufficient supply, especially in the workforce segment, support the growing case for multifamily development, especially in undersupplied markets with high barriers to entry.

The existing U.S. housing shortage was significantly exacerbated by the drop in housing construction following the 2008 Global Financial Crisis (GFC). Freddie Mac data indicates a shortage of four million units nationwide. This shortage is particularly acute in the workforce-housing segment, typically defined as market-rate housing affordable to households earning between 80% and 200% of a market’s area median income. In contrast to the push for government-subsidized affordable housing and growth in the high-end market, the middle segment has received significantly less attention, and it is not keeping up with growing demand. The workforce cohort in the U.S. saw outsized growth during the 2010s, with the number of households earning $75,000+ growing by 3.7 million between 2009 and 2019, according to the Harvard Joint Center for Housing Studies.

Furthermore, this housing shortage is not spread evenly across all markets. Supply-constrained markets like those on the West Coast face a uniquely difficult challenge as developers must possess specialized expertise to solve regulatory, political and geographic challenges.

Demographic trends are also driving demand for multifamily housing. Educated young adults continue to prefer metropolitan locations that provide quality social and professional opportunities, areas that often lack sufficient workforce and attainable housing. These highly amenitized locations offer diverse employment opportunities in addition to convenient public transit, rich cultural experiences and nightlife. This supply/demand imbalance presents attractive opportunities for savvy developers experienced enough to deliver quality product in these attractive locations that is priced for this demographic group.

Over the past three years, the global economy has faced numerous challenges. COVID-19’s initial impacts caused an unprecedented disruption. Unemployment jumped from 3.5% in February 2020 to nearly 15% by April, and GDP saw an 8.8% drop from the first quarter to the second quarter of 2020, the largest quarterly drop ever recorded. Apartment demand dried up quickly, but it snapped back at breakneck speed as government stimulus kickstarted consumer spending and employment quickly recovered. However, compared to the speedy, volatile moves in aggregate demand, supply chains moved at a glacial pace. Worker shortages and supply chain disruptions persisted much longer than most anticipated, including the Federal Reserve. As a result, demand significantly outpaced supply throughout 2021, leading to the highest level of inflation since the early 1980s.

Fortunately, recent evidence suggests that supply chain disruptions and related price increases have abated. Figure 2 illustrates how the price of lumber grew from $460 per 110,000 board feet in February 2020 to a peak of $1,670 in May 2021. This was then followed by a volatile period between the second quarter of 2021 and the second quarter of 2022 before dropping to today’s price of $377, less than its pre-COVID level.

Another example comes from looking at container shipping prices. At their peak in September 2021, the price of shipping one container from East Asia to the North American West Coast was $20,586. As of January 4, 2023, that price has fallen to $1,382, a drop of over 93%, according to data from Freightos.

How Multifamily Generates Strong Returns

Supply chains returning to normal and costs leveling off will help assuage a primary development concern — uncertainty in the escalation of development costs. 2020-2022 saw unprecedented cost escalations reaching 1% to 2% a month in certain markets. However, data from CBRE shows that development costs are leveling off and are now expected to rise at a more predictable, pre-COVID rate of 2% to 4% per year in certain markets, providing more cost certainty and better returns to developers and investors.

Unfortunately, investors do face a new set of risks with rising interest rates and a looming recession. Here, the development business model may present a unique opportunity. Its long time horizon and relative insensitivity to interest rates (up to four times less sensitive compared to value-add product strategies, according to an internal analysis by Cityview) make it a potential source of strong returns for investors seeking to add differentiated growth exposure to their portfolios while also hedging against inflation. A multifamily development project can be four times less sensitive to a change in interest rates than a value-add or core project, due in large part to the value generated through the development process and the timing of when funds are utilized. This allows investors and developers to capitalize on the potential benefits of multifamily, including its historical recession resiliency, while offsetting some of the interest rate impact in today’s macro environment.

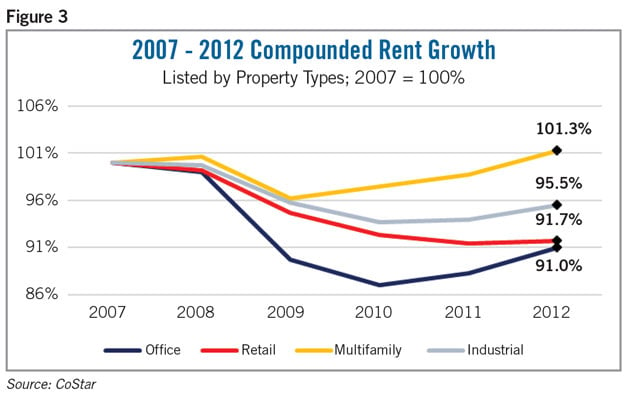

Recent recessions have shown multifamily to be uniquely resilient to macroeconomic volatility. It has historically been the best-performing property type during recessions, with demand remaining relatively strong and rents recovering faster than other property types. This is shown in Figure 3’s depiction of rent growth by property type during the GFC.

Occupancy data tells a similar story, as multifamily occupancy fell only 0.7% at its lowest point during the GFC, which is just half of the drop in retail occupancy (1.4%) and less than 1/3 of the drop experienced by industrial (2.4%) and office (2.7%), according to data from CoStar. Furthermore, the recovery and subsequent expansion period following recessions has also seen strong performance, with multifamily rents averaging growth of 20%.

Multifamily’s recession resiliency, ability to function as an inflation hedge and historical growth post-recession make it an attractive investment in these uncertain times for those looking to add differentiated growth exposure to their portfolios. Those who can develop and build may have the opportunity to supercharge that growth by generating value that isn’t always obtainable by merely operating an existing building with the added potential benefit of delivering new product into a post-recession market that has historically seen outsized returns.

Sean Burton is the CEO of Cityview. Ryan Graf is associate of capital raising

and investor relations at Cityview.