A Summer of Travel Turbulence

How hotels and airlines are navigating the post-COVID revival.

The pandemic has affected every aspect of the travel industry during the past 18-plus months. Airlines experienced turbulence not seen in decades, with thousands of flights delayed or cancelled during one of the busiest summers on record. Shifting labor supply and demand dynamics are partly to blame, brought on by inflationary pressure and prolonged depressed demand for air travel due to a two-year travel hiatus spurred by COVID-19 concerns.

Airline Labor Shortages

All aspects of air travel are facing labor shortages. Aviation requires a lot of skilled laborers, such as pilots and mechanics, who cannot be easily replaced because their jobs require extensive training and demonstrable skill. Pilots, for example, are seeking higher pay at a time when airlines gave many senior pilots early retirement packages as flights were grounded in early 2020. Many pilots are also moving to cargo companies, which provide better compensation packages (with the added benefit of not having to contend with unruly passengers). According to estimates from management consulting firm Oliver Wyman, North America is short approximately 8,000 pilots — roughly 11% of the total workforce — and that number is expected to grow to about 30,000 by 2032. All these factors mean airlines are struggling to organize staff for essential operations, and they may not have the backup crews necessary to allow flight operations to run smoothly.

Impact on Hotels

Persistent skilled labor shortages are driving flight cancellations left and right, and airlines are voluntarily reducing the number of scheduled flights to circumvent cancellations without the requisite backup crews in place. This directly impacts where hotels experience heightened growth and demand, even in the historically busy summer travel season.

Despite the lifting of travel restrictions at the start of the summer season, the trend to vacation at drivable destinations that started in 2020 and continued in 2021 has persisted into 2022 for two reasons: travelers want to avoid suffering through delays and cancellations at the airport, and they’re grappling with higher prices due to fewer scheduled flights and two years’ worth of pent-up demand.

These factors have led travelers to turn to drivable destinations despite higher gas prices. Consequently, many hotels that rely on leisure travelers who fly to destinations have not realized their full occupancy potential. Meanwhile, drivable vacation destinations from major metro areas (e.g., Massachusetts, Rhode Island, New Jersey and other areas close to New York City) boosted occupancies and revenue per available room (RevPAR) once again this summer, although not for COVID-related reasons.

Moody’s Analytics CRE hotel data reveals that drivable destinations received a boost from the summer’s air travel chaos. Myrtle Beach, Virginia Beach, Daytona Beach and Fort Myers all ranked in the top 10 metros for RevPAR growth in July 2022, ranging from 7.8% to 19.5%.

This trend was also present on the West Coast, as San Diego and Anaheim (home of Disneyland) also ranked in the top 10 in July. These two metros followed a similar pattern observed on the East Coast, with San Diego ranking in the top 10 for the second quarter of 2022 and Anaheim falling slightly short, coming in at 11th.

There is one noticeable exception — Oahu, Hawaii. In July, the metro posted an 18.4% increase in RevPAR from the previous month. That means that travelers were eager to visit despite higher average daily room rates and the possibility of air travel disruptions. Leisure travelers appear undaunted by logistical upheaval, and nowhere has this been more evident than in the latest TSA traveler throughput figures.

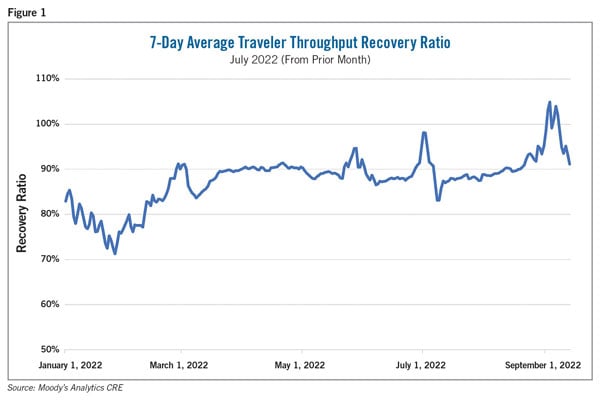

While the traveler recovery ratio (as measured by the number of travelers on a given month and day this year compared to 2019 based on TSA passenger throughput data) has held around the 90% mark for much of 2022, the end of summer and Labor Day weekend travel pushed the ratio past 100% for the first time ever, indicating that there were more travelers on that given day than in any year prior. The ratio has since declined closer to the 90% threshold once again due to the seasonality of leisure travel as well as the sluggish recovery in business travel. Nonetheless, this summer’s traveler numbers are an extremely promising sign for the hotel sector: more passengers than ever traveling by plane translates to elevated hotel occupancy along with the willingness to pay higher daily room rates.

In fact, even as the labor market remains tight, and undoubtedly so for the skilled labor needed for air travel to function smoothly, it appears that travelers remain undeterred, at least for the foreseeable future.

How long will these prospects last, especially in an environment of elevated inflation, remains to be seen.

Ermengarde Jabir, Ph.D., is senior economist with Moody’s Analytics CRE.