How Real Estate Tokenization Could Revolutionize Future Capital-Raising Efforts

Selling fractional ownership of properties has the potential to unlock much more investment.

How do you make bricks and sticks liquid? This is not a riddle or from a chemistry exam; it is a vital question that investors have posed to owner-operators in the real estate investment market since the industry’s earliest days.

So how do you bring liquidity to an illiquid asset class? According to the MSCI Real Estate Market Size Report 2021, the global real estate investment market sits at over $10 trillion, despite its inflexibility and lack of accessibility for the majority of retail investors. The options that do exist for retail investors are primarily limited to publicly traded and non-traded REITs. However, the introduction and continued application of digital securities within the real estate market has greatly expanded choices.

How Does It Work?

Digitization or “tokenization” is the process of adding digital elements to an otherwise traditional investment, such as stocks, bonds or real estate. These digital elements (sometimes referred to as “tokens”) are visible on a blockchain. In certain cases, they can be purchased, sold and traded freely on regulated marketplaces.

How does digitization benefit the real estate investment market? It turns equity in individual properties, portfolios, funds and non-traded REITs into small, fractional stakes with greater flexibility. Similar to the public markets, it is up to the issuer to determine the share price and the number of shares outstanding for the market cap.

This can increase investor diversification in markets that have been closed off to those without significant financial means. This broadening of the investor pool not only benefits those for whom real estate investment was previously too cost-prohibitive and restrictive, but also general partners who are now granted more avenues with which to enable liquidity optionality and raise capital for their projects. General partners can have more flexibility related to asset hold periods and access to a wider demographic of investors.

Additionally, the digitized equity can be accessed by this broad group of investors through a trading platform that is regulated by the U.S. Securities and Exchange Commission. Following any applicable regulatory lockups or holding periods, these investors would have the freedom to trade equity in a real estate investment as easily as shares of Apple or General Motors.

What are the prospects for the real estate digitization market? A December 2020 Bain & Company brief titled “For Digital Assets, Private Markets Offer the Greatest Opportunities” noted that global real estate is worth an estimated $317 trillion, but only $10 trillion of that is managed by funds and available to a broader investor base. Real estate digitization could greatly increase that.

Strong Growth

Since the start of the year, the nascent real estate digital security market has experienced significant growth. The Security Token Market’s December 2020 Real Estate Report put the total market cap of real estate tokenization at over $25 million. By June 2021, that market cap had risen to over $32 million, an increase of more than 25% in six months. With the introduction of easily accessible brokerage apps and secondary markets geared toward the retail investor, the real estate digitization market could be poised for exponential growth in the coming years.

One of the earliest entrants into the space is tZERO, a financial technology firm that brings together issuers and financial firms seeking a transparent, automated, digitally enabled marketplace and investors seeking access to a range of digital and conventional assets. It was launched by online retailer Overstock.com in 2014 as part of its Medici Ventures blockchain-focused subsidiary.

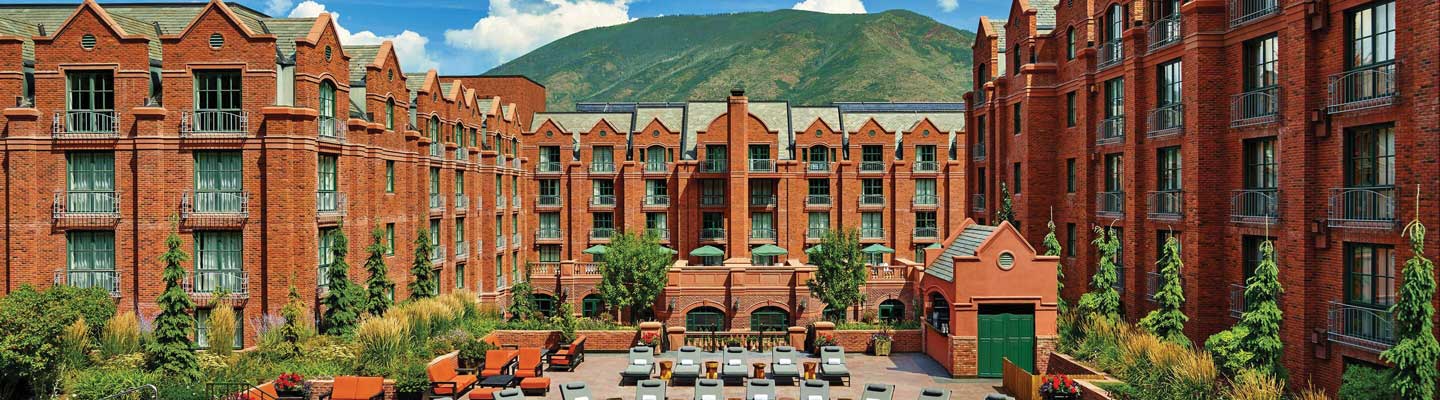

The St. Regis Aspen Resort in Aspen, Colorado, a digital security that trades on the tZERO ATS (Alternative Trading System), provides a case study for real estate tokenization. In July 2020, tZERO entered into an agreement with Elevated Returns, the property’s owner-operator, to digitize equity interests representing approximately 19% of the ownership interests.

Within six weeks, the St. Regis Aspen digital security (ASPD) commenced trading. The opening price was set at $1.25 per share based on an implied valuation from an appraisal completed by JLL. Since then, ASPD has experienced narrow trading pricing volatility in a challenging economic climate for the hospitality industry.

According to Solomon Tesfaye, head of business development and capital markets at tZERO, the company recently entered into a partnership with real estate private equity firm MarketSpace Capital to support the trading of $6.5 million in securities representing equity in an active adult living (55+) real estate development in Dallas, Texas.

While this is MarketSpace Capital’s first real estate digitization project, the firm has more than $400 million in assets under management, with plans to digitize and onboard more investments in the future.

Real estate digitization is a nascent industry that is garnering interest among domestic and international real estate owners due to the many benefits of the underlying technology.

Despite the promise of digitalization, there are a few barriers. Though it’s growing rapidly, the ecosystem is still young, which is less attractive to established, institutional players. Both general partners and limited partners must be educated on tokenization and secondary trading. Additionally, some limited-partner agreements and loan documents must be amended to be conducive for secondary trading.

Real estate remains one of the most coveted and lucrative investments in the world, and digitization can help solve the issue of liquidity. It has the potential to revolutionize the way investors access real estate investments and owners raise capital.

Ryan Zega is the associate director of business development and capital markets at tZERO.