Developers May Soon Feel the Workforce Woes Hitting Contractors

Fewer workers, higher wages and vaccination issues roil the construction industry.

Developers hoping to remodel or build any type of commercial property need an extra dose of patience this year. Projects are being bombarded with unbudgeted costs and unanticipated shortages and delays. Unfortunately, resolution of these issues is not yet in sight.

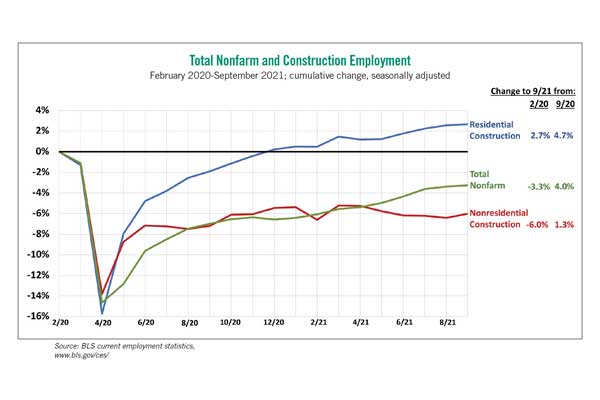

Consider construction labor. At first glance, it might appear there is no shortage of construction workers. Total construction employment as of September 2021 was running slightly ahead of total nonfarm payroll employment in terms of adding back workers who had been laid off in March and April 2020, according to the monthly payroll report from the Bureau of Labor Statistics (BLS). But the recovery is limited to residential construction — principally single-family homebuilders and residential subcontractors. Employment at residential building and specialty trade contractors in September 2021 exceeded the February 2020 level by 80,000 workers. In contrast, nonresidential builders, specialty trade contractors, and heavy and civil engineering construction firms had 281,000 fewer employees than in the month before the pandemic.

Those missing workers do not appear to be in any rush — or perhaps any condition — to return to construction jobs, however. Many of them have left the industry, dropped out of the workforce altogether, are coping with COVID-19 or other health conditions, or aren’t eligible to work where they are needed.

In a survey released in September by the Associated General Contractors of America, 90% of the more than 2,100 responding nonresidential contractors reported they had openings for hourly craft workers. For each of 21 crafts, at least 70% of the firms that were trying to hire a worker said the position was hard to fill. These results reinforce the news from BLS’s monthly Job Openings and Labor Turnover Survey, which found 344,000 job openings in the construction industry at the end of August, a leap of 38% from August 2020 and the highest August total in the survey’s 21-year history.

As the federal government and many other property owners impose more stringent COVID-related restrictions for anyone entering their premises, contractors are likely to struggle even more to field a healthy and qualified workforce. That is in part because construction workers have lower vaccination rates and higher vaccine hesitancy rates than other occupations. A daily survey of Facebook users by the Delphi Group at Carnegie Mellon University found that, as of late September, only 54% of workers in construction reported being vaccinated, compared to 81% of all other occupations. Conversely, 42% of construction workers were “vaccine hesitant,” vs. 17% of other respondents.

For owners, these worker shortages imply projects will take longer (even apart from delays resulting from slow deliveries and lack of materials) or cost more, as contractors incur more overtime costs for the workers they have on hand or boost pay and incentives to attract additional workers. The higher labor costs have begun to appear but are likely to accelerate in 2022.

In September, production and nonsupervisory employees in construction — craft workers, for the most part — worked an average of 40.9 hours per week, according to BLS calculations. That was the most for any month since the series began in 1947. Meanwhile, average hourly earnings for those workers climbed 5.8% from a year earlier to $30.79 per hour, the steepest year-over-year increase since 1982.

To date, contractors have not passed along the bulk of their labor or materials cost increases. Another set of data from BLS, producer price indexes, shows that the cost of materials and services (such as wholesale and trucking services) that go into new nonresidential construction soared 19.7% from September 2020 to September 2021. Meanwhile, an index that measures the price contractors say they would charge to build a fixed set of new nonresidential buildings rose 5% over those 12 months.

Thus, both materials costs and construction labor costs are rising faster than contractors’ bid prices. That situation cannot last for long. Developers should prepare to see higher bids and/or fewer contractors willing to bid on projects without price protection.

Ken Simonson is the chief economist with the Associated General Contractors of America. He can be reached at ken.simonson@agc.org.