"A Series of Unfortunate Events"

Costs for construction materials keep climbing amid shortages and supply-chain issues.

Contractors may be feeling like they are live versions of Lemony Snicket. Just when it seemed nothing worse could happen and new opportunities were just around the corner, new challenges kept arising. The miseries are likely to affect commercial property developers and owners as well.

The No. 1 concern is materials costs. After a rapid runup from April to September last year, the cost of inputs to nonresidential construction leveled off for two months, in part because lumber prices retreated from record highs.

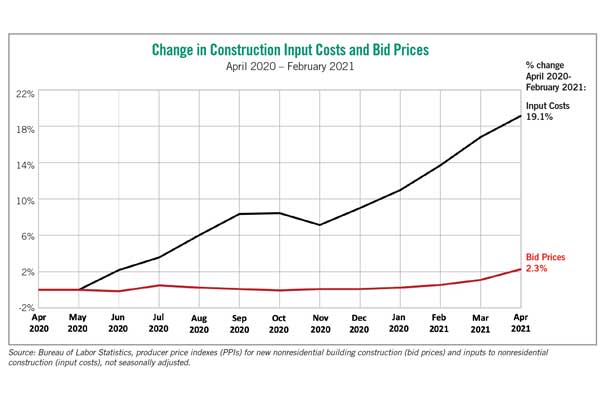

From November to May, however, lumber prices took off again, and were joined by a host of other materials. Both the Random Lengths Lumber Price Index and quotes for hot-rolled steel topped $1,500, more than three times the year-ago levels. The retail price of diesel fuel climbed for 20 straight weeks, rising 82 cents per gallon or 35% in less than five months. Copper futures set highs before mid-May. Meanwhile, contractors’ bid prices climbed just 2.3% from April 2020 to April 2021, as weak demand for new projects forced contractors to hold down their prices even though their costs were soaring by 19% over the same interval.

The dichotomy between flat bid prices and escalating costs is shown in the chart below. The black line traces the monthly change in the producer price index (PPI) for all goods and services purchased for nonresidential construction, other than capital goods and items imported directly by contractors. (The index does cover distributors’ sales of imports, which comprise most imported materials.) The red line shows the change in a PPI that measures the prices contractors say they would charge to build a fixed set of nonresidential buildings — warehouses, schools, offices, industrial (manufacturing) and health care buildings.

As prices ratcheted up, so did lead times for many materials. As early as March, suppliers of steel joists were quoting delivery times stretching into late fall or even the first half of 2022. The crippling cold that struck Texas in February damaged facilities producing the building blocks for a host of plastic construction products. These include PVC plumbing pipes and fittings; vinyl siding and vapor barriers; and resins for acrylic paints, geotextiles, and the layers of oriented strand board. Meanwhile, the freeze also created a surge of demand for PVC pipe to replace burst water pipes. This unfortunate event has meant many projects nationwide may be delayed for lack of seemingly minor inputs.

Production problems at cement plants in Texas and California caused yet another headache for some contractors in a number of midwestern and western states: rationing. Some ready-mix concrete companies were notified they would get only 50% of the amount of cement they had received in the winter quarter — just as demand was increasing with the arrival of the spring building and paving season.

Ship and rail delays at ports on both the east and west coasts, especially Los Angeles and Long Beach, have left contractors unable to finish projects that need appliances, plumbing fixtures, flooring and a variety of other imported products. Just as some of those bottlenecks seemed about to ease, the six-day blockage of the Suez Canal in March added new uncertainty about whether European manufacturers that rely on components from Asia would be able to meet delivery commitments. The backlog of containerships and lack of containers reaching Asian shippers compounded the problems.

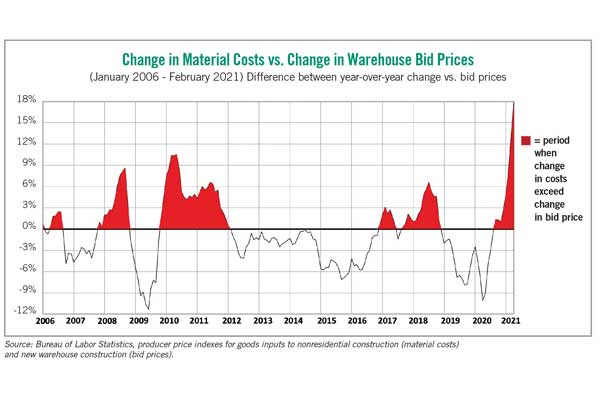

Eventually these backlogs and price surges will abate. However, past episodes of materials price spikes show it can take as long as two years before contractors are able to pass through their added costs. The chart above shows the difference in the year-over-year change in the PPI for the cost of goods used in nonresidential construction, less the PPI for contractors’ bid prices for building new warehouses. The periods in red are times that contractors were “in the red” — with higher increases in costs than in bid prices.

That may sound comforting to project developers and owners, but it is likely to mean many contractors, especially smaller subcontractors, are driven out of business or withdraw from certain market segments, potentially leaving projects unfinished or far behind schedule. An unfortunate event for all concerned.

Ken Simonson is the chief economist with the Associated General Contractors of America. He can be reached at ken.simonson@agc.org.