Will Technology Impact Manufacturing Reshoring?

And what are the implications for industrial space demand?

The U.S. manufacturing renaissance is an evergreen topic — and one that resurfaces every election cycle, given that the economic implications are so profound. This article examines the potential impact of technology on the reshoring of previously outsourced industries. It also looks at the history of domestic manufacturing, which can provide context for understanding what the future may hold.

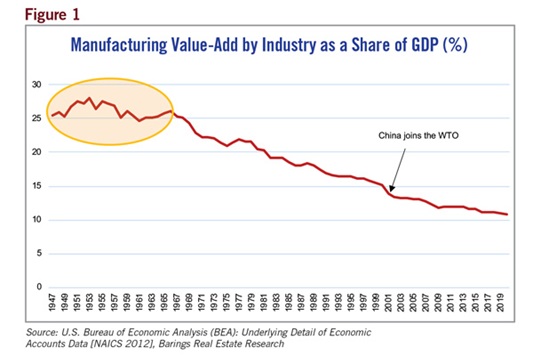

Manufacturing accounts for only 11% of GDP today, but this was not always the case. For nearly a quarter of a century following World War II, the manufacturing value-add share of GDP remained relatively stable at around 25%, before gradually declining to its current value (Figure 1). A natural question arises: What was so unique about the postwar period and, more importantly, can the conditions for manufacturing primacy be replicated today?

The postwar economic expansion in the U.S. was unique in that it was a period of virtually uninterrupted economic growth — bringing about elevated levels of home and car ownership and record levels of durable goods purchases consumed by the baby-boom generation. That mass consumption, in turn, spurred the successful reconversion of several wartime manufacturing industries to civilian production. Scarce foreign competition and abundant, inexpensive sources of energy were factors that led to dominance and complacency in some domestic manufacturing sub-sectors. This was particularly true in the automotive industry, which ultimately made it more vulnerable to a challenging set of developments that followed in the 1970s.

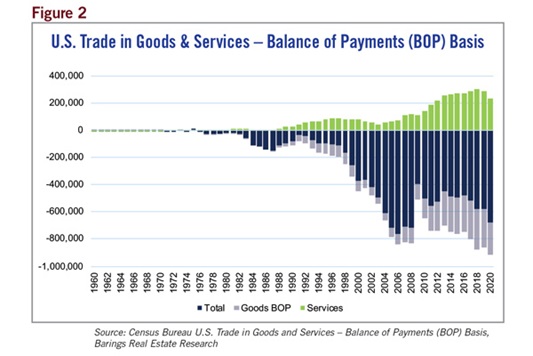

The 1970s brought with it several structural forces that went on to have a significant impact on the U.S. economy. First, the U.S. terminated the Bretton Woods system, which in 1944 set up the rules for financial relations among North America and Western Europe, Australia and Japan. This rendered the dollar a fiat currency and enabled the U.S. to indulge in deficit-financed consumption, which ultimately led to a persistent trade deficit (Figure 2).

Second, the U.S. became increasingly reliant on foreign oil. Along with this came explosive growth in the container shipping industry, which significantly expanded the scope of imports to the U.S. from low-cost production centers in Asia.

Finally, the U.S. re-engaged with China, which supported that country’s ascendancy in global trade. These structural forces were too powerful for domestic manufacturing to contend with, resulting in a gradual demise in its primacy.

State of Domestic Manufacturing Today

Fast-forward to today, and although the U.S. has once again achieved energy independence, domestic manufacturers need to contend with a fresh set of challenges. In addition to the increased competitiveness of foreign producers — especially the dominance of China in the global manufacturing value chain — emerging markets are becoming attractive from both a production and a consumption standpoint.

Additionally, there are also several supply chain challenges that could accompany any sort of plant repatriation, as well as the more immediate concerns of costs, capacity and capability — which limit how quickly previously outsourced production can be reshored.

Given the limitations, the manufacturing sectors that will likely continue to grow are those where the U.S. has a comparative advantage. These sectors can be identified through the analysis of both employment and the value-added share of overall GDP across manufacturing sub-sectors.

Looking at employment trends first, total manufacturing employment indicates that domestic manufacturing is in a secular decline. However, the aggregate trend is not representative of developments within individual sectors. Food and beverage, for example, has gained in terms of employment, while apparel manufacturing has lost over 90% of its employment level since the 1990s. In contrast, some capital-intensive manufacturing sectors such as transportation equipment (which includes automobiles), machinery, and fabricated metals and chemicals (which includes pharmaceuticals) have gained employment in the recent economic expansion.

Unsurprisingly, analyzing the value-added share of manufacturing to overall GDP helps us identify some of the same manufacturing sectors that are reporting employment growth. Durable goods sectors such as computer and electronic products, fabricated metals and machinery, as well as non-durable goods sectors such as food and beverage and chemicals, are all identified as key contributors to manufacturing’s share of economic activity.

The Importance of Emerging Technology to Manufacturing

This leads to the critical question: Can previously outsourced manufacturing industries such as apparel be reshored, and can the U.S. maintain its comparative advantage in other labor- and capital-intensive sectors such as food and beverage and computer and electronic products?

Consider the example of apparel. Although mass-market fashion brands and retailers are currently focused on low-cost production, technological advances and responsible consumerism could shift the value proposition away from costs and toward sustainability, flexibility and speed-to-delivery. For unit-cost savings to be realized under this new paradigm, technology will either have to make current processes more efficient or bypass inefficient processes altogether.

There are start-ups working on both solutions. U.S. companies such as Softwear Automation are attempting to completely automate the sewing process, for instance, while companies like Ministry of Supply are employing emergent technologies including gluing, bonding and 3-D knitting to make existing sewing processes more efficient. However, many of these technologies and start-ups are currently in the nascent stages, and therefore better suited to small-scale batch production than to mass production and commercialization, which are ultimately required to trigger a large-scale reshoring effort.

Technology is also making its mark in food & beverage, and it has the potential to help the U.S. maintain its lead in this labor-intensive manufacturing sector. The health risks associated with repetitive motion and heavy lifting were a concern prior to the pandemic. However, these concerns have now been overshadowed by the social distancing and hygiene considerations brought to the forefront by COVID-19. As a result, many leaders in this industry, such as Tyson Foods, have committed to investing in automated solutions.

But in some cases, smaller firms are leading the way. Gourmet food company Daniele Inc., which uses robots to perform most of the physical work in its plants, is an example. Other examples of successful automation come from related industries such as warehousing, where players like Ocado — a global software and robotics business that provides end-to-end solutions for online grocers — have shifted the value proposition of what technology can achieve.

Finally, in the computer and electronics industry, the U.S. is deliberating increasing the share of its semiconductor manufacturing. While the industry had largely outsourced production to overseas markets such as Taiwan, Mainland China and South Korea over the past several decades, recent trade tensions between Mainland China and the U.S. have increased government and private interest in reshoring previously outsourced chip fabrication. Intel’s recent announcement to build two chip fabrication plants in Arizona is an example of this emerging trend.

However, tech disruptions need to be assessed on a case-by-case basis — sometimes even within the same industry — and it is more likely that we will see technology-enabled scale and cost savings achieved in the medium- to long-run, rather than in the short run.

Implications for Commercial Real Estate

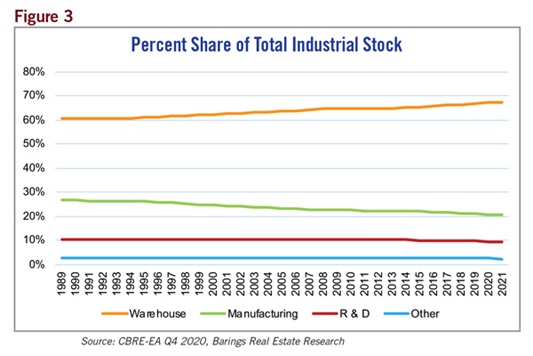

Against this backdrop, there are questions around the implications for commercial real estate, and specifically for the industrial real estate and manufacturing sub-sectors. Unsurprisingly, in terms of current inventory, the warehouse sub-sector accounts for almost 70% of the industrial footprint nationally, according to CBRE research.

While flex/R&D and the “other” sub-sectors of industrial have maintained their share of overall industrial inventory, manufacturing has lagged in space additions and given up share of total industrial (Figure 3).

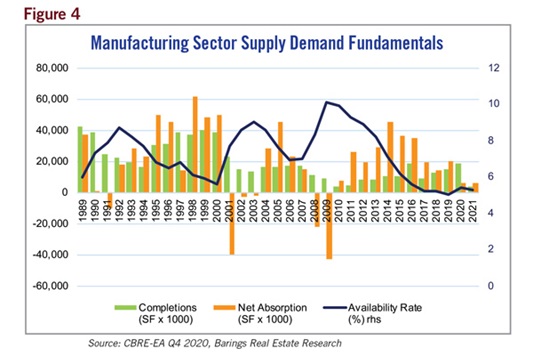

Completions have also lagged demand in manufacturing over the last two decades, resulting in tighter space market fundamentals, most notably in the last expansion (Figure 4).

In addition to technology and the resulting investment in domestic CapEx to reshore, functional obsolescence also has the potential to drive additional space demand going forward.

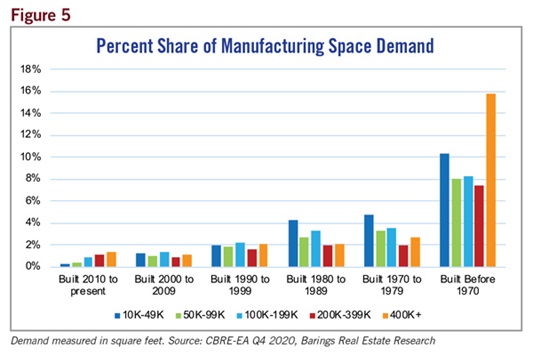

As revealed in Figure 5, more than half of the national stock of manufacturing space is more than 50 years old.

In addition, according to the Bureau of Economic Analysis, domestic investment by multinational companies has historically lagged investment in their foreign facilities, resulting in older equipment with lower productive capacity in outsourced industries.

The emphasis on domestic manufacturing and the rapid pace of technological advances offers the opportunity for domestic manufacturers to invest in PPE that not only increases productivity but does so at lower costs — thereby increasing the value proposition of reshoring in some industries.

In conclusion, both structural and cyclical factors support additional space demand in the manufacturing sub-sector today, as well as in the warehouses that will be needed to accommodate the storage and distribution of any additional production.

Developers and investors in industrial properties could benefit from focusing on these emergent trends.

They could also diversify their industrial footprint by identifying and investing in both existing and new manufacturing bases that cater to this second production wave in select industries.

TJ Parker, CFA, CAIA, is managing director of real estate research with Barings LLC.