EB-5: An Alternative Source of Capital to Support Commercial Real Estate

The program helps attract foreign investment into projects all over the U.S.

The EB-5 program, also known as the U.S. Immigrant Investor Program, is a federally authorized economic development tool that provides access to foreign direct investment for U.S. businesses and creates jobs for U.S. workers. The program is currently under reauthorization (see shaded box below).

Under the EB-5 program, investors are required to make a minimum investment of $1.8 million into an economic development project in the U.S. that creates at least 10 full-time jobs for each investor. The required investment can be reduced to $900,000 if the project is in a high-unemployment or a rural area. In return, investors receive a conditional visa that is valid for two years.

Permanent visas are rewarded to investors who can demonstrate that they have achieved the required economic benefits from their investments.

In 1992, Congress enhanced EB-5’s economic capacity by creating the Regional Center Program, allowing companies that are approved by the U.S. Citizenship and Immigration Services (USCIS) to establish a Regional Center and pool EB-5 capital from multiple foreign investors.

According to the USCIS, there are currently 673 approved regional centers promoting economic growth in 48 states, the District of Columbia and three U.S. territories. In addition, based on statistics published by the U.S. Department of State, more than 93% of the EB-5 capital formation between 2008 and 2019 was facilitated through regional centers.

EB-5 Capital Investment and Impact

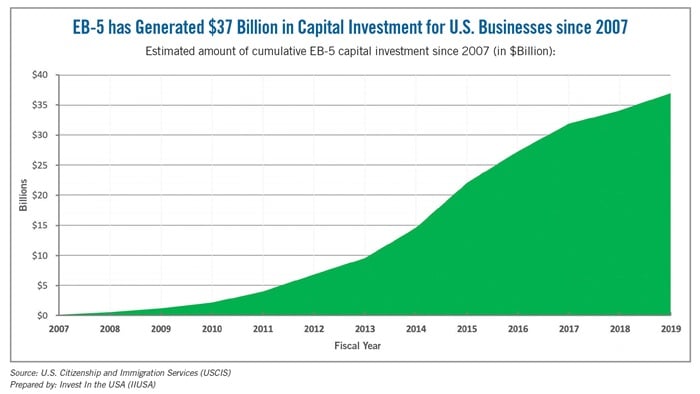

When domestic financing was difficult to secure during the Great Recession in 2008, EB-5 became an alternative source of funding. Based on the data of EB-5 investor applications published by USCIS, an estimated $37 billion in capital investment has been generated through the EB-5 Regional Center Program since 2007 to support a variety of economic development projects in the U.S.

In addition, researchers at IMPLAN, the Alward Institute for Collaborative Science and the Center for Economic Business Research at Western Washington University conducted a series of peer-reviewed economic impact studies in 2013, 2014, 2015 and 2018 that took an in-depth look into EB-5 capital investment by industry sector and by geographic location.

EB-5 Funding by Industry

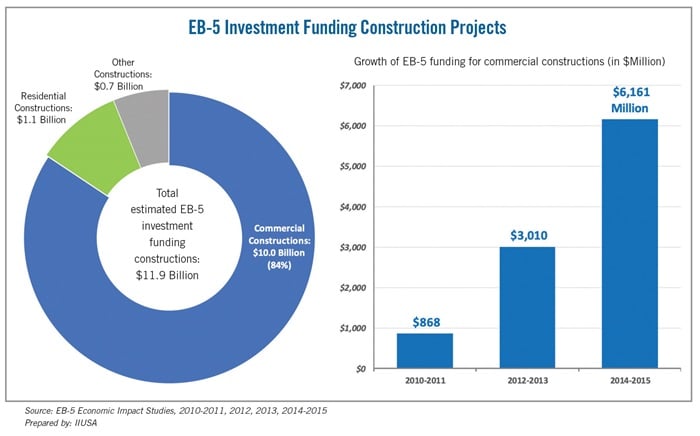

These economic impact studies found that the EB-5 program raised a total of $16.7 billion in capital investment between 2010 and 2015. Nearly $12 billion (or 71%) of EB-5 capital was used to finance construction projects in the U.S. In addition, non-construction-related sectors with significant EB-5 capital investment during the same period included hotels and restaurants (an estimated $1.2 billion); real estate (an estimated $540 million); retail and wholesale trade (an estimated $516 million); and architecture, engineering and related services (an estimated $412 million).

EB-5 Investment by State

The impact studies also determined that EB-5 capital has financed job-creating projects in 38 states and the District of Columbia. In particular, top areas for EB-5 investment between 2010 and 2015 included the state of New York (received more than $4.5 billion in investments from EB-5 participants), California (nearly $4.1 billion in EB-5 investments), Florida ($1.1 billion in EB-5 investments), Texas (nearly $1.1 billion in EB-5 financing) and Washington State ($1.0 billion in EB-5 investments).

EB-5 and Commercial Real Estate

EB-5 capital has been primarily used to fund construction projects in the U.S., especially for commercial structures such as offices, retail centers, shopping malls and warehouses. Based on data from the EB-5 economic impact studies, between 2010 and 2015, a total of $10 billion in EB-5 investment was used to finance commercial construction projects, accounting for 84% of the EB-5 funds that were invested in the construction sector. Furthermore, the estimated amount of EB-5 investment for commercial construction projects was more than $6.1 billion in 2014 and 2015, an increase of 610% from 2010 and 2011. (2015 is the most recent year for which data is available.)

B-5 Financing in Commercial Real Estate Projects

Success stories of using EB-5 to finance commercial real estate projects can be found across the country. For example, in downtown Brooklyn, New York, $200 million in EB-5 capital financed the 1.2 million-square-foot mixed-use complex known as City Point. In Philadelphia, $13.5 million in EB-5 funding was utilized to transform the former Philadelphia Naval Base into a 6.5 million-square-foot business campus for more than 130 companies. This development accounts for more than 10,000 jobs in industries as varied as fashion, pharmaceuticals, education and more.

And in Dallas, $65 million in EB-5 investment supported the construction of the KPMG Plaza at Halls Arts. In addition to creating nearly 2,000 jobs, this project now is an 18-story office building that is home to many global and local businesses.

Lee Y. Li is director of policy research and data analytics with IIUSA.

The Future of EB-5The EB-5 program first launched in 1990 and has been regularly reauthorized by Congress as part of the annual budget process. However, the spending bill enacted at the end of 2020 decoupled the program from the federal budget. It is set to expire on June 31, 2021, unless it is reauthorized by Congress. In 2019, U.S. Senators Chuck Grassley (R-IA) and Patrick Leahy (D-VT) introduced the EB-5 Reform and Integrity Act. According to a February 2021 article from National Law Review, the bill would:

|