An Industrial Project Encounters Unique Challenges

An abandoned cemetery dating to the 1800s was among the obstacles for this distribution facility near the Cincinnati/Northern Kentucky International Airport.

Given the current booming growth within the industrial sector fueled by the rise in e-commerce and supply chain reconfiguration, many developers are struggling to find sizeable land sites without complicated entitlement processes that offer available incentives. A recent project in the Cincinnati area provides a case study of these challenges, which included relocating a long-lost cemetery as well as more typical environmental issues.

Core5 is an industrial real estate property company headquartered in Atlanta that develops properties throughout the U.S. In recent years, it has sought to establish a presence in the Greater Cincinnati market, which is within a one-day drive of 60% of the U.S. population and a two-day drive of almost 85% of the country. Amazon is building its U.S. Prime Air Hub at the Cincinnati/Northern Kentucky International Airport; when completed, it will coexist with DHL’s mega-hub operations there.

To support this industrial demand, the local market continues to see a trend toward larger building sizes, increased trailer storage and additional employee vehicle spaces. The ability to house these ever-growing buildings is challenged by topography, utility availability and limited infrastructure.

Data collected by CBRE shows that the number of new speculative industrial projects in the Cincinnati/Northern Kentucky region has risen from three in 2014 to 20 in 2020. Even with the additional supply and available real estate, the vacancy rates have remained lower than the national average, which confirms that demand for available space remains high in this region.

Finding a Location

After reviewing available sites, Core5 identified property in the Northern Kentucky Industrial Park in the city of Elsmere that had been available for more than 50 years. At over 1,400 acres, the Northern Kentucky Industrial Park is the largest planned industrial park in the Greater Cincinnati area. It is located east of the Cincinnati/Northern Kentucky International Airport. Most development over the past 20 years around the airport has occurred on the west side in Hebron, Kentucky.

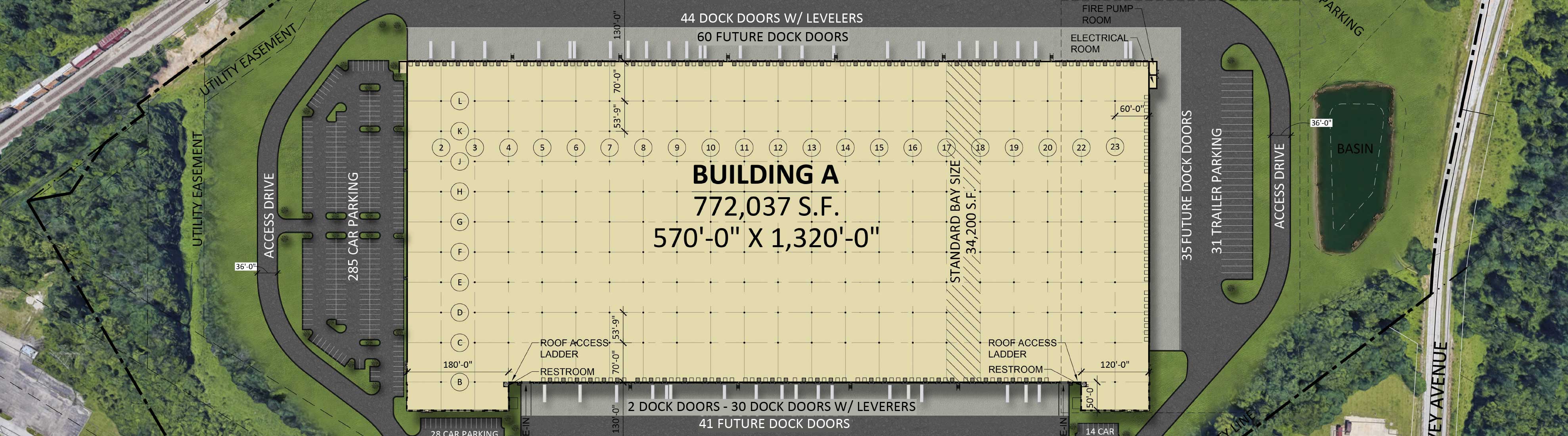

The site had been proposed for build-to-suits over the years, but the property faced challenges that included a lack of definitive roadway access, a private family cemetery dating back to the 1800s with no recorded owner, stream and wetland permitting, and topographical constraints. In order to create a building large enough to attract the attention of large corporate users, Core5 obtained three additional parcels that allowed the development of a 772,037-square-foot infill site.

The site’s location, however, offered some unique attributes that offset the entitlement hurdles. It features excellent utility capacities due to the industrial location. The property also is closer to the new Amazon and DHL air hubs than properties on the west side of the airport. Additionally, the site’s unique urban infill location makes it much more attractive to the labor force than locations elsewhere in Northern Kentucky. When completed, the building will be close enough to housing that many employees could walk to work.

Long-Lost Cemetery

One of the first challenges during the entitlement phase was to solve a half-acre cemetery relocation and a title issue relating to a lack of a defined parcel owner (known as a “ghost parcel”). At some point in the late 1800s, the parcel was carved out of surrounding property transfers as a burial plot for the Rice family and did not carry a legal owner. Adding to the complication, it was in the center of the overall site and was a critical piece for the design of the facility.

Because it wasn’t familiar with this process, Core5 engaged local legal teams and environmental engineers specializing in cemetery relocations to develop feasibility strategies and cost summaries. Eventually a plan coalesced, and the group began the process of researching possible heirs, posting public notices, attending public hearings and issuing numerous legal filings. But just when everything seemed to be on the correct trajectory, the COVID-19 pandemic hit.

It brought the entire process to a halt. Challenged with a limited ability to meet in person, hold the required public hearing or attend court rulings, the once-viable plan appeared to be heading toward dismantlement. Thankfully, the local jurisdictions and legal teams were able to reconvene, and the ability to hold virtual meetings only cost the project two months of delay.

Overall, this process took approximately 10 months to complete. It ended with a successful proceeding through the Kenton County Fiscal Court that perfected title in favor of the development. That allowed the site to be incorporated into the adjacent parcel and included in the overall site.

The second challenge was dealing with cemetery markers found within the ghost parcel. The markers appeared to be more than 100 years old with no visible signs of visitation as the trees, brush and overgrowth limited access. The Core5 team enlisted an archaeologist with K & V Cultural Resources Management to help construct a plan for identifying the markers, contacting heirs (both known and unknown) and facilitating a proper relocation of the headstones and related earth volumes to a well-maintained cemetery. Following guidelines set forth by the Kentucky Heritage Council and Kenton County, this multiphase process to move five adult and five infant/child burials took approximately seven months and cost more than $100,000 to complete.

Environmental Issues

Next came stream and wetland impacts that existed in the valleys across the site. These are common in the Northern Kentucky Region, so the team used an environmental engineer and an Army Corps of Engineers preemptive walk-through to establish an estimated cost for both the stream and wetland impacts. The Core5 team was able to include these costs early in the budgeting process so they were not a surprise upon receipt of the mitigation credits.

The last challenge in the due-diligence period was resolving the primary access drive into the site. As part of the purchase, Core5 would be granted an access easement to the primary roadway. However, the access was partially obstructed by overhead power and transmission lines. Instead of working with the utility companies to relocate towers, the group laid out multiple driveway options that avoided the towers.

The ideal entry sequence ultimately would require the acquisition of small portions of the neighboring properties; however, Core5 identified similar-sized portions of its land that could be provided in exchange. These parcels were not buildable land for Core5 but were well suited for the future plans of both neighboring companies. Ultimately, the team negotiated individual purchase and sale agreements that would close immediately following the land acquisition of the original three parcels.

On closing day for the project, the plan was for Core5 to purchase three separate parcels including the ghost parcel, subdivide the newly acquired land for the access drive, close on the land swap purchase and sale agreements to finalize access to the main roadway, and consolidate all parcels into one plat for development of the distribution facility.

Now fully under construction, the speculative distribution center features 40-foot clear heights inside the rack areas to maximize vertical storage options, 70-foot staging bays for increased space of material handling equipment, 60-foot column spaces to enlarge aisle spacing and promote additional safety distances for picking equipment, and tri-dock loading with additional loading bays on one short side of the building.

The project is expected to be completed in the third quarter of 2021.

JD Barnes is development manager with Core5 Industrial Partners.