What's on the Horizon for Commercial Real Estate?

In October, NAIOP gathered national research directors for an in-depth discussion of city rankings, the future of coworking and other vital topics.

In October, the NAIOP Research Foundation’s National Research Directors Meeting brought together NAIOP Distinguished Fellows and research directors from national real estate brokerage, data and investment firms at CRE.Converge 2019 in Los Angeles. Attendees discussed current Foundation research and trends in industrial and office development.

Market Tiers and Rankings: Clear as Mud?

Maria Sicola and Charles Warren of CityStream Solutions presented the initial findings of a white paper sponsored by the NAIOP Research Foundation that describes how the commercial real estate industry currently sorts metropolitan markets into tiers or rankings. Sicola and Warren based their findings on interviews with industry researchers, consultants and academics, plus published reports that utilize or examine market tiers and rankings.

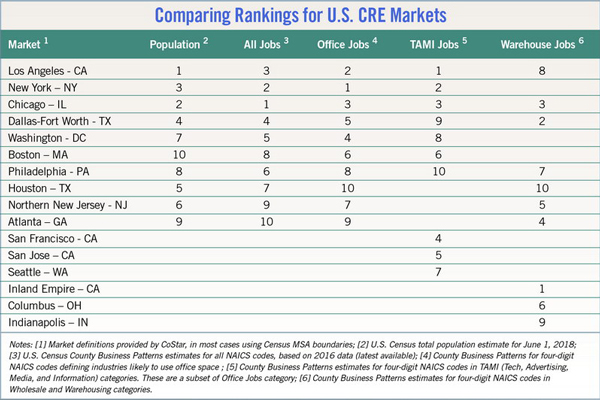

This table shows that the largest markets by population align closely with those that have the largest number of jobs and office-using jobs. However, there is less overlap between these markets and those with the highest concentration of tech, advertising, media and information (TAMI) jobs or warehouse jobs. This divergence helps to illustrate why market tier rankings are rarely identical, but often overlap. CityStream Solutions

Sicola observed that most people who develop and interpret market-tier models tend to use them to evaluate risks and opportunities in different markets, not to predict their future performance. Market tiers have historically been organized around market size, with larger markets usually perceived as less risky. However, in recent years there has been “a movement away from size in and of itself to measures around price, cap rates, velocity and volatility,” she said. Some researchers have branched out further to look at measures such as walkability or whether a market is anchored by an 18- or 24-hour city.

This expansion in the number of variables that analysts consider has led to more variation in the market-tier rankings developed by different firms. Product type — whether categorizing industrial, office or multifamily markets — also has a significant effect on which markets emerge as primary, secondary or tertiary markets. The intended audience for a tier-ranking system can further affect how an analyst sorts markets, as conservative investors and yield-seeking investors will prioritize risk and potential return differently.

The profusion of different methodologies and resulting categories can lead to significant confusion for those trying to make sense of conflicting reports. Their task is further complicated by the tendency for analysts to offer explanations of their methodologies that are “clear as mud,” as Jeanette Rice, writing for CBRE, observed in 2016.

Using data from CoStar, Warren demonstrated how market rankings can be affected by variables measuring size, price and liquidity, as well as by product type. He then previewed an alternative approach to market tiers that CityStream has been working on.

One weakness of the many approaches that analysts use in developing tier models is that they reduce all their variables into a one-dimensional outcome that places an individual market in a higher or lower tier. Warren described an alternative model, similar to the way Morningstar is known for rating stocks, which categorizes markets using two dimensions — size and risk/return characteristics. Hypothetically, this type of model would allow users to more easily identify if a market is in the “first tier” for their own particular investment goals and strategy.

Feedback to Sicola and Warren’s presentation was generally positive. Attendees agreed that different types of investors and developers will look for different types of markets, but the creation of a descriptive model for real estate markets that could be widely shared across the industry would be beneficial.

Sicola and Warren’s proposal for a two-dimensional model also generated significant interest. While there was little disagreement about categorizing markets by size, attendees focused their feedback on the proposed risk/return dimension.

Frank Nitschke, executive director of investment research and strategy at PGIM Real Estate, argued that for a new model to be widely accepted, categories based on risk/return characteristics should be based on clearly defined quantitative measures rather than qualitative judgments. Joshua Harris, vice president of strategy at Skanska USA, maintained that a dimension measuring risk/return would be most useful if it clearly measured a continuum of volatility. Adam Brueckner, vice president of research at Oxford Properties Group, added that it could be useful to label the risk/return dimension using the familiar “core,” “value” and “opportunistic” categories.

Sicola and Warren plan to follow up with meeting attendees as they conclude their research.

Coworking in WeWork’s Wake

Turning to a discussion of recent trends, attendees had a lot to say about WeWork’s recent difficulties and their expectations for the real-estate-as-a-service market. Dean Violagis, vice president of research at CoStar, agreed with other attendees that WeWork’s problems reflected a flawed approach to long-term leases and aggressive expansion.

“Leasing 100,000 square feet here, 100,000 square feet there was not going to be sustainable,” he said.

However, the concept of flexible office space remains appealing.

“A lot of landlords are getting involved because they see it as a good option to have in their properties,” he said.

Shawn Gilligan, research and strategy associate at QuadReal, said WeWork and other coworking operators that focus on servicing high-end customers with high-cost space had adopted a high-risk business strategy. If there were an economic downturn, operators stuck in expensive long-term leases would find it difficult to sell desk space at a sustainable price when market rates declined. Coworking firms can significantly reduce their risk by leasing low-cost space in Class B or C office buildings.

Several attendees noted that companies with a business model like Convene, which shares risks and returns with building owners, are likely better positioned to weather the next recession.

Despite WeWork’s shortcomings, Raymond Wong, vice president of data operations at Altus Group, noted the company’s transformative role.

“Coworking space has been around for years,” he said. “They made coworking space cool.”

The success of WeWork and other coworking operators at providing high-quality flexible office space gives companies a new way to attract and retain talent.

Harris and Mark Stapp, a professor in real estate at Arizona State University, observed that office building owners increasingly see coworking as a revenue-generating amenity that allows traditional office tenants to increase or decrease their use of office and meeting space as needed. Sarah Dreyer, vice president and head of Americas research at Savills, added that coworking brings hospitality services to office space, making real estate as a service more attractive to tenants who employ highly skilled workers.

Stapp noted that space-utilization studies show that leased space designated for an individual worker is only occupied less than a third of the time.

“Corporations ask ‘Why are we leasing all of this space when it’s utilized only 30% of the time?’ ” he said. “And so I do think this is going to continue to be a strategic tool.”

Harris predicted that if WeWork breaks its leases, the quality of the spaces it leaves behind should make them easy to re-lease with minimal tenant improvements. He went further to note that a broader shift to real estate as a service could help building owners significantly reduce costs associated with the tenant-improvement cycle. Owners stand to benefit in the long run if tenants become accustomed to trading customized buildouts for flexible high-quality office space.

Other Trends in Office and Industrial Real Estate

Attendees closed the meeting with a discussion of other emerging trends in commercial real estate.

Violagis observed that there is still a high level of activity in industrial real estate, with developers continuing to build large fulfillment centers. Although e-commerce is leading to strong growth in fulfillment and distribution centers, Jack Kern, director of research and publications at Yardi Systems, has seen an increasing trend for retailers to carve out storage spaces within their stores to facilitate omnichannel distribution.

Several attendees noted that reverse logistics presents unique challenges to manufacturers, retailers and distributors. Stapp said a staggering volume of returned merchandise is being landfilled. By contrast, Kern noted that returned merchandise often finds a second life on eBay.

Ian Anderson, senior director of research at CBRE, opened a conversation about the current state of office development by noting that owners of older Class A office buildings in markets like midtown Manhattan and Washington, D.C., appear to be struggling with higher vacancy rates amid an excess supply of office space and competition from coworking operators. By contrast, lower-cost Class B properties have recently experienced the strongest rental growth rates.

Harris indicated that environmental sustainability mandates in cities like New York and D.C. are likely to further contribute to the obsolescence of older buildings, which can be expensive to retrofit. Gilligan observed that the problem of obsolescence and oversupply is market-specific. Demand is sufficiently robust in some Canadian markets like Toronto and Vancouver that owners of older Class A buildings only need to “sweep the floors” before leasing space to a new tenant.

Several attendees also discussed how a continuing trend toward multinodal urban development — a response to traffic congestion and the expansion of public transit networks — is affecting office markets. In some cases, central business districts in traditional urban cores are losing office tenants to the suburbs as inner- and outer-ring suburbs become more urbanized. Suburbs can be particularly attractive if the cost of living and office rents are particularly high in an urban core, or when locating an office in a suburb will lower commute times for most employees.

Shawn Moura, Ph.D., is the director of research for NAIOP.