Shipping Innovations Along Inland Waterways Present Opportunities for Developers

Container-on-vessel service along the Mississippi River and into the Midwest could increase demand for distribution facilities.

While slow-moving barges laden with bulk cargo or containers are a familiar sight on the Mississippi River, they could soon be joined by a fleet of innovative ships providing new container-on-vessel (COV) service to the Midwest. As the new COV service picks up speed, it could provide opportunities for commercial real estate developers to build new logistics and distribution centers.

Why COV Matters

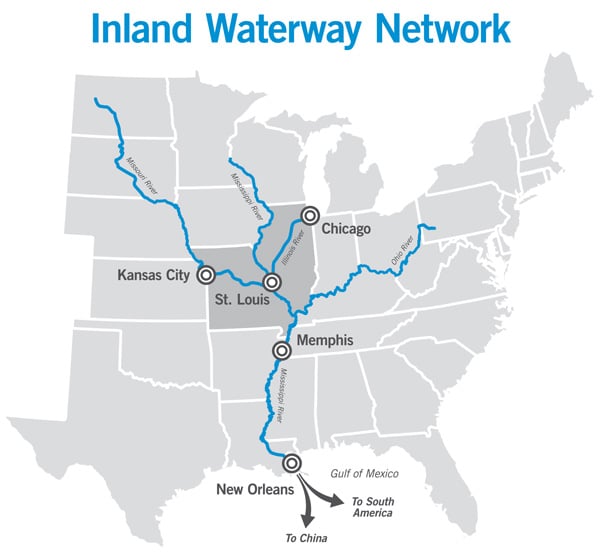

COV service is just like it sounds — a waterway vessel stacked with containers. However, unlike the oceangoing ships that carry containers to ports along the U.S. coasts, or traditional barges that move them along the lower Mississippi, these vessels would be capable of carrying mass quantities of containerized freight on an all-water route, connecting ports in the St. Louis region and elsewhere in the Midwest to the lower Mississippi River — and ultimately to Asia, Europe and other foreign ports.

This new type of vessel is poised to take advantage of greater shipping volumes to Gulf Coast ports in the wake of the 2016 expansion of the Panama Canal. The decade-long, $5 billion project allows larger ships to pass through the canal. According to the American Association of Port Authorities (AAPA), these newer vessels are up to 1,200 feet long and can carry as many as 13,000 containers. That’s more than three times the capacity of earlier ships. Since the expansion, the traffic through the Panama Canal has increased from 330 million tons in 2016 to 442 million tons in 2018, according to statistics from the Panama Canal Authority.

Inland ports that could benefit from COV service along the Mississippi River and its tributaries include Kansas City and Chicago. Source: St. Louis Freightway

American Patriot Holdings LLC (APH) is developing the specialized vessels that will provide COV service. They have patented features enabling high cargo payload and more rapid upriver speeds. APH’s Liner vessel will carry up to 2,500 containers at speeds of 13 miles per hour with virtually no wake, making round trips from the mouth of the Mississippi to the St. Louis region possible in 10 days. That’s significantly faster than other waterborne options.

“Cargo flows to the lowest cost and most efficient route, so all we had to do was build the lowest-cost, most efficient route,” said Sandy Sanders, executive director of the Plaquemines Port Harbor and Terminal District (PPHTD), which is located at the mouth of the Mississippi River south of New Orleans. A new gateway terminal is planned for PPHTD that would be part of a hub-and-spoke transportation system for container transport vessel shipments from Plaquemines to Midwest markets, which represent 40 percent of U.S. land area and 15 percent of the nation's gross domestic product.

APH’s Hybrid vessels would be a little smaller and more nimble than the Liner ships. They would be able to make direct trips between Plaquemines and Midwest ports along the Mississippi while also connecting with other ports on the tributary rivers, where they could pick up additional freight. APH anticipates existing container-on-barge (COB) services would also support the hub-and-spoke system as feeder vessels. Final engineering and designs are underway for the ships, which recently completed model testing in Germany.

Sal Litrico, CEO for American Patriot Container Transport, a wholly owned subsidiary of APH, notes that the ability to move a critical mass of containerized product significantly faster than COB results in lower land-related transportation costs. Litrico said shippers could potentially save between 30 to 40 percent vs. other intermodal alternatives. With the additional travel time to the Gulf Coast offset by congestion-related delays and longer dwell times at the West Coast ports, this alternate route becomes even more viable for shippers.

A recent study by the Soy Transportation Coalition/Illinois Soy Association (STC/ISA), which represents 13 states and 85 percent of the soy production in the U.S., validates the projected savings. The study, conducted by Informa Economics, evaluated grain exports from the Midwest utilizing the APH/PPHTD all-water route to Asia vs. intermodal to the West Coast, concluding the all-water routing demonstrated significant savings.

“Our research highlights this innovative approach can provide a cost-effective, fast and secure transportation option to our international customers,” said Mike Steenhoek, executive director of the STC.

The CRE Angle

The development of the new hub-and-spoke system would require the build-out of river terminals capable of loading and unloading containers. That could drive demand for logistics and distribution facilities to handle the increased freight moving into and out of the Midwest.

“What do you do with all that cargo, how do you sort it, where do you put it — that’s the real issue,” Aaron Ellis, public affairs director for the AAPA, told Redshift, an online publication that looks at the future of manufacturing, in May 2017.

Anthony Johnson, executive vice president and shareholder industrial business unit leader for Clayco, a real estate, architecture, engineering, design-build and construction firm based in Chicago, thinks COV service could provide solid opportunities for the commercial real estate industry.

“The opportunity to bring the COV service to improve the movement of international freight into the St. Louis region is a positive step for the logistics and distribution industries,” he said.

PPHTD has Memorandums of Understanding in place with the St. Louis Regional Freightway and various ports in the St. Louis region and throughout the Midwest, as well as an agreement with APH, all aimed at advancing the COV effort. The next step is continuing to line up cargo for the return trips back down the Mississippi River to the Gulf of Mexico.

Mary Lamie is executive director of the St. Louis Regional Freightway.