E-commerce 2.0: Last-mile Delivery and the Rise of the Urban Warehouse

Today’s industrial users are looking beyond rental rates to consider transportation and inventory carrying costs when making location decisions.

THE ERA OF e-commerce began unceremoniously in July 1995, when Jeff Bezos boxed up the first book sold on Amazon.com from his Seattle garage. Over time, nearly all major retailers began selling and shipping items from their own websites. This is now having a monumental impact on the way goods are created and distributed — and on the industrial real estate necessary to do so.

By the end of the second quarter of 2016, e-commerce sales had grown 16 percent year-over-year, a rate that dwarfs the 2 percent overall retail growth for the same time period. Enormous e-commerce sales have been a boon to industrial real estate, with record-low vacancies and record-high asking rents, net absorption and development.

A majority of U.S. industrial real estate is concentrated in massive big-box distribution centers in core markets such as California’s Inland Empire, Atlanta, Chicago, Dallas, northern New Jersey, Houston and eastern Pennsylvania. Each of these markets is strategically located near a large population center. But not all of them are close enough to the demographic that is one of the biggest driving forces behind e-commerce: millennials.

Millennials grew up in a “one-click” world, where convenience is king. As millennials aged and their purchasing power grew, they continued to prefer the one-click lifestyle. Many moved to urban areas where they could live, work and play without having to get into their cars to drive to and from suburbs.

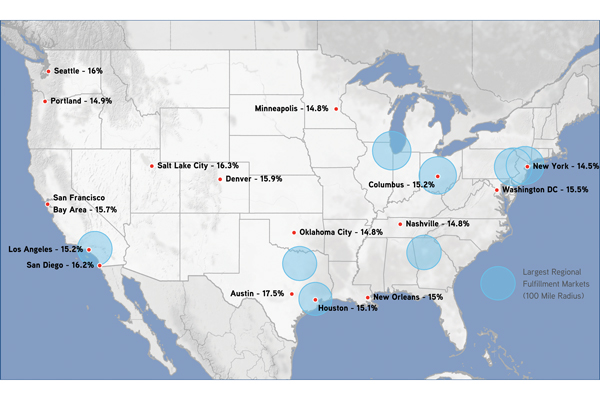

This map illustrates a 100-mile radius around each of the largest regional fulfillment markets in the U.S., as well as the locations of the cities with the highest percentages of millennials.

Source: Headlight Data, Colliers International

While big-box warehouses in core industrial markets represent the “first mile” of distribution, the “last mile” of distribution to reach this growing consumer base — to get goods directly to the purchaser’s home — is still being figured out. Real estate professionals generally define a last-mile facility as one from which goods are delivered directly to the consumer. What is clear is that last-mile distribution is becoming more reliant on urban warehousing to get products to consumers quickly while mitigating rapidly expanding supply chain costs.

The map above illustrates a 100-mile radius around each of the largest regional fulfillment markets in the U.S., as well as the locations of the cities with the highest percentages of millennials. In markets like New York, Los Angeles and Houston, fulfillment centers and millennials overlap. But some markets with fast-growing millennial populations, including Austin, Seattle, Portland, Salt Lake City and New Orleans, have limited regional distribution center capabilities nearby. This can create significant demand for urban warehousing in these locations, as well as significant opportunities for industrial developers.

Deciding to Occupy an Urban Warehouse

Just five years ago, the primary purpose of warehousing was to store product at low cost. Since then, however, Amazon has demonstrated that next-day and even same-day delivery is possible in many markets. In today’s “need-it-now” economy, a primary purpose of warehousing is to reduce delivery lead time — the time from the receipt of the customer’s order to delivery of the product, while keeping overall supply chain costs down. A retailer aiming to ensure customer satisfaction must now carefully consider transportation and inventory carrying costs as well as warehousing costs.

To understand the complex decisions that go into occupying an urban warehouse, one first must understand what goes into overall supply chain decision making. Brad Bossence, vice president of LeanCor and a professional education instructor at Georgia Tech’s Supply Chain & Logistics Institute, offers some insights into supply chain costs and how urban warehouses can lower costs while getting products to consumers more quickly. Bossence notes that many companies are learning to embrace a “total cost of fulfillment” point of view.

“A true ‘end-to-end’ perspective is necessary when making warehouse location decisions,” Bossence insists. “Typical supply chain network modeling should look at the ideal locations and numbers of warehouses as well as their size, stock-keeping unit (SKU) strategy — what inventory and how much of it is stored where — etc. Transportation costs are only part of the total picture, and transportation strategy should enable speed to market and the ideal level of inventory on hand.”

Both large and small organizations are working to assess the full cost of moving products through their supply chains and whether having an urban warehouse will lower those costs. Transportation costs are easy to see, according to Bossence, because “they have a profit-and-loss category that can be connected to rate per mile or cost per load.” The same is true for warehousing. Rent and common area maintenance, labor, material handling equipment and technology are all typical warehousing costs that are visible on an income statement. Inventory carrying costs (ICC), however, are not easily captured, because these costs are spread throughout financial statements.

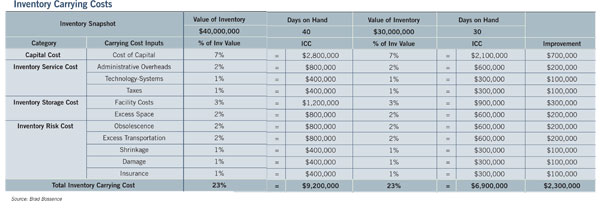

Inventory carrying costs typically range between 18 and 25 percent of total inventory value, depending on the commodity and storage requirements. The inventory snapshot illustrated in the table on the following pages breaks down ICC by category, totaling 23 percent of total inventory value based upon the average days on hand (DOH). Lean warehousing practitioners recommend measuring inventory in DOH because time is a measurement that is easily understood. For simplicity, assume that the value of one day’s inventory equals $1 million. If the average days on hand for the inventory is 40 days, the inventory value is $40 million, so the inventory carrying cost in this example is $9.2 million.

If the amount of time the inventory is held can be reduced from 40 to 30 days, as illustrated in the table, an additional $10 million in working capital is available, while the ICC is reduced from $9.2 million to $6.9 million, resulting in cost savings of $2.3 million.

An understanding of inventory carrying costs creates a better base upon which to model the warehousing, transportation and inventory costs that will best service customer expectations. Locating distribution points closer to customer bases will minimize both delivery lead times and inventory levels in warehouses. Today, the competitive advantage rests with Amazon in many retail categories because of its ability to service its customer base in many markets almost immediately.

Location and Features

After a retailer decides that an urban warehouse would be a cost-effective investment to more quickly reach a target demographic, it must find a location for that facility. Urban areas typically offer only infill locations, since they typically have little land available for development. Urban warehouses may be located within the urban core. But because many emerging urban infill sites are zoned for creative office or apartment use — since warehouses have a reputation for bringing an influx of unwanted trucks — most urban warehousing is located one to 10 miles outside the urban center.

Some existing urban warehouses may suit modern distribution facilities. But many have low clear heights, shallow bay depths and a lack of employee amenities such as break room space, suitable restrooms and sufficient parking spaces, making them less than optimally functional. Because of this, many investors are getting creative in redeveloping sites to provide modern distribution facilities near urban areas. Former manufacturing plants, big-box retail stores and even obsolete office buildings are being redeveloped to close the “last-mile” gap.

What features and amenities are prospective occupants of these redeveloped urban warehouses demanding? Their requirements include the following:

- 28- to 32-foot clear height ceilings.

- Extensive glass for natural light.

- Modern design.

- Numerous dock-high and ground-level doors.

- 50 by 50-foot column spacing.

- LEED elements.

- Easy access to bike or walking paths.

One Example

One such redevelopment is Northern Stacks, a mixed-use redevelopment just a few miles outside Minneapolis, a city with a large and growing millennial population. Northern Stacks is a joint venture between Hyde Development and M.A. Mortenson Co.

Hyde Development Founder and Partner Paul Hyde is familiar with the many challenges involved in redeveloping industrial sites as modern distribution facilities. According to Hyde, redevelopment of blighted sites is vital for inner-ring communities that have no land available to grow their tax bases. The Northern Stacks project faced many challenges, including the following:

- Cleanup of an environmentally contaminated site.

- Working with multiple regulatory agencies with jurisdiction over the pre-existing on-site pollution, including the U.S. EPA, U.S. Navy and Minnesota Pollution Control Agency.

- Rezoning the site from its prior heavy industrial zoning to a modern industrial zoning standard.

- Assembling financing from a variety of sources to fund the $12 million environmental cleanup and $18 million worth of new infrastructure.

- Demolishing 1.5 million square feet of the existing 2 million-square-foot 1940s-era building.

- Adaptive re-use of 561,000 square feet of the former building into a state-of-the-art technology center for BAE Systems.

- Development of over 1 million square feet of new industrial buildings for multiple uses.

- Creation of a brew pub in the former boiler room to entice companies to locate at Northern Stacks.

- Retaining and up-lighting smoke stacks as the park’s signature element.

According to Hyde, tenants looking to lease space in urban warehouses rarely just want to store boxes. They lease in urban locations because they value the benefits of those locations. The tenants at Northern Stacks — including Everlast Climbing Industries, a manufacturer of indoor climbing walls, and Lindenmeyr Munroe, a paper distributor — were drawn to the site because they concentrate on servicing people living in the Twin Cities and companies doing business there. Urban warehouse tenants prefer to be near a skilled labor force and public transit, close to the interstate highway system and the downtown core, and proximate to customers, so they can reach those customers as quickly as possible.

The Future of Urban Warehousing

There is no question that as e-commerce continues to grow and consumer habits continue to change, urban warehousing is becoming more useful and practical. But challenges will persist. Obtaining sites for redevelopment will continue to be difficult in an environment where older warehouses can also be redeveloped into higher-value uses such as creative office space and residential lofts.

The Twin Cities’ largest infill redevelopment project, Northern Stacks, features both office and bulk warehouse space. Its first building, Northern Stacks I (at right in the photo above), received NAIOP Minnesota’s Award of Excellence for Industrial-Bulk Distribution in 2015. Five additional buildings are planned or under construction.

Photo by Peter Vondelinde Visuals, courtesy of Fridley Land LLC

Another challenge is the availability of labor. According to Bossence, “the largest challenge urban warehousing will face is sustaining a competitive and well-trained labor force.” Warehouses usually cluster or locate within an industrial park, so tenants often compete with one another to find and retain well-trained associates. Companies with higher pay and benefits, more committed leadership, safe working conditions and opportunities for advancement typically “lead the pack” as preferred employers.

Creative, multistory development could also shape the direction of urban warehousing in the coming years. In October 2016, Prologis announced that it will develop what is believed to be the nation’s first multistory distribution center in Seattle, another city with a strong millennial population that is outside the core regional distribution markets. Hyde believes multistory warehousing will be confined to markets with limited product available for redevelopment.

The cost of constructing a multistory warehouse could be at least double the cost of redeveloping an existing building, depending on the location and materials needed for construction, so owners will need to find tenants willing to pay a premium for this type of space in these locations. While it is too early to forecast the future of demand for multistory warehouses, markets with little land for redevelopment that may see multistory warehouses in the future include the Bay Area, New York City, Miami and the South Bay submarket of Los Angeles.

E-commerce is rapidly changing the face of the retail world. Traditional big-box competitors are under pressure to reduce delivery lead times in order to increase speed to market. In addition to Amazon, the majority of demand for urban warehousing will come from the following users:

- The growing food distribution industry, including online food distributors like Blue Apron and Hello Fresh.

- Delivery firms such as UPS, FedEx, USPS and On-Trac.

- Companies that service millennials’ active lifestyles, such as those that support sports like hiking and biking.

- Industries servicing the growing office, retail and residential markets in urban areas.

While many challenges remain, as long as urban populations continue to increase and demand to reduce delivery lead time remains, urban warehousing will continue to grow and shape urban landscapes throughout North America.

James Breeze is national director of industrial research for Colliers International.