Newmark Zimmer Q3 State of Kansas City

November 13, 2025

By: Scott Bluhm, SIOR, Senior Managing Director, Principal, and John Hoefer, Senior Managing Director, Principal, Newmark Zimmer

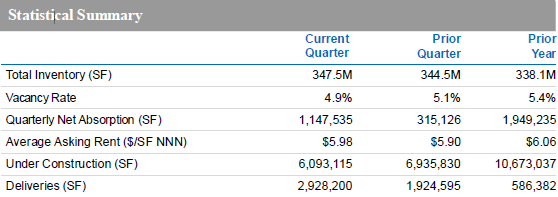

Q3 State of Kansas City Industrial Market

Kansas City, Missouri, ended Q3 of 2025 with moderate success and growth, while many top U.S. industrial markets continued to struggle. Kansas City saw 1.2 million square feet of net absorption compared to 315,000 square feet in Q2. Kansas City remains the 15th largest industrial market by square footage, with 347,473,601 square feet. Vacancy continued a downward trend to 4.9%, tied for the fourth lowest vacancy of 30 industrial markets. We expect even lower vacancy heading into 2026, with market conditions causing fewer speculative new construction starts and more leasing occurring. Approximately 80% of the 6 million square feet under construction are build-to-suit (BTS) projects, a consistent trend since 2024. Kansas City is a market that often withholds publishing asking rents but continues to publish rent growth based on executed lease comps. Kansas City saw the largest vacancy decrease year over year, the third-highest market in net absorption YTD, and sixth in new deliveries YTD of the top 30 industrial markets.

Notable Projects Impacting Pipeline:

- Panasonic 2.3-million-square-foot EV Battery Facility in De Soto

- Amazon’s 630,000-square-foot BTS in Kansas City (KCI)

- Church & Dwight’s 553,000-square-foot Distribution Center in Raymore

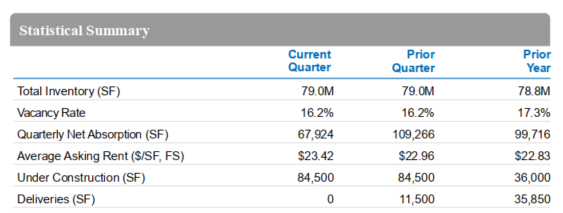

Q3 State of Kansas City Office Market

The Kansas City, Missouri, office market has continued to demonstrate clear signs of strength and stability in Q3 of 2025, marking its fifth consecutive quarter of positive absorption. Overall vacancy declined 110 basis points year over year to 16.2%, positioning Kansas City well ahead of the U.S. national average of ±20%. Asking rents climbed to $23.42 per square foot – an increase of more than 2.5% year over year – while many peer markets remain flat or in decline. The absence of new multi-tenant construction and the strategic conversion of outdated office assets are helping to maintain balance between supply and demand, creating a more favorable environment for continued rend growth and rising occupancy through 2026. Together, these fundamentals reflect a healthier, more resilient office market in Kansas City, particularly in well-located and amenity-rich buildings.

Notable Lease Transactions:

- Propio Language Services – 4900 College Blvd – 78,600 square feet

- Conexon – 2323 Grand Boulevard – 48,830 square feet

- Security Benefit – Aspiria Campus – 26,000 square feet