Survey Shows Progress in Diversity Efforts in Real Estate Investment Management

However, a lot of work remains despite tangible advances in recent years.

Women and minorities have made some progress in reaching the C-suite in commercial real estate investment management firms during the past few years, but the 2021 NAREIM Diversity & Inclusion Survey shows that there is still a lot of work to do.

“Material, sustained changes will take time to show through in the data,” said Zoe Hughes, CEO of NAREIM, in a release. “But what is clear is that there is a mandate and momentum for DEI (diversity, equity and inclusion) to be a priority within the real estate investment management industry.”

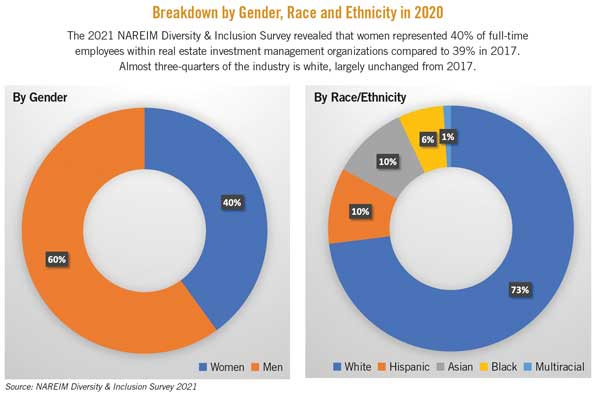

The survey, conducted by NAREIM and executive recruitment firm Ferguson Partners, reveals that the real estate investment management industry as a whole is mostly male and white. Men, who are 49.2% of the U.S. population according to U.S. Census, comprise 60% of full-time employees in the real estate investment management, and non-Hispanic whites, who are 62.8% of the U.S. population, represent 73% of workers. (Blacks make up 6% of the industry, while Asians and Hispanics each represent 10% of CRE investment-management staffing.)

However, despite strides in recent years, C-suite jobs remain heavily skewed toward white men. The survey shows that women and minority professionals each compose 15% of executive management positions in real estate investment management. In 2016, NAREIM’s survey showed that women held 12% of executive positions and minorities represented 10% of C-suite positions. Since a previous NAREIM survey in 2017, women increased their representation in C-suite jobs by 25%, while minorities saw their executive representation grow by 50%.

“You are not going to flip on a light switch and overnight have a materially more diverse industry, but you are seeing the right steps take place to move in that direction,” said Erin Green, managing director at Ferguson Partners, in a release.

While there is plenty of room for improvement, the real estate investment management industry appears to be committed to change. The 2021 NAREIM survey shows that 96% of respondents have a DEI program or initiatives to improve DEI within their organizations, and 71% of participants said they have staff dedicated to DEI, either via specific job roles or through employee committees. In 2017, just 37% of survey respondents said they had such programs in place.

The survey also highlights the goals of these DEI programs. It shows that 78% of respondents are seeking a greater number of diverse employees, 72% are in search of a more diverse management team, and 51% want more leadership roles for women.

For the first time, the survey measures gender disparities across job functions at real estate investment management firms. For example, roles such as human resources, administration, and corporate marketing, PR and communications skew heavily female, while roles such as acquisitions, portfolio management and research skew heavily male. Job functions such as sustainability, finance and accounting, legal and compliance, and capital raising and investor relations show greater gender balance.

The 2021 NAREIM Diversity & Inclusion Survey goes beyond demographic measurement to examine the impact of diversity on the bottom line. This was done through exclusive interviews with representatives from investment firms.

GCM Grosvenor Managing Director and Head of Real Estate Peter Braffman said his research, which compared the performance of diverse real estate investment managers against the Burgiss real estate benchmark, found that “there was no sacrifice of performance from an investment in diversity,” according to the report. Additionally, diverse real estate investment managers outperformed two well-known metrics used to calculate return on investment, internal rates of return (IRR) or multiple on invested capital (MOIC), in six out of the seven years between 2012 and 2018.

“As an industry, we need to demystify the notion that if you’re investing in emerging or diverse managers, you’re limiting your subset and therefore you’re sacrificing performance,” Braffman said. “This blanket statement is out there. But it’s just not true.”

Suzanne Tavill, global head of responsible investing at the StepStone Group, said that focusing on diversity can be a long-term investment in an organization’s decision-making process.

“We believe strongly that to make effective investment decisions in a sustained manner, you have to have a broad funnel when sourcing your team and curating a diverse team,” she said.

The 2021 NAREIM Diversity & Inclusion Survey was conducted between September and November 2020, comprising 74 organizations representing more than $2 trillion of assets under management.

Other Voices

The 2021 NAREIM Diversity & Inclusion Survey held a series of conversations with real estate investors on how they are approaching diversity. Here’s a sample of the comments:

“You’re not going to, all of a sudden, create a field of female and diverse middle or senior management. You’ve got to start at the bottom, at the analyst level, and grow them internally.” — Christina Scarlato, Principal Portfolio Manager for Real Asset Investments, The World Bank Pension Fund

“We don’t think that diversity in investing is just about firms satisfying an ownership percentage threshold. However, we do like to see a diverse person in the ownership structure. We do care about them having a seat at the table and a voice in decision-making.” — Alisa Mall, Managing Director of Investments, Carnegie Corporation of New York

“This isn’t just some ‘social do-good.’ You can truly add alpha and value to your portfolio by focusing on these issues. And it behooves us to pay attention and make sure we’re not missing something.” — Bob Sessa, Director of Real Estate, Employees Retirement System of Texas

“We ask for pictures of the management and investment teams when they come and present to us, whether an existing or a potential relationship. It helps us identify the people who work on our account, which was the original goal; however, we have now found that it also lays out for all to see the diversity of the team — or lack thereof.” — Mike DiRé, Director of Real Estate Investments, California State Teachers’ Retirement System (CalSTRS)

Trey Barrineau is the managing editor of publications for NAIOP.

RELATED ARTICLES YOU MAY LIKE

From the Editor: As the Economy Improves, What’s Next for CRE?

Fall 2023 Issue

Construction Cost Challenges Shift from Materials to Labor

Fall 2023 Issue