Thinking through possible ramifications if a long-term trade war ensues between the U.S. and Canada.

Canada is contending with an unprecedented trade war with its largest trading partner, the United States. At the time of this writing, the full scope of tariffs remains unclear and has changed several times already.

This article explores the impact tariffs could have on Canadian commercial real estate (CRE), assuming that they remain part of the nation’s new economic reality in 2025. It will address five key areas: the currency, industrial leasing, interest rates, geographic impacts and market uncertainty.

Weakening Canadian Dollar

There was a dramatic reaction to the tariff threats on the Canadian dollar, which reached a 22-year low in early February and then promptly rebounded to more normal levels. The Canadian dollar had already been declining for several months, especially after Donald Trump’s election as U.S. president.

The decline in the Canadian dollar is part of an across-the-board decrease in non-U.S. currencies. Trump’s election strengthened the U.S. dollar relative to almost every other world currency. The Canadian dollar was middle of the pack in terms of its relative decline in the immediate election aftermath.

Courtesy of Colliers

Canadian currency is often driven by energy prices more than other factors, such as interest rate differentials or global “flight to safety” trends. While tariffs may increase the cost of energy, it is unclear whether Canada will benefit given its dependence on U.S. refining and distribution.

A weak currency is a double-edged sword. On the negative side, it contributes to inflation, as imports cost more and the prices of raw materials and machinery increase. Given Canada’s struggles to contain inflation just two years ago, another round of outsized price growth would be very challenging for the real estate market, especially development. On the positive side, a weak currency puts Canadian CRE “on sale” and attracts buyers from Asia and Europe.

In addition, the Canadian dollar recently reached year-to-date highs as concerns about the U.S. economy weakened the American dollar. The Trump administration is attempting to overhaul the U.S. economy through measures including government austerity, aggressive tariffs and changes to the taxation system. While the Canadian dollar remains around 70 cents U.S. — below the level of last year — it has recovered from the lows of January.

Outsized Impact on Industrial

Most trends of the past decade have greatly benefited the industrial market, including the growth of Amazon in Canada, the adoption of same-day delivery options for groceries, the surge in e-commerce before and during lockdown, and the increasing interest of global investors in Canadian warehouse space.

Tariffs would have a significantly negative impact on Canada’s industrial market. Tariffs target exports, which are tied to physical output in industries such as agriculture, automotive, chemicals and resources. These industries are large users of industrial space as they need to warehouse products prior to shipping, domestically or internationally. Analysis from RBC Capital Markets states, “We see the potential for more pronounced negative impacts in industrial from supply chain disruptions and risks of material demand erosion for goods produced and distributed by tenants.”

The industrial sector has softened considerably over the past year, as record-high development and economic weakness have slowed the leasing market. While vacancy remains below long-term averages, the national vacancy rate of 3% represents a significant increase from the post-pandemic norm of 1% or below.

The secondary impacts are unclear, however. Trends such as nearshoring and increased domestic manufacturing, food production and infrastructure spending may benefit the warehouse and logistics market.

Lower Borrowing Costs (or Will They Be Higher?)

Generally, in economic crises, the Bank of Canada has pursued aggressive easing. This has happened twice in the past decade: during the COVID-19 pandemic and in 2015 with the collapse of global oil prices. This time, there is more uncertainty, but lower borrowing costs still seem likely in 2025.

Courtesy of Colliers

In its rates scenario toward the end of March, BMO Economics predicted that the Bank of Canada would implement four rate cuts starting in June to alleviate the impact of tariffs. BMO reasoned that the central bank would prioritize concerns about a weakening economy and labor market over currency fluctuations, inflation or debt levels. RBC’s analysis concurs, projecting an additional four rate cuts in 2025.

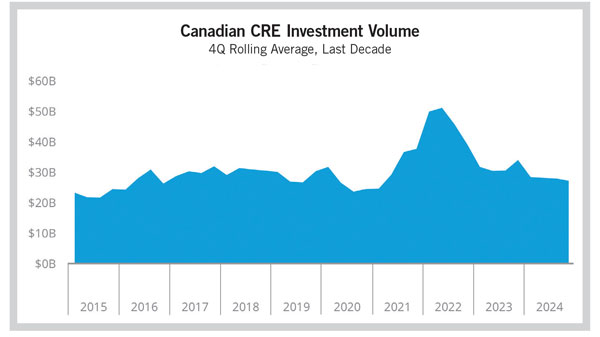

Investment volumes in Canada remain at historically typical levels, roughly equivalent to those of stable, normal markets from 2016 to 2019. Nonetheless, notable rate decreases would benefit the investment market, as they always have.

Some analysts have argued that tariffs and retaliation may increase prices for Canadians on such items as food, materials and cars. The weakening Canadian dollar will put upward pressure on prices for many other goods priced in U.S. dollars. As a result, inflation will rise, and the Bank of Canada will need to raise rates to reduce consumption, encourage savings and discourage further debt. This is a scary thought for CRE investors who thought they suffered through the worst in 2023.

Uneven Geographic Impacts

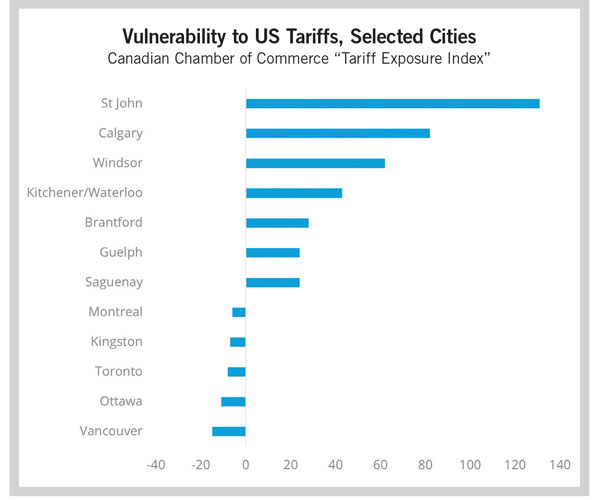

Canada’s provinces have very different economies. While across-the-board tariffs will impact everyone, certain regions will bear a disproportionately large burden. Canada has a massive resource economy as a world-leading producer in areas including nickel, canola, heavy oil, potash (fertilizer), diamonds, uranium, lumber and gold. Trade in certain minerals and resources is highly diversified. For example, Ontario nickel is exported to the United States, but it is also increasingly being used by the steel industries in Japan and South Korea. Other resources, such as oil, are much more tied to the U.S. market.

Per the Canadian Chamber of Commerce Business Data Lab, the most exposed markets to trade with the U.S. are:

Saint John, New Brunswick: Canada’s largest refinery is in this coastal city.

Calgary, Alberta: Hub of the Canadian oil industry.

Southwestern Ontario: The auto manufacturing region in central Canada, encompassing cities such as Cambridge, Windsor, Brantford and Guelph. Ontario is home to assembly plants for Ford, Jeep, Chrysler and Chevrolet, as well as parts makers Magna and Linamar.

Saguenay, Quebec: Quebec’s uniquely affordable hydro-powered electricity system makes it the center of aluminum production in Canada.

The impact of tariffs will be significantly lower in “knowledge work” areas such as Ottawa, Toronto, and Vancouver, and in the prairies, especially given the easing of tariffs on fertilizer. While tariffs harm the Canadian economy and real estate market overall, their impacts will be felt most significantly in resource- and automotive-centric markets.

Uncertainty Weighs on the Market

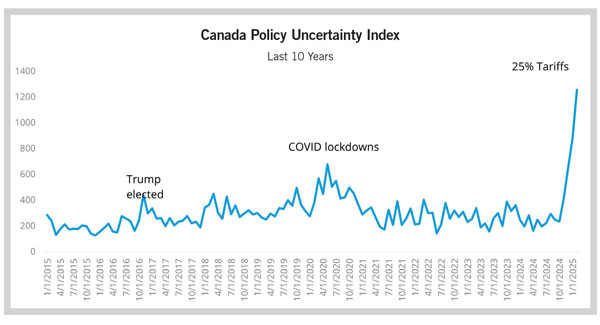

High levels of uncertainty tend to derail deals in CRE, as people seek clarity about the near future. The industry experienced this during the COVID-19 pandemic, but very accommodating economic policies mitigated its impact. This time, with tariffs, the issue is not global, and the response remains unclear. The Canada Policy Uncertainty Index is at record highs, surpassing the levels reached during the 2016 Trump election, the war in Ukraine and even the COVID-19 lockdowns.

Courtesy of Colliers

While COVID-19 was a once-in-a-lifetime event, the policy response was clear after the initial surprise. Governments were going to pursue every possible easing measure: mortgage deferrals, zero percent interest rates, income supports, forgivable business loans and so on. In addition, Canada was hardly alone in its actions; most countries took a similar approach.

What makes the tariff situation unique is that Canada is isolated and the permanence of tariffs is unclear. Is this all a negotiation tactic? Is it about the border, military support for NATO or changes to trade agreements? Is it possible to maintain tariffs on key sectors like oil, fertilizer and automotives, or will it prove too harmful to both sides?

As the Canadian government works out its retaliation tactics — barring American liquor and implementing electricity tariffs, for example — it seems possible both countries will step back from the brink. Uncertainty doesn’t persist at this level forever. At some point, there will be clarity on tariffs and relations with the U.S. more generally.

The surprise reelection of Canada’s Liberal Party to a fourth term this spring was largely a consequence of the trade war with the U.S. and the resignation of longtime leader Justin Trudeau. Newly elected Prime Minister Mark Carney, the former head of the Bank of Canada, has promised support for heavily tariffed industries such as automative and agriculture. This may limit the impact on industrial leasing, although U.S. companies looking to avoid tariffs (e.g., General Motors, Ford) may still scale back Canadian operations.

As far as the impact on real estate, the Liberals have emphasized housing reforms, including a dramatic reduction in local development charges, as well as an explicit role for the federal government in homebuilding and affordable housing development.

Having clarity on tariffs should benefit CRE deal-making in Canada. Even the most drastic scenario — 25% tariffs on all exports — will provide greater transparency and allow for movement out of the current limbo.

Enduring the Storm

Tariffs are a frightening thought, especially for trade-dependent economies like Canada’s. The trade war seems likely to drag on real estate, as consumer confidence, market sentiment and investment suffer due to the uncertainty and chaos.

However, there may be some unexpected upsides, such as the easing of interest rates by the Bank of Canada and a renewed focus on long-dormant national projects such as high-speed rail, pipelines and other neglected infrastructure. It’s even possible there will be winners from the trade war, as domestic retailers, hotels and hospitality benefit from the “buy local” surge. Concerns over inflation, the dollar and the job market are all warranted, but CRE in Canada may be positioned to endure the tariff storm.

Adam Jacobs is head of research with Colliers in Canada.