Property owners and developers are looking for effective strategies to future-proof their investments.

Recent large-scale events, such as the Southern California wildfires, continue to highlight the urgency of addressing climate-related disasters in commercial real estate.

As these issues escalate, commercial property owners and developers face increasing challenges in ensuring that buildings remain financially viable. As insurers reevaluate their risk strategies and, in some situations, consider withdrawing from high-exposure markets, adaptation takes on greater importance. The effort to strengthen buildings and infrastructure against climate-related threats will become a primary focus.

The Climate Risk Landscape for Commercial Real Estate

One challenge is that climate-related issues vary widely by region. In Los Angeles, the threat of future wildfires poses issues for insurance and risk, while in Florida, hurricanes, tropical storms and flooding are top concerns.

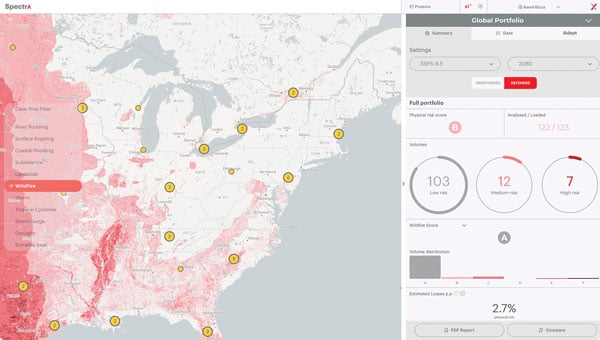

Developers are making greater use of advanced climate modeling technologies, such as Climate X's Spectra platform, to gain granular insights into future climate physical risks. Courtesy of Climate X

The key question is not just how to identify risks but how to respond in a way that maintains value for property owners and developers. This can mean accounting for rising insurance premiums, higher operational costs and potential changes to the long-term value of assets. Investing in climate resilience — whether through flood defenses, fire-resistant materials or energy-efficient upgrades — must be carefully weighed against returns.

To navigate this complex landscape, developers are increasingly turning to advanced climate modeling technologies that provide granular insights into potential future climate physical risks including flooding, wildfires and storm surges. This new generation of tools combines climate model data with digital twins — leveraging satellite remote sensing and local environmental agency and buildings information to feed into hazard models that can derive the probability and severity of climate physical risks across different emissions pathways and time horizons.

This data is already being used to help commercial real estate developers make informed decisions about future-proofing their investments. For example, a major developer used climate modeling data to inform its location strategy and integrated resilience measures into the building design. This included installing storm shutters with reinforced aluminum frames to protect windows and glazed areas from wind-borne debris, as well as reducing the proportion of glass on building facades to mitigate pressure imbalances during extreme wind events.

Climate modeling data also helps developers balance up-front adaptation investments with long-term financial sustainability at the portfolio level.

Predevelopment Climate Adaptation Strategies

One of the most effective ways to reduce risk is to incorporate climate adaptation before development begins. Site selection is critical, as developers must assess current and future climate threats to reduce risk as long as possible.

Climate threats are one factor in an equation that also includes financing considerations, time horizons and government-backed resilience initiatives. While planned state and federal infrastructure projects such as flood defenses or wildfire mitigation can help reduce risk, their long-term viability depends on political priorities. Changes in leadership can delay or even cancel these initiatives, making it essential for developers to rely on data-driven assessments of both moderate and extreme climate scenarios. By understanding how risks evolve, developers can make more-informed decisions about where to build and how to future-proof return on investment.

For example, in parts of California, prolonged drought and soil shrinkage has led to increased cases of foundations cracking, similar to subsidence issues seen elsewhere. Reinforcing foundations in high-risk areas can mitigate these effects. In hurricane-prone areas like Florida, deeper pilings and impact-resistant glass help structures withstand high winds and sudden pressure shifts.

New York City is implementing large-scale flood defense initiatives. Following the devastation of Superstorm Sandy, the city launched the Brooklyn Bridge-Montgomery Coastal Resilience (BMCR) project, a $300.5 million system designed to protect Lower Manhattan from severe weather events. The project includes nearly 100 electronic flip-up flood gates spanning eight-tenths of a mile along the East River. When completed in 2026, it will be part of a broader 3.25-mile flood protection system shielding over 150,000 residents. These infrastructure investments highlight the scale of adaptation efforts needed in flood-prone urban areas.

Developers should also consider how buildings will perform under changing climate conditions. For instance, according to the Environmental Protection Agency, cities in the Southwest “have experienced an increase in heat wave frequency, duration, length of heat wave season, and intensity between 1961 and 2023.” Many of the region’s buildings were not originally designed for extended periods of extreme heat. This has led to increased cooling system failures.

Retrofitting Strategies

Commercial real estate owners don’t always have the luxury of incorporating climate adaptation measures from the ground up. Instead, they often need to retrofit existing buildings to withstand evolving risks. Retrofitting strategies can include enhancing structural resilience, upgrading critical systems, and implementing nature-based solutions to mitigate climate stressors.

A key focus in retrofitting is asset hardening, which strengthens buildings against physical climate threats. This includes reinforcing building envelopes with weather-resistant materials, installing flood barriers, and upgrading HVAC systems to manage extreme heat. The BMCR project is a prime example of proactive flood mitigation through infrastructure enhancements. Similarly, fire-resistant retrofits, such as ember-resistant vents and fireproof cladding, are critical in wildfire-prone regions.

Regulating indoor temperatures is another crucial adaptation measure. High-performance insulation, energy-efficient cooling systems and smart temperature control technologies help buildings remain habitable during extreme weather. Green roofs, which provide natural insulation while reducing stormwater runoff, also play a role in mitigating the effects of extreme heat.

Investing in these hardening strategies enhances long-term property values, reduces insurance premiums and makes buildings more resilient to climate risks. Proactively implementing adaptation measures strengthens climate resilience and makes properties more attractive to investors and tenants who prioritize sustainability.

Working With Insurers

Even as commercial real estate owners retrofit properties and developers increasingly build with adaptation in mind, they must also navigate the evolving insurance landscape. As it stands, catastrophe (CAT) models often fail to account for long-term climate change, making it difficult for insurers to price risk accurately. This has led to soaring premiums or insurers pulling out of high-risk markets altogether. If a property becomes too expensive to insure, it risks becoming a stranded asset, creating financial headaches not just for owners but for investors and banks as well.

Property owners are also exploring alternative risk transfer mechanisms like parametric insurance, which triggers payouts based on predefined conditions such as wind speed or rainfall levels, offering faster claims processing and greater predictability. Others are turning to self-insurance pools, where groups of property owners collectively set aside reserves to cover potential losses. These approaches can reduce reliance on traditional insurers, improve cost control and offer a practical solution for managing climate risks in hard-to-insure markets.

Insurers are also beginning to take a more proactive approach. Some now offer more favorable insurance terms for properties that incorporate resilience measures such as flood barriers, fireproofing and storm-resistant materials. Other insurers are going further, working with property owners to develop adaptation strategies and even advocating for government-backed resilience bonds to protect high-risk areas, such as funding coastal flood defenses.

Banks also play a key role, not only by managing their own exposure to climate risks but by actively supporting adaptation efforts through targeted lending. Financing climate-resilient infrastructure, whether for private developments or public sector projects, helps protect communities, keeps assets insurable and reduces the risk of broader financial fallout.

Embracing Climate Resilience in Commercial Real Estate

The commercial real estate industry is confronting the growing impact of climate change. By leveraging advanced climate modeling technologies and predictive analytics, developers can make informed decisions to future-proof their investments. Being proactive about adaptation, whether by implementing resilient design in new developments or retrofitting existing structures, can deliver strong returns while reducing risk. Collaborating with insurers and banks throughout the process helps ensure that properties remain insurable and financially viable.

Access to granular adaptation data is key to navigating the complexities of climate change successfully. With the right insights, property owners and developers can not only mitigate risks but also capitalize on new opportunities.

Lukky Ahmed is CEO and co-founder at Climate X, a climate risk data and analytics provider.