Uncertainty regarding the impacts of federal policies is affecting most construction segments.

The U.S. construction industry continued to post gains in output and employment in early 2025, but confusion and uncertainty about the impact of federal policy actions are threatening to darken the outlook.

Construction industry employment expanded by 174,000 jobs or 2.1%, seasonally adjusted, between February 2024 and February 2025. That continued a slowdown that began three years earlier, after annual job growth peaked at 5.1% as the industry emerged from the pandemic-caused recession.

Nevertheless, the industry’s head count has consistently outpaced the total nonfarm economy, which posted an increase of 1.2% from February 2024 to February 2025. In particular, nonresidential construction firms — nonresidential building and specialty trade contractors plus heavy and civil engineering construction firms — have added employees at a 2.6% clip, more than double the all-industry rate. Even residential firms — homebuilders and multifamily general contractors plus residential specialty trade contractors — added employees at a 1.5% pace.

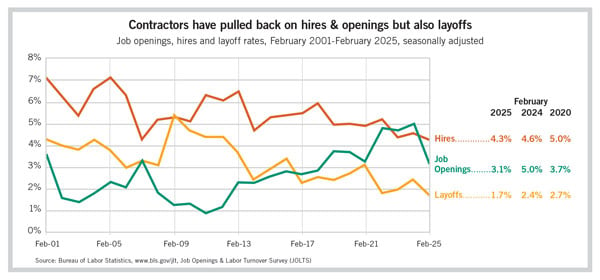

Contractors have pulled back on hiring and job openings, suggesting little expectation of new short-term opportunities. But firms are hanging onto existing employees, which implies they expect to have enough work to justify retaining them. Specifically, the hiring rate (hires as a percentage of employment) ticked down from 4.6% in February 2024 to 4.3% in February 2025, while the job openings rate (openings on the last business day of the month divided by the sum of openings and employment) plunged from 5% to 3.1%. Meanwhile, layoffs and discharges as a percentage of employment cooled from 2.4% to 1.7%. (All series are seasonally adjusted.)

More evidence of the “growing but slowing” trend comes from the Census Bureau’s monthly data on “value put in place” or spending on projects underway. Year-over-year growth in private construction spending decelerated from 22% in February 2022 to 2% in February 2025. (The data are seasonally adjusted at annual rates but not adjusted for inflation.)

The most notable slowdown among private construction categories was for manufacturing plants. Spending on manufacturing construction leaped 34% from February 2023 to February 2024 but only 5% over the next year. Since peaking in June 2024, spending has actually slipped more than 1%.

Several other private structure types have also slumped in the past year. Spending on medical buildings and other private offices both tumbled 11% from February 2024 to February 2025. Meanwhile, warehouse construction spending dropped by 5% and retail construction by 7%, while lodging construction edged down 0.4%.

Nearly every type of construction faces higher costs and greater uncertainty because of tariffs and fees for U.S. port calls by China-built ships. These added costs, along with the loss of export markets due to retaliatory measures from foreign governments or boycotts by their citizens, are causing developers, investors and project owners to pause, delay or cancel planned construction.

The reality, threat or rumor of arrests and deportations of immigrants is further adding to costs and uncertainties related to construction projects. While 18% of the U.S. labor force in 2023 was foreign-born, the share among construction trades was nearly twice as high at 34%. In several states, including California, Texas, New Jersey and Maryland, the share was over 50%. And among some building trades, such as plasterers and drywall installers, the share was more than 60%. These workers have been known to leave jobsites upon hearing of potential “raids” conducted by Immigration and Customs Enforcement agents. Replacing these workers is expensive, time-consuming and disruptive to schedules.

The one exception to the slowing and uncertain market is data center construction, which increased for the 20th time in 21 months in February and has grown 39% year over year. So far, there is little indication that data center owners have pulled back on construction projects.

Apart from data centers, most construction segments are likely to hit the pause button until there is greater clarity about Trump administration policies and their impact on costs and supply chains. Whether the pause turns into a slump remains to be seen.

Ken Simonson is the chief economist with the Associated General Contractors of America. Contact him at ken.simonson@agc.org.

Tariff Announcements and Dates Affecting Construction*10% “baseline” tariff on nearly all imports; additional country-specific “reciprocal” tariffs announced, then suspended for 90 days on April 9 China: 10% Feb. 4; 20% March 4; 54% April 5; 145% April 9; may be scaled back Canada, Mexico: 25% if not covered by USMCA; 10% on energy, “critical minerals” Steel and Aluminum: 25% Copper: Pending investigation by Department of Commerce Lumber: Possible 25%; possible higher tariffs on Canadian lumber Cars and Trucks: 25%; also applies to unspecified parts Fee on Chinese Ships Calling on U.S. Ports: Various rates starting in October and rising through 2028 (*As of April 23) Source: White House and media reports; courtesy of the Associated General Contractors of America |