Real estate sponsors are exploring options such as niche property types and alternative private capital solutions.

Closed-end private equity funds have long been the primary avenue for real estate sponsors to secure institutional capital commitments. However, as the institutional real estate industry matures, breaking in as an emerging manager is increasingly difficult.

Yet amid these challenges, opportunities remain for best-in-class sponsors — particularly specialized operators — to raise funds. Alternative private capital solutions are also creating new pathways to success in an increasingly competitive fundraising environment.

A Mature Industry That Favors Incumbents

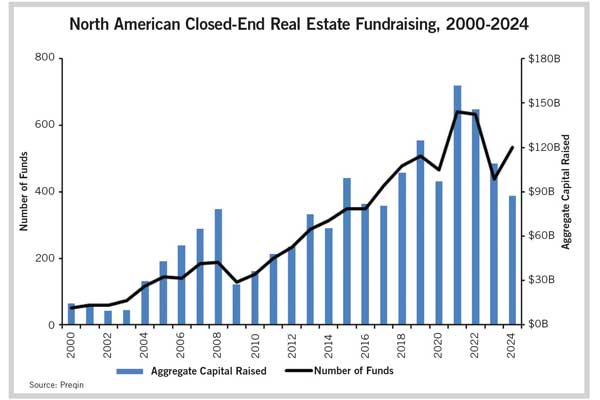

Closed-end private equity fundraising has experienced extraordinary growth since the early 2000s. North American fundraising volumes peaked at $161 billion across 638 funds in 2021, marking a significant expansion from the $78 billion raised across 189 funds prior to the global financial crisis (GFC) of 2007-2009.

This period of growth corresponded with gradually increasing target allocations to real estate among institutional investors. Prior to the GFC, U.S. institutional investors had an average target allocation to real estate of 7% to 8%; now the average allocation is 10% to 11%. This expanding pie accrued disproportionately to the industry’s established incumbents but also fueled the emergence of new investment managers, particularly from 2010-2015, as institutional investors reshuffled their portfolios in the wake of the GFC. A select group of these then-emerging managers have since grown to become leading brands in the institutional real estate industry.

As the real estate private equity industry matures, however, aspiring fund sponsors face more barriers to entry. Institutional investors prefer to limit the number of fund sponsor relationships they maintain, and the bar for adding new sponsors is much higher. Larger, established sponsors are seen as proven stewards of institutional capital and therefore present less career risk to institutional portfolio managers. As one investor recently told Park Madison Partners, “My job is not to have the top-performing portfolio in the industry but simply to generate healthy returns and not make a mistake.” Most investors have also “picked their horse” when it comes to major property types, geographies and strategies. Breaking in as an emerging manager requires offering investors something new or complementary to their existing exposure or perhaps dislodging an underperforming incumbent sponsor.

Closed-end fundraising in general has also become more difficult in recent years. Secular shifts catalyzed by the COVID-19 pandemic, the rapid rise in interest rates and declining valuations have thrown sand in the gears of real estate capital markets. As transaction volumes fell, institutional investors received fewer distributions from existing investments, causing them to face liquidity constraints. High levels of uncalled capital also meant investors were in no rush to make fresh commitments. Additionally, institutional target allocations to real estate have stopped expanding, with several large institutions even announcing cuts. As a result, North American closed-end fundraising volumes have fallen approximately 45% below the 2021 peak.

Finding Success Through Specialization

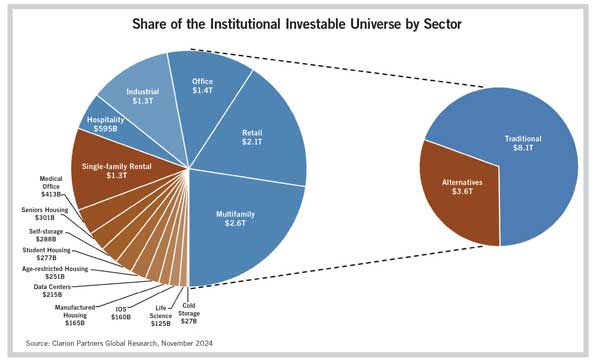

Despite a challenging fundraising environment, the growing popularity of alternative or niche property types offers a promising avenue for aspiring fund managers. Institutional investors increasingly recognize that building a diversified real estate portfolio requires expanding beyond office, multifamily, industrial and retail. Niche sectors include self-storage, student housing, senior housing, manufactured housing, data centers, cold storage, industrial outdoor storage (IOS), medical office, lab/life sciences, parking, single-family build-to-rent, media/studios and cell towers. These sectors tend to have specialized uses, idiosyncratic demand drivers and unique risk factors, thereby providing attractive diversification benefits.

In addition, exposure to niche property types presents investors with the opportunity to generate outperformance relative to traditional property types. Many niche property sectors remain highly fragmented and are dominated by noninstitutional, mom and pop owners. The comparably small equity checks of $20 million or less have historically deterred institutional buyers. Aggregating smaller niche assets into larger, institutionally scaled portfolios can therefore be a lucrative strategy, with such “roll-up plays” often resulting in significant portfolio premiums upon exit versus individual asset sales. According to NCREIF data and Clarion Partners Global Research, from the first quarter of 2007 to the fourth quarter of 2024, niche property types returned a cumulative 324% versus 166% for traditional sectors. Niche sectors outperformed during the GFC and COVID-19 recession as well.

As more institutions seek to expand their holdings of niche property types, emerging managers have an opportunity to break in. Despite constituting an estimated 30% of the institutional investable universe, niche property types make up less than 10% of institutional portfolios. The complexities and nuances involved in managing niche property types suggest the need for specialized, vertically integrated platforms to build institutional quality portfolios. However, many of the more established fund managers either lack the specialized expertise to succeed in these sectors or have funds that are too large to make smaller transactions worth pursuing.

For institutional investors, this dynamic has created something of a “barbell” approach, with allocations being directed toward a combination of megafunds that provide diversified private real estate exposure and smaller “sharpshooter” sponsors specializing in specific geographies or property sectors. This puts the squeeze on diversified midsize sponsors, many of which are forced to extend their fundraising periods or close below target. However, for vertically integrated sector specialists, particularly in niche property types, this scenario potentially sets the stage for closed-end fundraising success.

Not an Easy Path

Given the challenges of starting a fund business in the current capital markets environment, real estate sponsors are advised to consider whether the trade-offs are worth it. The benefits of funds are certainly alluring, including discretionary capital, a steady stream of management-fee income, stronger investor relationships and better ability to scale. But the general partner (GP) economics can be quite challenging for the first several years. Fund businesses typically do not turn an operating profit until Fund II. Additionally, each fund typically requires a GP co-investment of at least 1% to 2%. Since promotes are fully pooled — meaning calculated based on the performance of an entire fund rather than on an individual deal — and the funds themselves typically have an eight- to 10-year life, the GP may not experience a positive overall return on investment until Funds III or IV.

Emerging managers are also under intense pressure to perform well. Institutional investors expect smaller, emerging managers to outperform relative to their larger, more-established peers. Early stage fund managers must therefore consider every investment’s potential to earn outsized returns while also controlling downside risks. Too many bad deals in a fund could not only dampen the prospects of earning carried interest but also handicap a sponsor’s ability to raise subsequent funds.

Finally, fund managers are almost always fund-raising. Fundless sponsors commonly complain about the time required to raise money deal by deal, but raising a fund also involves a major time commitment. According to investment data company Preqin, the average time from first to final close on a closed-end fund now exceeds 24 months. During this time, fund managers will likely have hundreds of investor meetings, engage in dozens of due diligence processes and close a handful of investors — all while continuing their daily responsibilities of running a real estate investment management business. Even between funding rounds, a fund manager must actively engage with investors to ensure strong relationships and trust for the next fund series.

Alternative Private Capital Solutions

As the institutional closed-end fundraising route becomes more difficult, real estate sponsors are increasingly pursuing alternative private capital solutions. For example, programmatic joint ventures and separate accounts can be effective methods for sourcing long-term strategic capital partners. While these arrangements typically offer less discretion than traditional funds, real estate sponsors benefit from having a reliable, aligned capital source that supports their investment strategy and long-term growth objectives. Allocations from high-net-worth investors and other retail channels have also increased, allowing several fund managers to build institutionally scaled platforms with less reliance on institutional capital sources.

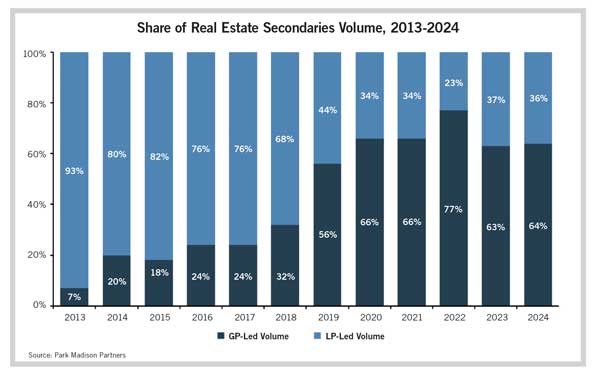

For sponsors with existing portfolios, GP-led secondaries and continuation vehicles have emerged as effective tools for unlocking liquidity and securing new institutional capital partners. As of 2024, these recapitalizations accounted for an estimated 65% to 75% of all real estate secondaries transactions. Capital commitments to secondaries-focused funds have surged, driven by institutional appetite for attractive entry points and exposure to preidentified assets.

Importantly, GP-led recapitalizations offer meaningful benefits not only to sponsors but also to existing limited partners (LPs). In the current environment — where exits and distributions have been scarce — recaps provide a unique opportunity to deliver liquidity at scale. Selling investors often receive proceeds that approximate or even exceed fair market value, particularly when the recapitalized business plan relies on a capable sponsor to execute a more complex value-add strategy. These transactions allow LPs to exit on favorable terms while enabling sponsors to retain control of the assets and continue driving performance alongside new capital partners.

GP-led recapitalizations can be valuable for real estate sponsors at all stages of their evolution, from emerging managers to fundless sponsors to established managers. Beyond facilitating liquidity, such recapitalizations allow sponsors to crystallize gains for existing limited partners, reset GP economics, extend hold periods and build new investor relationships. That said, it is critical for sponsors to maintain alignment of interest and uphold their fiduciary duty to existing investors, ensuring that recapitalizations are structured with transparent governance and meet the objectives of all parties involved. When executed thoughtfully, recapitalizations offer a powerful alternative to traditional fundraising and asset sales.

Multiple Paths to Success

For sponsors willing to invest the time and capital, a fund management business provides a host of benefits and represents a well-worn path to accessing institutional capital. Despite higher barriers to entry and a more mature industry, raising a closed-end fund remains viable for best-in-class real estate sponsors with the right team, track record, strategy and focus. Alternatively, if a fund is not practical or preferred, many other private capital solutions allow sponsors to secure institutional investor relationships, achieve scale and position their platforms for long-term success.

John Sweeney is a partner and chief operating officer at Park Madison Partners.