How Supply Chains and Logistics Drive Site Selection

The “Rule of 1.5” explains the impact of transportation costs on industrial real estate.

A recent Q&A in the Wall Street Journal with Marie-Christine Lombard, CEO of international freight-forwarding firm Geodis SA, includes a comment that sums up the current state of the global logistics industry: “The entire supply chain is being rethought and recalibrated and re-costed.”

Lombard is correct. Risk is being assessed differently and the supply chain is changing, which means industrial real estate will follow.

For example, when transportation costs 10 times more than rent, transportation will dictate site selection. It is far and away the biggest determining factor that goes into where companies locate industrial real estate. Specifically, there is a concept called the “Rule of 1.5,” which is defined as whatever affects transportation will impact industrial real estate a year and a half later.

A Rough Road for Transportation

The transportation sector has experienced tremendous challenges over the past few years. In 2017, the railroad industry accelerated the shift to PSR (precision scheduled railroading), which focuses on fewer served destinations, fixed schedules and the consolidation of intermodal terminals to improve profitability. It has also led to the loss of railroad workers; for example, more than 20,000 were laid off in 2019, according to a January 2020 report from The Washington Post.

Simultaneously, the trucking industry entered the ELD (electronic logging device) era. According to the Federal Motor Carrier Safety Administration (FMCSA), an ELD “monitors a vehicle’s engine to capture data on whether the engine is running, whether the vehicle is moving, miles driven, and duration of engine operation (engine hours).” While this improved work conditions for drivers by preventing companies from driving beyond their hours via the old system of pen-and-paper logbooks, it also effectively removed 8% to 10% of the industry’s capacity from the road.

Additionally, the railroad industry’s shift to PSR has added more pressure on trucking to make up those lost miles. (For example, a company that used to get its rail deliveries in a secondary or tertiary market might now have to get them from a major metro. Those goods would have to travel by truck.)

Then in early 2020, FMCSA launched the DAC (Drug and Alcohol Clearinghouse). This online database houses up-to-date information about drug and alcohol violations by those who hold commercial driver’s licenses (CDLs) and commercial learner’s permits (CLP). A November 2021 report by the New York Post claims that more than 72,000 U.S. truckers had been suspended because of DAC violations since January 2020. This number is equivalent to Schneider, US Express, Werner, Swift and JB Hunt suspending all their drivers.

Then came COVID, which compressed 10 years of e-commerce adoption into three months. Transportation costs increased rapidly, aided by inflation, clogged supply chains and soaring gas prices.

The Rule of 1.5 in Action

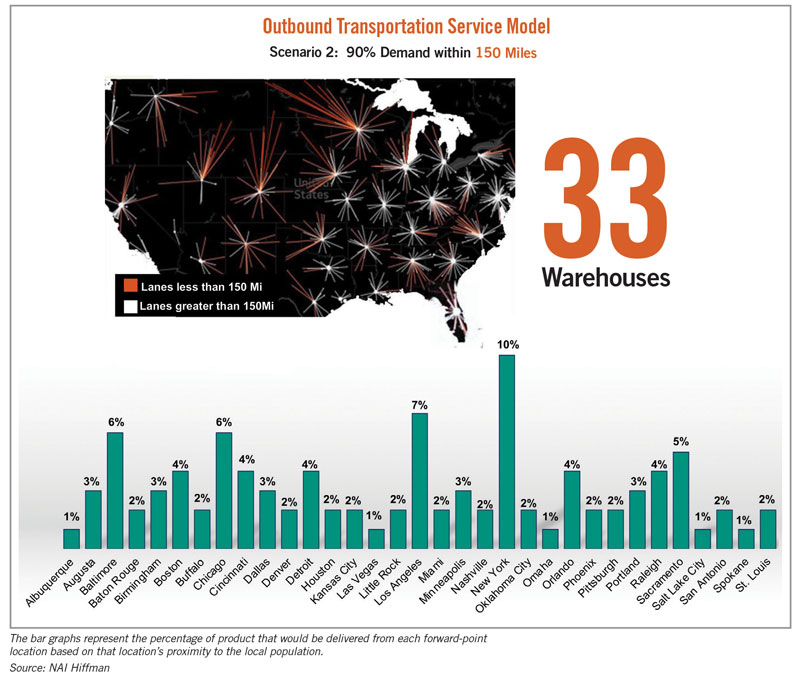

A team at NAI Hiffman created an outbound transportation network model for a fictitious company shipping a fictitious product. It uses the same algorithm technology that corporations use in site selection. It’s based on population (consumers and labor) and a service-level constraint (distance). Additional calculations by corporations can include factors such as real estate cost, taxes, labor cost and ZIP code analysis all the way down to the SKU level. The outcome is a two-pronged solution, with the identified locations representing forward-point deployment with access to the population (the end consumer). These operations would be backfilled by multistate replenishment hubs with intermodal access.

The model showed that it is nearly impossible to meet 100% of demand within 300 miles of a warehouse, but reaching 90% of demand could be done by building just 10 facilities. Meeting 90% of demand within 150 miles of a warehouse required 33 facilities.

Also included in the model is the percentage of the fictitious product that would service the population out of each location, along with the amount of space that should be allocated to each location. In other words, if the Des Moines location handled 10% of the product and the national warehouse footprint was a million square feet, the Des Moines facility should be 100,000 square feet.

This brings us to the present, where corporations have realized that their supply chains are not as robust as they thought. A lost sale eliminates the efficiencies of a complex, inconsistent network, so “just in time” (goods are shipped only when needed) is being replaced by “just in case” (large inventories are kept on hand to ensure that orders can be fulfilled). Additionally, China is proving to be an unreliable supplier. While it will remain a key component, corporations are exploring alternatives to diversify their supply lines.

The Bottom Line

In a sense, the Rule of 1.5 has written the future of industrial real estate. Corporations will be forced to combat length of haul. A nonlinear supply web will replace the supply chain as “international regionalization” will reduce distances while increasing the ability to react to the market. This could lead to a new form of globalization with bilateral trading blocs between like-minded nations, multishoring, nearshoring, reshoring, and friend-shoring (encouraging companies to shift manufacturing away from authoritarian states and toward allies) as the U.S. decouples from China.

It is no coincidence that U.S. manufacturing jobs increased by 350,000 (25%) in 2022. A Deloitte study showed that 62% of corporations were considering reshoring/nearshoring, and in Thomas’ 2021 State of North America Manufacturing Report, 83% of companies reported that they were looking to add manufacturing in North America.

A new network model is under development. As that progresses, there will be surprises. Model 2.0 will take it further than population and service level by including power, gas, water and climate concerns while maintaining that critical transportation overlay.

Now there just needs to be a name for the fictitious company that will be a reality in 1.5 years.

Adam Roth is a director of NAI Global Logistics at NAI Hiffman.

RELATED ARTICLES YOU MAY LIKE

Facility Managers Must Prepare for an All-Electric Future

Fall 2023 Issue