A reformed Immigrant Investor Program demands more rigor from developers but still offers abundant opportunity.

In a capital markets environment defined by volatility, constrained lending and increasing investor caution, real estate developers are once again looking to the EB-5 Immigrant Investor Program as a supplemental — yet strategic — source of project financing. In a properly structured project, EB-5 capital can serve as a patient, flexible tranche in the development capital stack. While the program has undergone significant reform under the EB-5 Reform and Integrity Act of 2022, its core value proposition remains the same: a pathway for qualifying foreign nationals to obtain U.S. permanent residency in exchange for making a job-creating investment.

For developers navigating a tougher deal-making environment, EB-5 capital can help close funding gaps and revive projects that might otherwise stall.

EB-5 Program Basics

Under the program, foreign nationals may be eligible for an employment-based, fifth-preference (EB-5) immigrant visa if they have invested, or are actively in the process of investing, $1.050 million (or $800,000 in a high unemployment or rural area) in a qualifying new commercial enterprise (NCE) that creates or preserves at least 10 full-time U.S. jobs. Most developers raise this capital through a regional center designated by U.S. Citizenship and Immigration Services (USCIS), which allows them to credit indirect and induced job creation based on econometric modeling.

Developers typically access EB-5 through regional center sponsors and operators who structure the financing and then, in turn, facilitate the raising of capital from would-be immigrants.

Key structural features of EB-5 capital include:

Higher leverage: EB-5 typically can stretch senior debt leverage beyond what is usually provided by traditional sources.

Lower financing costs: EB-5 participants generally require low investment yields, which allows the debt to have somewhat lower costs than other sources.

Private credit: Because EB-5 is not a bank or public debt execution, debt terms do not have to conform to portfolio restrictions required by bank regulators or capital markets.

These features make EB-5 capital particularly well suited to real estate developments that create lots of construction jobs and, in some cases, many jobs after completion, such as with multifamily, hospitality, industrial, infrastructure and mixed-use projects.

Why Developers Are Taking a Second Look at EB-5

n the current environment, traditional sources of mezzanine debt and preferred equity have become more expensive and risk averse, and senior lenders are increasingly conservative in their loan-to-cost ratios. EB-5 capital can offer developers a lower-cost alternative with built-in flexibility.

Here is how EB-5 can help:

It fills financing gaps: Developers facing capital shortfalls due to higher interest rates or reduced valuations can use EB-5 proceeds to stretch proceeds of senior debt.

It improves leverage profile: EB-5 plays well with other sources of capital and other financing incentives. EB-5 has been successfully combined with New Markets Tax Credits, C-PACE (Commercial Property Assessed Clean Energy), opportunity zones and many state-level programs.

It enables shovel-readiness: For projects with zoning entitlements and a clear job-creation model, EB-5 capital can provide the final push to secure senior financing or begin construction.

Moreover, the Reform and Integrity Act introduced new safeguards — such as investor protections, regional center oversight, vetting procedures and increased transparency requirements — that are making EB-5 capital more predictable and potentially attractive to institutional players.

The Math

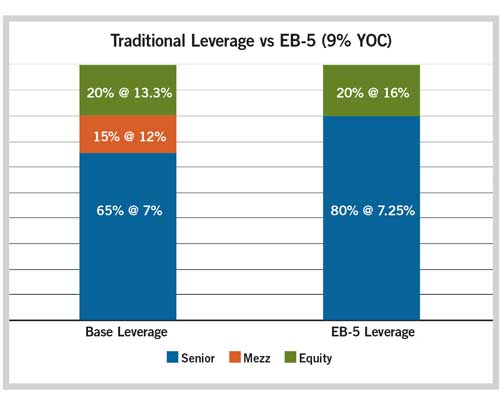

The power of EB-5 leverage is demonstrated by basic development math (see graphic). Assuming a 9% yield on cost, a typical financing structure with 65% senior debt costing 7%, combined with 15% mezzanine debt at a rate of 12%, would provide equity yields of about 13.3%. Using EB-5 to stretch the senior debt to 80% costing 7.25% (just a 25-basis point premium to the rate previously quoted) and eliminating the mezzanine would provide equity yields of 16%. Under this scenario, EB-5 would lower the total cost of financing by nearly 70 basis points. This hypothetical demonstrates how EB-5 can bridge the gap between feasible and not feasible.

Structuring Matters: Legal and Operational Considerations

While EB-5 capital can be accretive, the immigration components of the EB-5 program are highly regulated. Developers must ensure compliance with both immigration law and securities regulations. Some key structuring elements include:

NCE and JCE structure: EB-5 capital must flow through an NCE into a “job-creating entity” (JCE). Developers typically serve as the JCE or partner with the JCE.

Required immigration filings: All projects sponsored by a regional center must file an application for approval of an investment in a commercial enterprise (Form I-956F) with USCIS before foreign investor petitions (Form I-526E) can be submitted. The process requires early legal coordination, up-front filing fees ($47,695 for a Form I-956F) and the provision of extensive details about the project.

Material change risk: USCIS closely scrutinizes any post-submission modifications to the business plan, offering documents or capital structure for deviations it may view as “material.” This means developers should avoid last-minute changes and ensure conservative assumptions are baked into the original submission.

Early engagement with experienced EB-5 immigration counsel, economists and securities counsel is critical to crafting a successful raise.

EB-5 Beyond 2025

EB-5 capital is not a silver bullet, nor is it appropriate for every deal. But for developers willing to invest in the right project and the right team, it can represent a competitive advantage, especially in geographies or sectors prioritized by the Reform and Integrity Act, such as rural areas, areas experiencing high unemployment, and infrastructure projects.

Additionally, international investor interest remains strong. A global backlog of high-net-worth individuals in China, India, Latin America and the Middle East continue to seek U.S. permanent residency through investment. Potential investors from these regions would otherwise wait years, or decades in some cases, to become legal permanent residents in other green card categories.

A Tool Worth Mastering

The new EB-5 landscape demands more rigor but still offers opportunity. With its long-term, low-cost capital and job-creation incentives, EB-5 can unlock critical financing for projects that matter. For developers facing a capital squeeze, it is a tool worth mastering.

As with any specialized strategy, success lies in informed execution. With the right legal, financial and operational guidance, EB-5 capital can help get a developer’s next project across the finish line.

Adam Greene is executive vice president of Peachtree Group’s EB-5 program. Jessica DeNisi is a partner at Klasko Immigration Law Partners, where she leads the firm’s EB-5 developers and regional centers practice.