By strategically addressing this environmental imperative, developers can simultaneously enhance the value of their properties.

Even amid macroeconomic headwinds, the industrial real estate sector continues to be well positioned for steady growth, fueled by onshoring and reshoring efforts, e-commerce expansion, and the fast-paced buildout of logistics and AI infrastructure.

However, as demand surges, so does scrutiny over the environmental impact of new development. While the industry has made significant strides in improving operational efficiency — reducing energy consumption and integrating on-site renewables to address Scope 1 and 2 emissions — embodied carbon remains a largely untapped opportunity to lower emissions at scale.

Unlike operational emissions, which can be reduced over time through efficiency improvements and renewable energy adoption, embodied carbon is largely determined by decisions made before and during construction. Addressing this challenge early in the design and material selection process is key to meeting both regulatory and market expectations in today’s evolving landscape.

Courtesy of BranchPattern

Up-front emissions from new construction are immediately reflected in an organization’s Scope 3 inventory, which is a growing area of investor focus. For developers and fund managers, achieving low-carbon performance standards not only improves GRESB scores, an overall measurement of ESG performance, but also mitigates the risk of stranded assets as carbon limits tighten.

Whole-building Life Cycle Assessments

Embodied carbon refers to the greenhouse gas emissions associated with the entire life cycle of a building, including raw material extraction, manufacturing, transportation and construction. In the context of industrial real estate, materials such as concrete, steel and asphalt are among the largest contributors to embodied carbon emissions due to their energy-intensive production processes. These emissions are often overlooked in the design and construction phases, yet they represent a significant portion of a building’s total carbon footprint.

GRESB’s 2025 Real Estate Benchmark found that 50% of participants now track embodied carbon emissions of their developments compared with only 23% in 2023. As awareness grows around the environmental impact of material selection and other contributors to embodied carbon, more developers and investors are turning to whole-building life cycle assessments (WBLCAs) to measure these emissions in a more comprehensive way. WBLCAs evaluate the full range of impacts, from sourcing and transportation to construction and eventual demolition. This allows stakeholders to better understand the environmental consequences of their decisions and identify opportunities for emission reduction.

A recent BranchPattern study analyzing nearly 100 industrial WBLCAs found that embodied carbon intensity (ECI) for core and shell buildings declined by approximately 4% year over year compared to the building consultancy’s 2023 study. It’s important to note that part of the decrease can be attributed to the expanded dataset used in this latest report, which provides a more robust picture of trends across industrial projects.

Despite making progress, industrial development remains a high-impact sector in terms of carbon emissions. More aggressive strategies will be necessary for the industry to align with global climate goals and make deeper reductions in embodied carbon emissions moving forward.

Key Insights From Industry Benchmarking

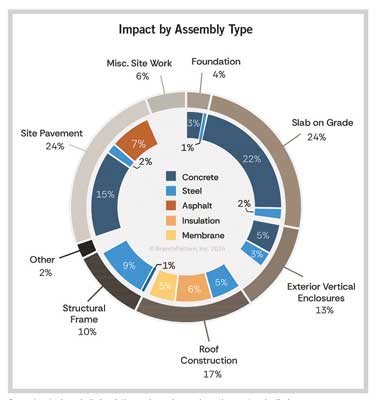

Recent industry benchmarking reveals some important trends. Concrete and steel continue to dominate the embodied carbon footprint of industrial buildings, with concrete alone accounting for roughly 45% of emissions and steel contributing an additional 21%. These materials are essential for structural integrity, but their carbon intensity can be significantly reduced based on material choices and design strategies.

Concrete used in slabs, site paving and walls remains the single largest contributor to up-front carbon, followed by asphalt for paving and structural steel/decking. These findings underscore that nearly every industrial project has untapped opportunities for carbon reduction.

Emissions generated by pavement and slab-on-grade work also play a substantial role. Site preparation, including roads, parking lots and foundations, can contribute up to 30% of a project’s embodied carbon. By optimizing pavement design and using lower-carbon concrete mixes, developers can reduce emissions in this area as well.

Regional variations further impact emissions levels, influenced by factors such as climate, seismic requirements and material availability. For example, colder regions typically require heavier structural systems, leading to higher emissions, while areas with stricter policies — such as the Buy Clean California Act — tend to see greater use of low-carbon materials.

These variations suggest that localized data — and data quality in general — should be prioritized. The commercial real estate industry needs stronger transparency and accountability across the supply chain, including contractual requirements for emissions reporting on new buildings.

Practical Strategies for Reducing Embodied Carbon

Some common barriers to implementing and prioritizing embodied carbon reduction include the perception of cost premiums, limitations of the supply chain, limited internal awareness or alignment, and schedule pressures.

Concrete, steel, asphalt, insulation and membranes have the most embodied carbon impact across the average industrial product. Of all assemblies, slab on grade, site pavement and roof construction typically contribute the largest impacts due to the high quantity of these intensive materials. Courtesy of BranchPattern

To make meaningful progress in reducing embodied carbon, developers, architects and contractors must integrate low-carbon solutions at every stage of a project. The following strategies, implemented early in and throughout the timeline of development, offer clear, actionable paths for industrial developments.

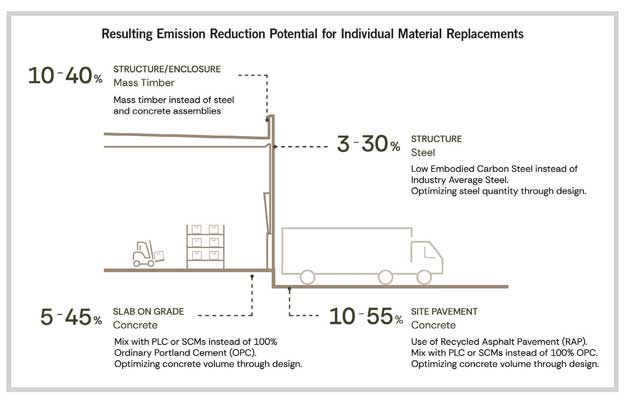

Optimizing the use of concrete and improving mix design is one of the most impactful strategies. By replacing traditional Portland cement with blends incorporating fly ash, slag or limestone, developers can reduce emissions by up to 40%. Reducing the volume of concrete through more efficient designs, such as thinner slabs or alternative structural systems, also plays a significant role in minimizing embodied carbon.

Similarly, choosing low-carbon steel is another critical area for improvement. Steel produced through an electric arc furnace generates significantly fewer emissions compared with traditional blast furnace methods. Additionally, prioritizing high-recycled-content steel can further reduce a project’s carbon footprint. Beyond concrete and steel, evaluating emerging low-carbon materials such as mass timber, bio-based insulation and carbon-capturing concrete can help developers stay ahead of the curve in adopting innovative solutions to reduce embodied carbon.

With site work, developers can focus on reducing unnecessary paved areas and optimizing sub-base materials. Exploring alternatives like permeable paving and using lower-carbon asphalt and concrete formulations can also substantially reduce embodied carbon.

Leveraging environmental product declarations (EPDs) is another effective strategy. EPDs offer detailed information on the environmental impacts of materials, better enabling developers to compare and select lower-carbon options. Integrating EPD tracking into procurement processes ensures accountability and encourages more sustainable decision-making.

Finally, developers may choose to require carbon accounting for completed projects and establish internal performance incentives for teams that meet embodied carbon targets. This builds organizational accountability and accelerates progress toward decarbonization goals.

The Business Case for Embodied Carbon Reduction

For industrial real estate developers and investors, reducing embodied carbon isn’t just about meeting sustainability targets; it’s a strategic move that enhances asset value, reduces regulatory risk and unlocks financial incentives. As regulations evolve, many investors are prioritizing responsible business practices, increasingly incorporating embodied carbon metrics into risk assessments.

Industrial spaces with lower embodied carbon footprints are becoming preferred leasing options, helping developers secure blue-chip tenants faster and differentiate properties in competitive markets. According to JLL, “65% of future industrial and logistics space requirements from top occupiers will be tied to corporate carbon reduction targets,” showing that carbon, in particular, is a driver for how tenants value a potential space.

In a down market, there’s an even stronger case for action: Investing in decarbonization during slower cycles positions portfolios to outperform when growth resumes. A holistic view of both operational and embodied emissions provides intelligence for guiding investments and managing long-term risk.

Taking stock of investor expectations — including GRESB and other assurance frameworks — allows developers to proactively manage climate risk and improve financial positioning.

At the same time, major jurisdictions across the U.S. are implementing policies designed to curb embodied carbon emissions. From state-level Buy Clean programs to evolving climate disclosure rules, proactive adoption of these measures can help developers avoid costly retrofits or compliance challenges in the future.

Equally important is planning for the next phase of regulation: building performance standards, carbon caps and disclosure requirements that could soon affect both capital and operational budgets.

A Strategic Opportunity

Industrial real estate is at an inflection point, with sustainability expectations accelerating across the market. As stakeholders navigate these shifts, adopting embodied carbon reduction strategies will be crucial for future-proofing assets to improve resilience and preserve long-term value, meet investor demands and maintain market leadership.

By embracing data-driven decision-making, utilizing innovative materials and pursuing forward-thinking design approaches, industrial developers can reduce carbon emissions while enhancing the value and performance of their properties. With the right strategies in place, the industry can meet today’s sustainability challenges and position itself for long-term success in an evolving commercial real estate market.

The developers that move decisively now — building clear decarbonization road maps and embedding carbon intelligence into every project — will define the next generation of market leadership.

Anand Parthasarathy is a principal and practice lead at BranchPattern specializing in sustainability consulting for commercial real estate portfolios.

|

Scope 1, or direct, emissions are emitted from sources directly owned and operated by the project, such as running a boiler or refrigerant leaks. These emissions typically happen on-site. Scope 2 emissions are associated with the energy that is purchased by the project that it does not produce itself. Together, Scope 1 and Scope 2 make up the operational carbon emissions. Scope 3 emissions are the hardest to measure. They encompass all other indirect emissions such as those tied to raw material production, material transportation, disposal of building materials and so on. They make up the embodied carbon on a project. |