Legacy buildings are enhancing their architectural identity and user functionality to appeal to modern office tenants.

The office sector continues to navigate one of its most profound resets in decades. From the pandemic era of fully remote work to hybrid solutions to more and more companies announcing return-to-office mandates, office developers, landlords and tenants have been forced to get comfortable with flexibility and change. In markets like Midtown Manhattan and other central business districts, trophy office buildings are consistently leading the return-to-office movement by offering modern infrastructure and experiential upgrades.

Today’s tenants are seeking more than just efficient layouts and prime addresses; they are drawn to environments that promote wellness, creativity, productivity and collaboration. As a result, the most desirable office spaces have evolved to include experiential quality, design authenticity and hospitality-driven programming.

The reimagined Transamerica Pyramid Center in San Francisco preserves its historical significance while introducing modern amenities. Courtesy of SHVO

While the desire for amenities and newly designed space is evident, delivering these attributes via ground-up development has become increasingly difficult. In dense urban cores, buildable parcels are scarce, capital costs are high, and entitlement timelines are lengthy. In contrast, underutilized midcentury office buildings — many with strong architectural foundations — can present a faster, more strategic path to competitiveness. The growing appeal of these repositioned assets has made adaptive reuse a dominant trend among institutional owners.

Location remains foundational, but experience now defines value. For legacy buildings, this means going beyond cosmetic upgrades and undertaking transformations that enhance both architectural identity and user functionality.

Delivering What the Market Demands

Recent market performance underscores the bifurcation in the office market, where newly built or recently renovated spaces far outperform older, outdated buildings. Trophy buildings — defined by location, quality and service — are capturing a disproportionate share of tenant demand. As of October, availability in Manhattan’s top-tier segment had dropped to 10.1%, down from 17.5% at the start of 2023, according to data from CoStar Group.

This pattern is a function of quality more than geography. Tenants are selecting buildings that support hybrid work with enhanced infrastructure and purpose-built shared spaces. Experience-driven design is now an expectation for success rather than just another amenity. According to Gensler’s 2024 global workplace survey, employees in offices with strong design identity and access to collaboration space report higher levels of satisfaction and productivity. Additionally, Kastle Systems reported at the end of May 2025 that on the most active workdays, trophy buildings had reached 94% of their prepandemic occupancy, far exceeding the national average of 60%.

In parallel, investor strategies are evolving. PwC’s 2025 Emerging Trends in Real Estate report identified adaptive reuse and repositioning as among the most attractive investment plays in urban cores, citing their speed to market, sustainability profile and alignment with environmental, social and governance priorities. When thoughtfully executed, these projects offer compelling risk-adjusted returns, delivering differentiated products in markets otherwise saturated with obsolete inventory.

A Reintroduction to a New Icon

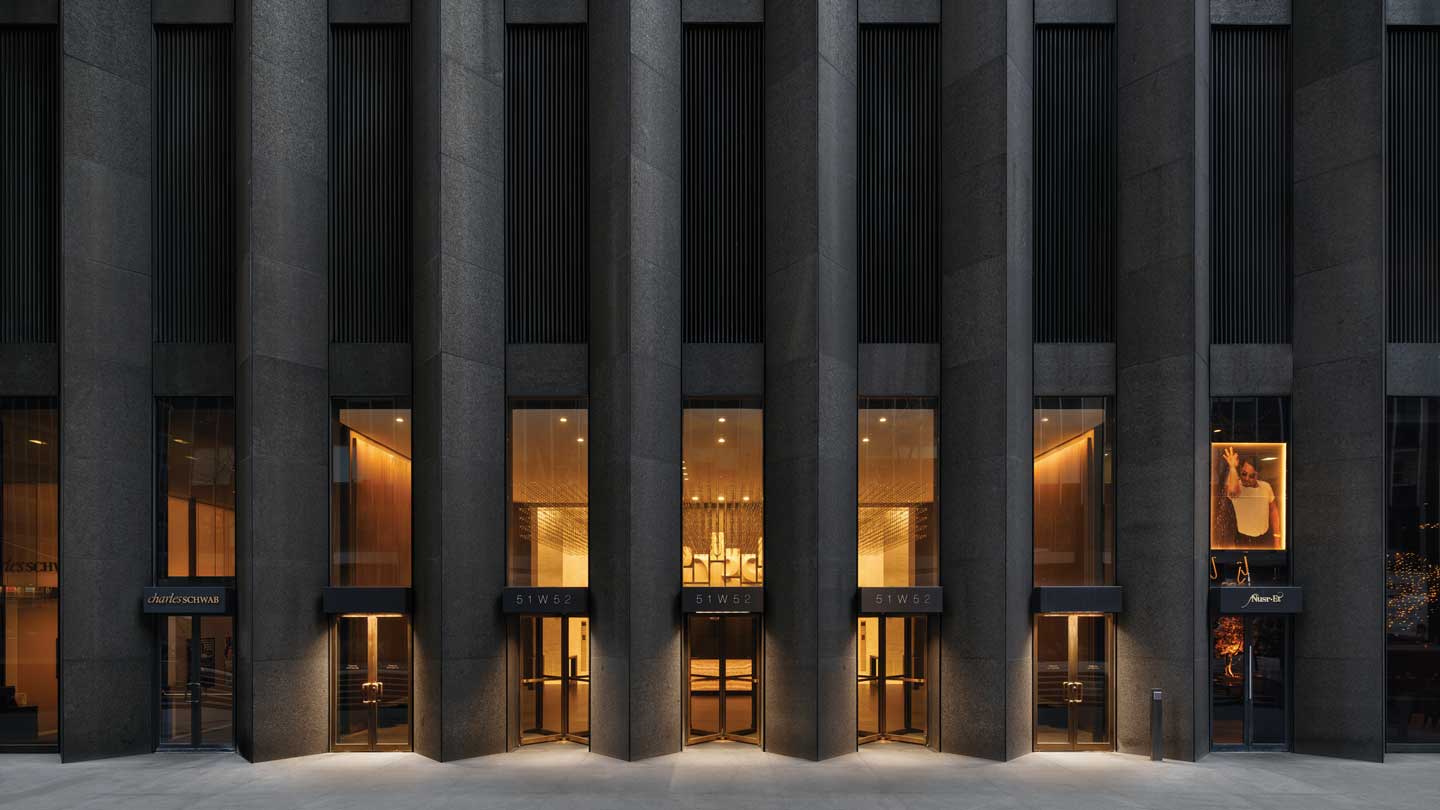

One such example is 51W52, also known as Black Rock. Originally completed in 1965 as the Midtown Manhattan headquarters for CBS, the 38-story tower was the only skyscraper ever designed by world-renowned architect Eero Saarinen. With its sculptural granite cladding and column-free interiors, it represented a forward-thinking vision for corporate architecture in its era. But by the 2020s, despite its pedigree, the building faced the same pressures as many midcentury assets — aging systems, a lack of amenities and outdated common areas.

In 2021, affiliates of Harbor Group International acquired the building and invested $128 million to reposition the iconic asset. MdeAS Architects and Vocon led the design transformation with a clear directive of preserving the integrity of Saarinen’s vision while unlocking a completely new workplace experience. The team began by stripping away accretions to the historic lobby, revealing travertine and bronze surfaces, and enhancing the entry sequence with a minimalist lighting strategy that emphasized Saarinen’s geometry.

The work extended far beyond the surface. Outdated mechanical systems were replaced, and the entire lower level was reimagined as a hospitality-grade amenity suite. A former mail room was converted into a wellness and conferencing center anchored by a grand custom stair evoking Saarinen’s sculptural sensibility. New tenant-only features include a lounge cafe, fitness facilities and spa-style locker rooms, all directly connected to a lounge dubbed Club 53.

These upgrades are not just aesthetic; they address the experiential and functional demands of modern office tenants. According to VTS’s Office Demand Index, demand for high-quality office space in New York City rose 19% between January and April 2025, with tours and deal activity concentrating in buildings offering hospitality-style services.

The historic lobby at 51W52. Colin Miller

Since 51W52’s repositioning, more than 550,000 square feet of space has been leased, including Harbor Group’s headquarters relocation. 51W52 offers a compelling case study in turning legacy constraints into leasing catalysts and demonstrates how high-design repositioning can honor historic roots while simultaneously meeting modern demands.

Extending the Playbook

This trend is also evident with the recent remastering of Transamerica Pyramid Center (TAPC) in San Francisco. Originally designed by futurist architect William Pereira in 1972, TAPC has long been seen as a symbol of San Francisco’s growth. Fifty years later, luxury real estate development and investment firm SHVO saw an opportunity to revitalize the entire city block where TAPC stands while still respecting Pereira’s original vision and the property’s unique heritage.

SHVO acquired TAPC at the height of the pandemic in 2020 with plans to reimagine the property alongside global architect Foster + Partners and supported by San Francisco-based Huntsman Architectural Group. The new design, unveiled in September 2024, breathed new life into the iconic asset, striking a deft balance between preserving its historical significance and introducing modern amenities.

Comprising three buildings — the 853-foot Transamerica Pyramid at 600 Montgomery St., 505 Sansome St. (Two Transamerica) and 545 Sansome St. (Three Transamerica) — along with the historic Transamerica Redwood Park, TAPC has been unified through a series of strategic ground-level improvements. The result is an inviting hub featuring retail, restaurants, green space and cultural exhibitions.

Transamerica Pyramid was reimagined with a hotel-like aesthetic, seamlessly integrating luxury, culture and public space. The project emphasizes the building’s historical significance while modernizing its functionality, as seen in the lobby redesign, which highlights and celebrates the original diagonal structure. The design prioritizes tenant experience through hospitality and service, with tenant-only amenities including meeting rooms, a wellness center, and a sky lounge and bar with panoramic views of the city.

SHVO’s bold, contrarian bet on San Francisco during the COVID-19 pandemic, when many were divesting from office assets, proved transformative. The company’s multiyear, $400 million makeover of TAPC has positioned the building as San Francisco’s most expensive office space. Leasing at TAPC has performed at pro forma, receiving strong demand from tenants across sectors with very high tour activity. With current pending deals included, TAPC sits at 85% leased, with major leases signed with top-tier technology, AI, venture capital and law firms, including Morgan Lewis and AppDirect.

Combining the Old With the New

As more cities contend with aging building stock and constrained development pipelines, thoughtful repositionings are emerging not just as an opportunity but as a necessity in competitive urban markets. Buildings that combine architectural heritage with modern infrastructure and curated tenant experiences present an intriguing alternative to building from the ground up, especially in dense urban cores where new developments aren’t always viable.

This evolution is not simply about preserving what was; it’s about designing what’s next. Repositioned assets are answering the call for resilient and adaptable workplaces that resonate with the modern workforce’s values of performance, wellness and purpose.

Jim Vallos is managing director of Harbor Group International.

51W52 Timeline1961: Construction started on the original structure. |