A mixed-use project in West Baltimore requires creative financing and strategic collaboration between public and private stakeholders.

Before the first wrecking ball swings or the crane lifts steel into place, MCB Real Estate, an institutional investment management firm and developer based in Maryland, has already performed the heavy lifting by structuring a complex capital stack that mitigates risk, attracts investment and makes ambitious projects feasible.

At Reservoir Square in West Baltimore, a site once emblematic of the failed urban renewal movement, this approach is transforming an underutilized space into a self-sustaining development that leverages public and private capital. The neighborhood is situated in an area that has faced discriminatory housing practices and disinvestment, leading to significant disparities in access to stand-alone amenities, health care, education and employment.

The first phase of Reservoir Square included restoring the street grid and creating 120 builder-ready townhome lots. Courtesy of MCB Real Estate

As cities confront aging infrastructure and redevelopment challenges, lessons from this project could offer a blueprint for rethinking urban spaces, modernizing essential institutions and expanding opportunities for residents. Even in an inflationary climate, the right partnerships can bring a vision to reality, creating a lasting impact where it is needed most.

A Personal Connection

Reservoir Square’s outcome is particularly personal for P. David Bramble, managing partner and co-founder of MCB Real Estate, because he grew up nearby and would visit his mother’s office in the former public housing project. Now, he and his wife are raising their three young children within the neighborhood. He describes the former site — an area once unfortunately dubbed “Murder Mall” — as “an extremely scary place.” Bramble is in a unique position to make Reservoir Square a catalyst for development in West Baltimore and, he hopes, a national model.

“Across urban America, decades of disinvestment and exclusionary practices have left deep scars on communities that once thrived,” Bramble explained. “In Baltimore, these challenges are particularly evident in long-overlooked neighborhoods like the one I live in. It is extremely important to demonstrate the impact of a mutually beneficial private-public partnership that can make a powerful and sustainable difference and bring investment to deserving communities.”

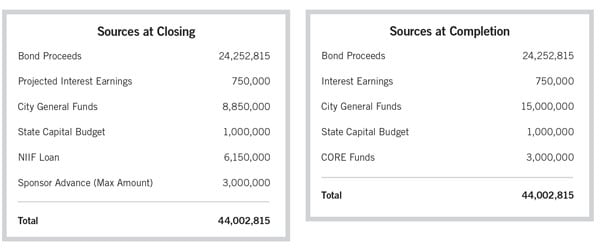

In December 2024, Reservoir Square achieved a major milestone by securing a $44 million investment from public and private partners. But the road to success is rarely smooth; potholes are inevitable and overcoming them requires a team that can adapt quickly and chart a new course when needed.

Overcoming the Appraisal Gap and Limited Traditional Funding

In 2017, a joint venture of MCB Real Estate, Atapco Properties and MLR Partners acquired control of the 8-acre public housing site formerly known as Madison Park North. The site’s size provided the proper scale to create a mixed-use redevelopment project with a vision to create an inclusive community integrating residential, commercial and public spaces. The vision is intended to promote active community interaction, strong economic growth and a renewed sense of prosperity for residents.

Following an iterative process with community leaders, the development team designed a master plan that offers myriad housing and retail options, all with the purpose of meeting a range of community needs.

The development faced initial challenges, including an appraisal gap and limited access to traditional funding. An initial $2 million grant from the Maryland Department of Housing and Community Development’s Project CORE, a grant focused on demolishing vacant buildings and stabilizing properties in Baltimore to revitalize neighborhoods, funded the demolition of the vacant housing project. However, the team needed creative funding for the remainder.

Part of the motivation behind developing Reservoir Square is to address the need for middle-class homeownership in Baltimore. As phase one of the project nears completion, 50 homes have been sold. Courtesy of MCB Real Estate

The team pivoted to focus on market-rate townhomes to drive economic development and fund infrastructure, thereby addressing the need for middle-class homeownership in Baltimore while also introducing essential amenities, including a neighborhood fresh food grocery store. To reach the nearest supermarket currently requires a 30-minute walk.

Proceeds from lot sales, along with revenue generated from a front-foot benefit — a fee assessed to homeowners to fund the construction of water and sewer lines connecting their properties to public infrastructure — also helped fund a portion of the overall infrastructure costs.

Phase one of Reservoir Square, launched in 2022, involved demolition of the remaining foundations, grading, utility connections, restoration of the street grid into the superblock, and creation of 120 builder-ready townhome lots. In addition to a $9 million investment from the development team, this work was supported by another $3 million in CORE funding, a deposit from the homebuilder and $500,000 from the state’s capital budget. A critical partnership with the Maryland Economic Development Corporation (MEDCO) to “purchase” portions of the infrastructure helped structure the funding to minimize unintended tax liability.

However, the project’s construction timeline did not align with the CORE funding cycle, creating a gap that could have stalled progress. To overcome the timing mismatch, the team secured a $3 million bridge loan from the Neighborhood Impact Investment Fund (NIIF), a Community Development Financial Institution (CDFI) Fund dedicated to inclusive growth in Baltimore’s disinvested neighborhoods. This initial bridge loan became the foundation of a long-term partnership that proved invaluable in navigating the complexities of the next phase: the introduction of commercial development at Reservoir Square.

Phase one set the stage for transformation by leveraging a carefully structured capital stack. As this first phase nears completion, over 50 homes have been sold, representing the most affordable new construction in Baltimore. Townhomes were initially priced in the upper $300,000s but have recently sold for as much as $489,000.

Still, when looking ahead to future phases, the development team faced funding gaps and had to carefully assess development costs versus projected value. Reservoir Square’s challenges — including its location in an underserved area and the fact that construction costs exceeded the completion value of any commercial use — made the situation complex. Nevertheless, the team remained committed to shaping a vision for phase two and driving progress forward.

Employment Services Provider Emerges as Key Driver

With infrastructure secured, the MCB-led development team meticulously explored multiple site iterations for phase two, understanding that the mixed-use project needed a high-profile anchor to address Baltimore’s most critical needs. The solution emerged through collaboration with the Mayor’s Office of Employment Development (MOED), the city’s employment development arm for Baltimore’s employers and job seekers.

The mixed-use development will include a new 68,000-square-foot headquarters building for the Mayor’s Office of Employment Development. Courtesy of MCB Real Estate

MOED operates six outdated structures that were originally built for much different uses, lack modern infrastructure and are too large for its needs. The facilities are dispersed throughout the city and situated in areas that are not well served by public transportation. The city expressed interest in consolidating all of MOED’s offices into a single central location. The development team proposed construction of a new state-of-the-art facility at Reservoir Square to serve as a comprehensive hub for all employment services. The 68,000-square-foot building would include a café and workspace for 120 employees. To ensure the project’s financial viability, the team sought a structure that would provide both immediate affordability and long-term stability.

The building’s construction costs alone would total $30 million. To make the rent feasible within the city’s operating budget, a $15 million to $20 million subsidy was necessary. A traditional private lease structure did not appear to be the right solution, so the development team took a more creative approach. Bond financing and a modified sale/leaseback structure offered a way to secure lower-cost capital by leveraging future lease payments to attract investors. By using tax-exempt bonds, the project could lock in lower interest rates, reducing long-term costs and making the development financially viable despite rising construction expenses.

To achieve this, the Reservoir Square team once again turned to MEDCO, which had the authority to issue tax-exempt bonds at rates 200 basis points lower than traditional lending. Meanwhile, NIIF reinforced its commitment with $6.1 million in bridge financing for the office phase.

The project was also eligible for New Markets Tax Credits (NMTCs), but this structure — which is premised on a taxable investment — typically does not align with tax-exempt bonds. To navigate this incompatibility, the development team structured the deal by involving the P3 Foundation, a nonprofit borrower, as a conduit for the financing. The team secured enough funding to move forward through grants, including $15 million from Baltimore City, $1 million from the state capital budget, and $1.5 million in CORE funds, along with the private investment generated from a NMTC allocation from a Community Development Entity (CDE). However, the clock was ticking, with a looming deadline of Aug. 31, 2024, to close the deal or lose eligibility for NMTCs, as the area was no longer classified as “distressed” according to the latest census data.

P. David Bramble (center back) at the groundbreaking for Reservoir Square. Courtesy of MCB Real Estate

Ironically, the area had improved so much under phase one of Reservoir Square that the site no longer qualified for federal needs-based programs, yet market values had not risen enough to support traditional financing. Then, mere weeks before the deadline, the CDE unexpectedly backed out, leaving no time to secure another NMTC lender. All the progress made seemed to be unraveling, leaving the development team facing the prospect of starting over.

Public and Private Partners Pull Together

The team carefully restructured the deal, removing and repositioning key pieces without letting it collapse, like an expertly executed game of Jenga. Given MOED’s importance to the city, and because of the relationships cultivated throughout the development process, the remaining deal partners pulled together to restructure the transaction. The project was kept alive by eliminating the NMTC components, simplifying the lease structure and securing an additional $1.5 million in competitive CORE funds to close the gap.

Mesirow, an independent financial services firm, underwrote $24 million in tax-exempt lease revenue bonds issued by MEDCO, financing a significant portion of the construction costs for MOED’s new office headquarters. The highly complex financing process required coordination across multiple funding sources and getting the bond investors comfortable with new construction. Despite these hurdles, the team secured a high investment-grade rating and low interest rate, ensuring the project’s long-term financial sustainability while advancing the redevelopment of West Baltimore. With the successful closing of bonds in December 2024, the project broke ground in March, and MCB will oversee construction through completion.

This critical milestone would not have been reached without innovative problem-solving and strong collaboration among public and private partners.

“There were a lot of moving parts in this transaction. The role of MEDCO was to simplify this complex deal and wrap it into one bond issuance,” said Tom Sadowski, MEDCO’s executive director. “Several financing approaches and layers of capital stack were explored, and we viewed this as the best way to complete the deal and move forward with the development. Our team played the role of honest broker between MCB, the city and the Neighborhood Impact Investment Fund to run everything through the tax-exempt bond funnel.”

The Reservoir Square financing package marked the first time in the past 30 years that this type of bond financing was completed in the city of Baltimore.

Creating a Model for Place-based Investment

By forming a coalition with the private sector and state agencies, the city leveraged its leasing power to generate a $44 million investment for West Baltimore, positioning Reservoir Square as a national model for transformative community development. The development includes a new American Jobs Center and the headquarters for MOED, which is generating 253 construction jobs and providing workforce services to more than 9,000 Baltimore residents annually.

“The extreme interest in and participation by various state and city public agencies, combined with the backing of private investment partners, has provided the fuel for Reservoir Square to make a substantial positive impact that will benefit West Baltimore City residents, businesses and related stakeholders,” Bramble stated.

With a creative financing approach and a commitment to place-based investing, the MCB-led team overcame complex redevelopment challenges, demonstrating how strategic collaboration can revitalize historically underserved communities. As Reservoir Square moves forward, its 120 townhomes, commercial and retail space, and job training services will be positioned to create an economic and community hub, setting a precedent for future urban revitalization efforts.

The next phase includes a 20,000-square-foot retail center configured to support an urban-format grocery store. The development team has signed a lease with a grocery store operator and is about to commence site prep.

Final delivery of all phases of Reservoir Square is expected by late 2026. In addition to meeting several critical neighborhood needs, the project will serve as an anchor node for the West North Avenue Development Authority, catalyzing further development, investment and revitalization throughout the area.

Theresa Stegman is vice president, development and structured finance, at MCB Real Estate.