Developers and designers are partnering to address the influx of baby boomers into the senior living market.

A capital markets environment marked by inflation, high interest rates, tariffs and supply chain disruption has created an unstable market for commercial development.

Construction costs remain inflated, most recently hindered by tariffs and federal policy affecting the labor market. U.S. Bureau of Labor Statistics Producer Price Index data released in June showed that inputs to commercial construction were 44.6% higher than in February 2020. While not as susceptible to the current economic climate as office or retail assets, senior housing isn't immune to its effect. According to a brief prepared by The Weitz Company for the American Seniors Housing Association in April, construction costs in the senior living sector were projected to rise approximately 4% to 6% over the 12 months following the report.

The general unease in the market means the Federal Reserve is unlikely to significantly cut interest rates, resulting in a lending environment that has caused some to shelve new senior housing development until next year. However, conditions surrounding some alternative asset classes such as senior housing are still favorable for growth, and developers are finding ways to stay active.

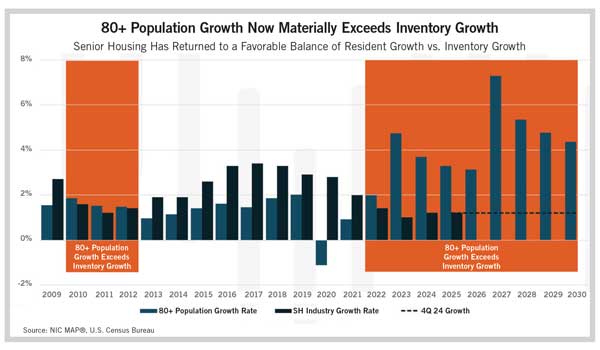

Demographic Shifts Amplify a Supply-Demand Imbalance

The U.S. population is aging. By 2030, all baby boomers will be 65 or older, and the cohort will have eclipsed the number of citizens 18 and younger. The 2020 census reported a sizable 34% increase in the 65-and-older population since 2010, estimating the number of baby boomers to be around 73 million.

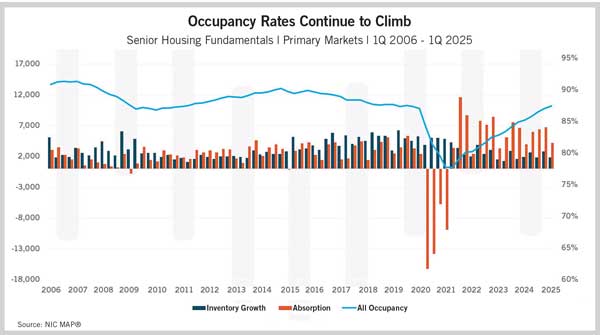

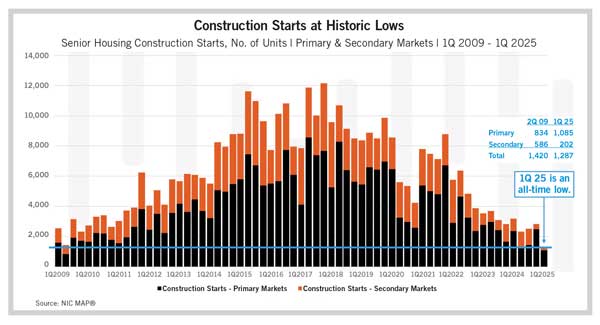

Since a steady COVID-19 recovery over the past 36 months, senior housing occupancy rates in primary markets exceed 87% and are trending higher while inventory growth lags. Meanwhile, senior housing construction starts across primary and secondary markets recorded an all-time low in the first quarter of 2025.

Benchmark Senior Living Vice President of Development Eric Gardner said finding a capital partner that understands these sector-specific metrics has been crucial to the company's successful ground-up developments in the current market.

"We have a solid relationship with a capital partner that has deep experience in senior housing and believes in the fundamentals of the business and the positive tailwinds that are upon us," Gardner said.

But belief in senior housing fundamentals is only part of the equation for potential capital partners. "Our operating platform, with 90%-plus occupancy and strong net operating income across our portfolio, provides assurances to investors and gives them the confidence to invest in new ground-up development during challenging times," Gardner said.

Site Selection and Community Engagement

Another important factor for new senior housing development to move forward is careful site selection with local buy-in. "We are extremely selective when choosing locations for ground-up developments," Gardner said. "Under the current lending environment, it is more important than ever to pursue only sites that are the best of the best. This approach allows both equity partners and lenders to get comfortable with the development proposal. ... Factors such as quality of competitive operators, age of competitive product, competitive product type and quality of site within the market all have a significant impact on site/market evaluation."

Meyer, a national architecture and design firm specializing in senior living, is partnering with Benchmark Senior Living to design a new 84,000-square-foot, 90-unit assisted living and memory care community in East Islip, New York, on Long Island's South Shore.

East Islip is a strong primary market area with high-demand metrics, including a robust senior population (those 75 and older) and a corresponding population of adult children who often act as caregivers. Adult children ages 46-64 constitute an important demographic cohort because seniors often locate near their children when choosing senior housing. The East Islip market also has a limited supply of similar product types — namely state-of-the-art building design with an amenity-rich environment that meets the demand of the baby boomers who are aging into the senior housing demographic. Lastly, the project site sits in the heart of the community with good visibility and accessibility on Montauk Highway and is part of a well-connected residential neighborhood. The scale and style of the building, combined with intentional landscape design, will give the property a distinctly residential feel.

Benchmark held multiple public meetings to convey the vision for the project and solicit input from neighbors and other community members. Company representatives also met with town staff and elected officials with the goal of crafting a development proposal that was responsive to input from the community. The result was a complete redesign of the project: flipping the building and the front entrance to face Montauk Highway, adding substantial parking for surrounding uses (two restaurants and a post office), enhancing landscape buffers to add almost an acre of green space to the plan, and running through multiple iterations of building elevations to arrive at an architectural style to blend with the surrounding residential environment.

"The community engagement was transformative for the project and resulted in a better plan for project stakeholders," Gardner said.

The family kitchen of Benchmark's East Islip senior housing community. Courtesy of Meyer/Benchmark Senior Living

Community engagement and connection also played a role in design execution. The site was previously home to a bowling alley that local residents frequented. Meyer designers incorporated a senior-friendly bowling alley into the community design to pay homage to the site's history. This feature also serves as a differentiator for the senior housing community that will encourage activity among residents and intergenerational engagement between residents and their visiting loved ones.

A New Focus on Existing Assets

Many investors have shifted from ground-up development to acquiring existing assets at below replacement cost, focusing on purchasing stabilized trophy assets, repositioning assets and undertaking large-scale renovations. Meyer has partnered with Washington, D.C.-based developer Capitol Seniors Housing on numerous renovation and repositioning projects, including completion of a two-year adaptive reuse conversion of a 145,000-square-foot Residence Inn by Marriott to a 116-unit assisted living community.

"To get a green light on a development deal, on a leveraged basis, you need to be able to show a project-level internal rate of return of 20% or 9% untrended yield on cost," said Michael Hartman, chief investment officer responsible for the Active Living platform at Capitol Seniors Housing. "Sometimes, we just can't get the numbers to work to have the equity investors who would normally be funding development. They can get the same returns they used to be able to get from developing by just buying."

Preserving trophy assets and repositioning assets requires less capital expenditure and can represent safe investment. However, while acquiring assets for large-scale renovations and adaptive reuse projects can approximate the returns of new development, they are also susceptible to financial risk and require sound coordination and strategy from all parties involved.

From a design perspective, it is important to expect the unexpected, perform comprehensive space planning, involve operators early on in the process, and have an intimate knowledge of the resident perspective. Renovations offer a unique opportunity to evaluate how a senior housing community is performing: Where is it meeting resident expectations and staff needs? What spaces are engaging and what spaces are underutilized? What is attracting new residents to the community? Developers are able to hear directly from residents and property staff and incorporate feedback into a design.

In approaching the design of senior living communities, Meyer is being mindful of who the residents are today and who they will be in the future. For example, the early baby boomers living in these communities place value on lifestyle, experiences, independence and a focus on holistic wellness.

A close partnership between the developer, operator and design team is necessary to ensure the spaces allow for optimized programs. While each space needs to be fully understood programmatically, adaptability in design is critical in an evolving senior living market.

The addition of senior-friendly bowling lanes will serve as a differentiator for the new senior housing community in East Islip. Courtesy of Meyer/Benchmark Senior Living

Senior housing is a product that requires multiple parties to understand the specific target population for a project to be successful. All parties — developers and equity partners, operators, architects and designers, and product vendors — should have a deep understanding of the needs of the intended resident, whether the community is active adult, independent living, assisted living or memory care.

Baby boomers are staying in their homes longer and transitioning to senior housing options later. This has led to adjustments in senior housing design, with greater emphasis on aging in place. Even at the entrance care level of independent living, designers are mindful of the higher acuity that may be occurring. Meyer designers focus on design elements such as adaptable ADA-compliant millwork, future conversion of grab bars in bathrooms, and flooring finish selections that allow for ease of movement for resident as they age. Designing for aging in place at the independent living level also helps to compensate for residents who may be hesitant to move to a higher acuity level due to fear of what that might mean for their way of life or because of the stigma surrounding it.

As baby boomers continue to age into the senior living demographic and the funnel for senior living residents grows, it is increasingly important for designers and developers to form strong partnerships to build financially viable projects that meet resident expectations.

Shannon Remaley, NCIDQ, EDAC, IIDA, WELL AP, LEED Green Associate, is a principal at Meyer. Dan King, AIA, NCARB, is a principal at Meyer. John Reynolds is the marketing strategist at Meyer.

Addressing the Middle Market Gap in Senior HousingAbout 60% of all seniors will change housing types between ages 65 and 84. Much of this shift can be attributed to traditional downsizing to a rental community, sometimes with access to the "safe urbanism" — walkable communities with urban amenities, culture and education — that baby boomers crave. As an aging population makes the transition to senior living, active adult communities provide a value-driven option that fills a hole in the market and allows healthy seniors to age in place. As of the second quarter of 2024, 11%-12% of Americans ages 75 and older resided in independent living, assisted living or memory care units, but penetration rates for active adult units for those 65 to 84 were only 0.5%. "I'm a big fan of [active adult communities]," said Michael Hartman of Capitol Seniors Housing. "I dedicated seven or eight years of my life just to active adult, but I think the book is still unwritten as to whether it s really going to work." Unlike traditional senior housing, where the continuum of care ranges from transportation, meals and basic services to long-term chronic care, active adult communities traditionally provide only age-restricted housing with coordinated activities. In addition to overcoming the stigma of senior housing, a case must be made for the financial premium of active adult communities versus conventional multifamily. "That's the magic question," Hartman said. "If it's $1,500 for a small one bed[room] over there, what's a reasonable rent to get you into an age-restricted [unit]? Is it $1,750 or is it $1,550? The rule of thumb in most markets in America is 15%. If I'm writing a business plan to convince you to invest in my deal, I'm going to say there are 10 apartment buildings [with one-bedroom units for rent] for $1,500, and I'm going to slap on $225. In some markets, it's more than 15%; in others, it is flat to multifamily." Active adult communities have typically relied on dedicated socialization activities that fall into three categories: games, fitness, and food and beverage. Developers and designers continue to work together to incorporate amenities to differentiate active adult communities and justify the premium to multifamily. Amenities such as yoga and meditation rooms, dietitians, catering kitchens and resort-style pools support wellness goals. Walking paths, pickleball, bocce, shuffleboard and cornhole encourage social, active lifestyles. Lastly, incoming baby boomers are much more tech savvy than their senior housing predecessors. The inclusion of amenities such as theater rooms, golf simulators and augmented reality rooms can make maintenance-free living in an active adult community of their generational peers more appealing to baby boomers. |