Office-to-Industrial Conversions: A Niche Market Worth Exploring

There’s a lot of potential, but the economic and regulatory challenges can be daunting.

When the conditions are right, converting an old office building to an industrial use could be a home run for owners, investors and warehouse tenants who are desperate for more space close to their customers.

Surging demand and rising barriers to new development have collided to create an extreme scarcity of logistics real estate across the country, said Melinda McLaughlin, senior vice president and global head of research at Prologis.

But according to two recent studies, a report by the Newmark Group, Inc., “Space to Replace: Divergent Market Fundamentals Drive Office-to-Industrial Conversions,” and another by Prologis, Inc., “Sizing Up Office-to-Logistics Conversions,” this type of conversion is niche but may continue to grow in land- and warehouse-constrained major markets around the country.

|

Key Takeaways on Office-to-Industrial Conversions

|

“Challenging economics add hurdles to the land availability, regulatory and competitive fronts,” McLaughlin said. “New supply from office-to-logistics conversions will take time to come online because resolving existing agreements, demolition, rezoning, entitlement, permitting and approvals take much longer than a typical greenfield logistics development.”

Newmark’s Elizabeth Berthelette, director of research, concurred.

“Office-to-industrial conversions are a niche trend, although we are continuing to see more older, functionally obsolete office projects being earmarked for redevelopment,” she said.

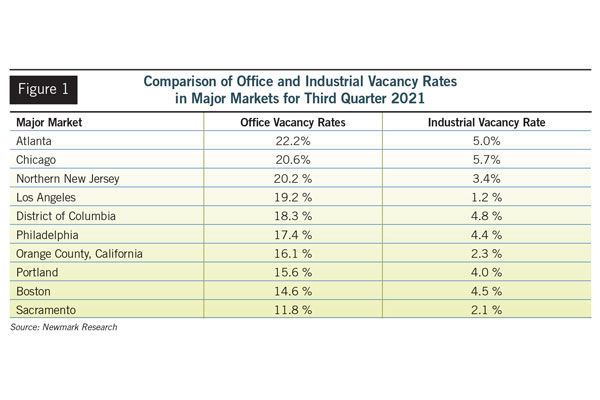

A critical element whetting the appetite for these types of conversions is the widening gap between office and industrial vacancy rates, according to third-quarter 2021 statistics detailed in the Newmark report. On a national level, office vacancy rates were 16.6%, while industrial vacancy rates were a mere 4.6%. In key major markets, the results were equally dramatic (see Figure 1).

According to Newmark research, there have been about 45 office-to-industrial conversions since 2018. (Office-to-industrial conversions typically require the demolition of the office building, not the retrofit of the building into a warehouse, which needs high ceilings, vast parking space and additional power.) That amounts to roughly 11.3 million square feet of space redeveloped or in the process of redevelopment into industrial use, Berthelette said. These conversions are mostly taking place in markets where density and land constraints are the driving force.

Berthelette noted that an office-to-industrial conversion could work in many markets as long as the property meets some basic criteria for an industrial redevelopment play.

“Based on our research, Atlanta, Chicago, Northern New Jersey, Los Angeles and Philadelphia have exhibited the most redevelopment activity,” she said. “They are prime logistics hubs with very strong industrial fundamentals.”

Onyx Equities and Russo Development recently bought a vacant Novartis office building in Morris County, New Jersey, with the intent to replace the 900,000-square-foot facility with an 826,800-square-foot modern industrial space. The site is part of the 202-acre Novartis campus. Ron Derven

She said Boston, where her office is located, is different from these markets because it is not a logistics hub — it is more of a tertiary industrial market. But it has other qualities that could make it an ideal area for office-to-industrial conversions: population density and limited developable land. Further, many municipalities in the Boston market have strict zoning regulations, which is a powerful barrier to entry for new greenfield development.

Newmark’s Proprietary Modeling

Berthelette’s research team began tracking office-to-industrial repositionings in the Boston area as they were gaining traction.

“We had seen a handful of these conversions already completed,” she said. “Reaching out to our research counterparts in other markets, we realized that there was more to this trend than one-off instances, so we created a model to identify potential office buildings ideal for industrial redevelopment.”

Her team analyzed about 50 projects — those already converted from office to industrial, as well as office buildings purchased for future conversion projects. They determined that office assets that fell within a specific acreage range and were close to highways were ideal for industrial redevelopment.

In the Boston region, however, the Newmark team had to look beyond the typical suburban locations for these potential conversions.

An artist’s rendering shows what the former Novartis office building in Morris County, New Jersey, will look like once it’s converted into an industrial facility. Russo/Onyx

“We examined all office buildings in the outer suburban ring around Boston, because most office repositionings in markets close to Boston’s urban core are focused on life science users as opposed to warehouse/distribution,” Berthelette said. “In reviewing outer suburban markets, we found a number of 1980s-vintage campus-style office parks with high vacancies. We asked ourselves: out of the hundreds of buildings examined, which have the most similar characteristics to our sample set?”

Berthelette’s group also used a second methodology — a binomial regression model — to identify potential office-to-industrial conversions. This model examined all the industrial buildings in Boston’s Route 495 submarkets and compared the characteristics to all the office buildings in the same geography. The model was able to predict within 97% accuracy which buildings were office and which were industrial. The buildings that were mischaracterized as industrial were potential targets for industrial redevelopment.

According to Mike Laccavole, a senior research analyst at Newmark, many office buildings that were mischaracterized as industrial had larger-than-average floorplates and higher vacancy rates than a typical office building and were class B or C. These factors made the properties more likely for industrial conversion.

Key Criteria for Office-to-Industrial Conversions

For an owner or buyer of an old office building interested in converting it to warehouse space, what are some of the criteria that the project must have to make it a viable candidate? Here are some tips from Newmark and Prologis.

Allstate has sold its Northbrook, Illinois, campus to warehouse developer Dermody Properties, based in Reno, Nevada. Dermody plans to build 3.2 million square feet of logistics space. Allstate’s Northbrook campus, which opened in 1967, currently has two million square feet of office space. Allstate

The project needs acreage for industrial use. It must have considerable land to be viable as a new industrial project. The Prologis report recommends at least eight acres of land to turn an old office into a modern logistics space. Newmark goes further, suggesting between eight and 35 acres, depending on the plan for the warehouse. According to Prologis, approximately 27,000 office buildings in the U.S., or 2.2 billion square feet in total office stock and 1.2 billion square feet in ground floor real estate, meet this criterion.

The Prologis analysis focused on the top 25 markets where it does business. The company narrowed down the potential number of opportunities even further by eliminating all Class A office buildings from consideration. According to Prologis, given the wide spread between rents and values for Class A office and logistics space, it focused only on Class B and below for conversion from office to industrial use, which encompasses roughly 65% of the square footage in its markets. Prologis projects that between 40 million square feet and 80 million square feet of office space will be converted to logistics space over the next decade.

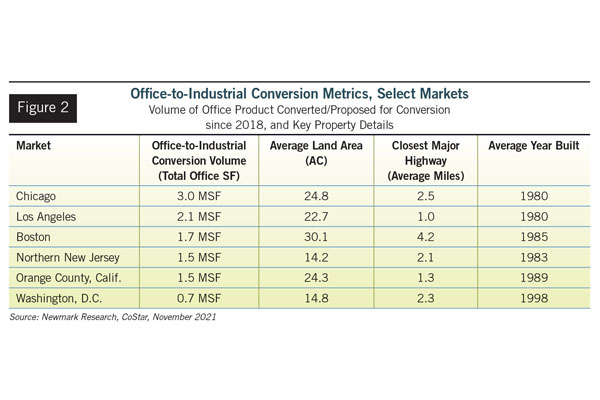

Properties are typically located near major highways. Newmark recommends that the potential office conversion be located within four miles of a major highway. As can be seen in Figure 2, Newmark found that in major markets, the closest highway ranged from only one mile to 4.2 miles for office-to-industrial conversions.

The best bet for office-to-industrial conversions is land- and warehouse-space-constrained markets. Although the office-to-industrial conversion can probably be done in any region, both Prologis and Newmark note that the focus needs to be on large, coastal markets with high land values and limited warehouse supply. Prologis notes in its report that the likely targets for conversions include the suburbs of New York (northern New Jersey), Southern California, San Francisco and Washington, D.C. Newmark adds Chicago to this list.

“Even though class B/C office rents generally exceed logistics rents in these locations, lower cap rates and tenant improvements costs for logistics properties add to the conversion rationale,” noted the Prologis report.

Empty buildings make good office-to-industrial conversions. The best prospect for an office-to-industrial conversion is an empty building. The next-best prospect is a building with a single tenant whose lease is coming up for renewal. Buying out all the tenants in a multitenant office building can be a big, expensive headache.

“There are potential office-to-industrial conversion projects that may be attractive on many levels,” said Newmark’s Lisa DeNight. “However, tenant relocation may be a challenge. Those buildings with single tenants are better than multitenant buildings, and the best option is a vacant building.”

Obsolete office buildings in need of major overhauls. The best-case scenario would be an office project that is so obsolete it is no longer useful as an office rental.

“If there is a functionally obsolete office property that’s been vacant for many years and is not viable for office use anymore, it could be considered a covered land play,” said Berthelette. “In our analysis, however, we did not come across a building that was completely uninhabitable. While there is still value in the original structure, the proposed industrial use garners a higher value.”

Party City’s headquarters in Rockaway, New Jersey, will be transformed from an office into a 121,038-square-foot industrial building. Ironically, it began life as a warehouse before being converted to an office, and now it will return to its original use. Ron Derven

The problem with numerous old office buildings in the post-pandemic world is that they might require costly upgrades to get them to the point where health-conscious tenants will rent. Those renovations need to be compared against tearing down the building and starting fresh with a new warehouse structure.

“There will continue to be a need for more industrial space, especially in last-mile locations around logistic hubs and dense populations,” said Berthelette. “The office market is facing likely changes, as there is still uncertainty around the work-from-home scenario and how much office space users will need in the future. There is also ongoing discussion around ESG (environmental, social and governance), LEED certification and bringing older office buildings up to more modern standards. Industrial developers and investors may look at older office buildings that need significant upgrades for redevelopment plays.”

Regulatory and zoning issues. Regulatory issue and community opposition represent issues that could make or break a conversion deal, although both Prologis and Newmark admit that converting the office into industrial space is usually far easier than converting retail to industrial space. That is because when a municipality loses retail, it loses sales tax revenues. Further, retail is typically located near its customers, while an office park is often off in its own area. Community opposition could well develop over big trucks, pollution and noise coming into the neighborhood. While the municipality will not lose sales tax with the conversion of office to industrial, there is an implied loss of white-collar jobs, according to Prologis. This might complicate the already lengthy rezoning/permitting/approval process in these high-cost areas, adding time and cost to the project.

Berthelette said zoning issues are not easily quantifiable when considering a project for conversions.

“Some types of development might face more resistance than others,” she said. “When a project is being considered for conversion, questions will arise regarding highest and best uses. Depending on the usage, developers may run into some regulatory challenges — which we have seen in several markets throughout the U.S.”

Materials and labor cost increases plague all projects. Finally, rising construction costs must be carefully considered in any office-to-industrial conversion.

“Razing an office building and constructing an industrial building, in this environment, results in significant construction costs — a trend in the industry for the last few years,” said Berthelette. “Now, with the current inflationary conditions and rising interest rates as well as major supply chain issues, the construction cost piece of the development puzzle gets increasingly more complicated.”

Ron Derven is a contributing editor for Development magazine.

Selected Office-to-Industrial Conversions

The Allstate Corporation has reached an agreement to sell its Northbrook, Illinois, campus to warehouse developer Dermody Properties of Reno, Nevada, for approximately $232 million, according to an Allstate press release. The sale is expected to close in 2022. Allstate is selling the property as employees have more choice about where they work and many are choosing to work from home. Dermody’s early plans call for 3.2 million square feet of logistics space. Allstate moved into the Northbrook site in 1967, and the campus currently includes two million square feet of office space.

Prologis recently acquired 112 West Park Drive in Mt. Laurel, New Jersey, from Veritas Real Estate, which it plans to develop as an 184,500-square-foot logistics facility, according to a CBRE press release. 112 West Park Drive is currently a 114,676-square-foot office building situated on 16.82 acres of land. The property is adjacent to the New Jersey Turnpike (I-95) and I-295 and is just 20 minutes to PhilaPort (Port of Philadelphia) and Philadelphia International Airport.

Amazon purchased an aging 230,000-square-foot office building on 25 acres in King of Prussia, Pennsylvania, from investor Eli Kahn and is expected to redevelop the structure into a warehouse, according to The Philadelphia Inquirer. Virtually every office-to-industrial conversion requires the teardown of the old office, but the building that Amazon purchased actually started out as a warehouse, then was converted to an office building, and now will be converted back into a warehouse.

EverWest Real Estate Investors, in joint venture with Woodmont Properties, has purchased 400 and 600 Atrium Drive in Somerset, New Jersey. Currently, there is a 351,782-square-foot office building and adjacent land site. The partnership plans to vacate and demolish the building and develop two Class A warehouse/distribution buildings totaling more than 426,000 square feet.

Russo Development and Onyx Equities have purchased a vacant Novartis property in Morris County, New Jersey. The partnership plans to eliminate an existing 900,000-square-foot building and replace it with an 826,800-square-foot modern industrial space. The site is part of the 202-acre Novartis campus.

Brookfield has purchased a two-story office building, located on 5.2 acres, near the Port of Los Angeles called The H. It is a 125,000-square-foot office building, and the company is planning to explore a logistics-based redevelopment project, according to the Commercial Observer. The property is located in Torrance, California.

An undisclosed buyer has purchased Party City’s headquarters offices in Rockaway, New Jersey, for $19.6 million to convert it to a 121,038-square-foot industrial building, according to Real Estate NJ. The structure started out as a warehouse, was converted to a 106,000-square-foot corporate office and now will return to its roots as a warehouse in the prime northern New Jersey marketplace.